BOFIT Weekly Review 22/2015

China’s foreign currency reserves shrink as capital exports rise

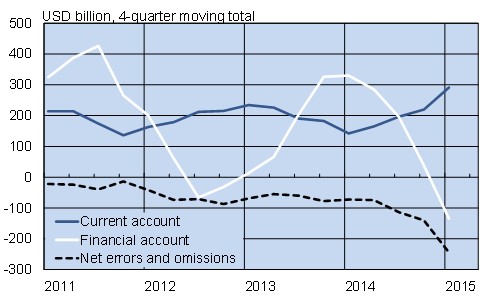

The goods trade surplus continued to rise in January-March on lower commodity prices that reduced the value of imports. The services trade deficit was up on increased Chinese tourism abroad. The services deficit was, however, insufficient to balance overall trade surplus growth, so the current account surplus was still up in the first quarter. On-year, the current account surplus reached nearly $300 billion, or about 2.8 % of GDP.

Net capital flows have recently been negative. Preliminary balance-of-payments figures show a net outflow of capital from the country in the past four consecutive quarters. The aggregate deficit of the capital and financial accounts amounted to $135 billion for 2014. The balance of payments “net errors and omissions” item was deeply negative, suggesting covert capital exports on a large scale and/or a smaller current account surplus than reported.

With increased capital exports and shifts in foreign exchange rates, China's currency reserves decreased in January-March by $113 billion to about $3.73 trillion.

Chinese balance-of-payments main items, USD billion

Source: Macrobond

Changes in capital flows reflect natural trends in the Chinese and global economies. Besides the government encouraging companies in recent years to invest in production abroad, the possibilities for Chinese to invest abroad have increased in step with rising living standards and relaxation of capital controls. There will be even more foreign investment options for Chinese at the beginning of July, when mainland Chinese will be allowed to invest in mutual funds in Hong Kong and mainland Chinese mutual funds can sell their products in Hong Kong.

The increased mobility of capital in the evolving environment forces the government to come to grips with the challenges of policy formulation. It is evident that China’s former expansionary policy no longer yields the same benefits it once did, and that capital flows now play a greater role in the formulation of exchange rate policy and monetary policy as a whole.