BOFIT Weekly Review 16/2022

China’s debt growth accelerated slightly in the first quarter

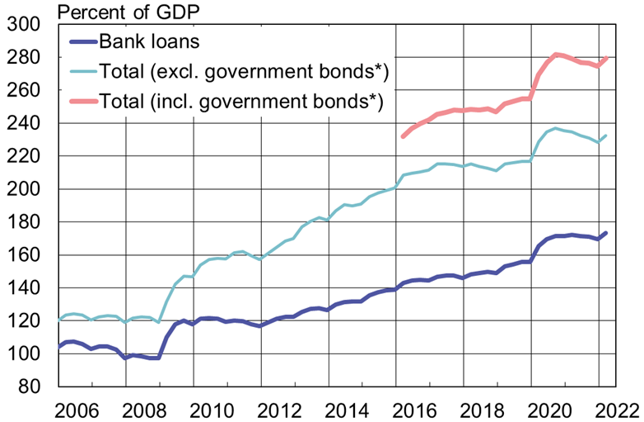

PBoC figures show that aggregate financing to the real economy (AFRE) was up by 10.6 % y-o-y at the end of March. Growth picked up from the second half of 2021, and in 1Q22 slightly exceeded nominal GDP growth. After falling for over a year, China’s total domestic debt-to-GDP ratio again began to rise in 1Q22. As of end March, total debt-to-GDP ratio stood at 279 %.

The central bank’s broad AFRE definition includes bond liabilities of corporations, the central government and local governments. Growth of both corporate and government debt accelerated in the first quarter. On the other hand, the reported stock of shadow banking instruments (entrusted loans, trust loans and banker’s acceptances) continued to dwindle as it has for years. Bank lending also seems to be slowing. Growth in the stock of bank loans at the end of March was up by about 11 % y-o-y.

China’s total domestic debt-to-GDP ratio increased in the first quarter

Sources: People’s Bank of China, CEIC and BOFIT.

*) General bonds issued by central and local governments. The IMF puts China’s actual public debt at 102 % of GDP as of end-2021.