BOFIT Weekly Review 45/2020

Central Bank of Russia keeps its key rate unchanged

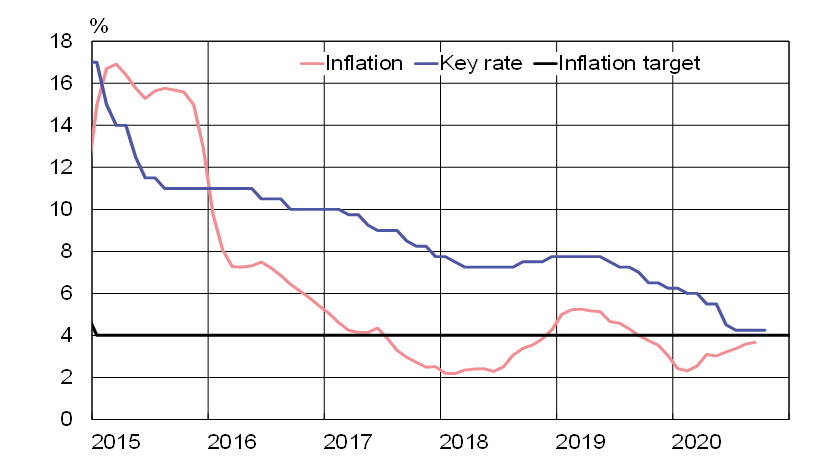

At its meeting on October 23, the CBR decided to keep the key rate unchanged at 4.25 %. The decision was in line with market analyst expectations. In its press release, the CBR noted that inflation was developing in accordance with its inflation forecast. The CBR did not rule out the possibility of a rate cut at upcoming meetings.

Annual inflation picked up to 3.7 % in September. The uptick was driven by weakening of the ruble’s exchange rate in recent months (BOFIT Weekly 37/2020). The ruble-dollar rate momentarily breached the 80-ruble level this week. At the same time, the euro-ruble rate briefly approached the 94-ruble level. The ruble has lost 14 % against the US dollar and 17 % against the euro since the beginning of June. Ruble depreciation has fuelled inflation expectations, which might lead to increases in prices of goods and services in the months ahead. On the other hand, inflation pressures have been weakened since summer due to falling domestic demand (BOFIT Weekly 43/2020). The Russian economy’s activity below its potential output level could also restrain inflation.

The CBR estimates that 12-month inflation will be running in the range of 3.9−4.2 % at year’s end. It now forecasts inflation in the range of 3.5−4 % next year. In subsequent years, inflation should stabilise close to 4 %. The CBR’s annual inflation target is 4 %.

The CBR also updated its GDP forecasts for the Russian economy for 2020 and 2021. The economy should contract by 4−5 % this year, i.e. half a percentage point less than the previous forecast. The revised outlook is mainly explained by better export performance in this spring. Economic growth next year should diminish to around 3−4 %, or about half a percentage point less than the previous forecast. The reduced growth outlook is affected by the surging covid pandemic in Russia and elsewhere. The CBR did not revise its growth projections for 2022 (2.5−3.5 %) and 2023 (2−3 %).

Russian key rate, annual inflation and the CBR’s inflation target

Sources: Central Bank of Russia, Rosstat, Macrobond and BOFIT.