BOFIT Weekly Review 11/2023

Russian government spending on investment rose sharply during the war, mixed performance in other investment

Fixed investment in Russia has recovered and grown briskly since the recession in 2020. In 2021, fixed investment was already several percent higher than in pre-pandemic 2019. On the other hand, investments that, among other things, support future economic growth were only at 2012–2014 levels as they fell sharply from autumn 2013 to early 2016 and subsequently performed tepidly.

Fixed investment continued to rise in 2022 in real terms. It was up by over 5 % measured in terms of fixed capital formation (in national accounts) and according to Russian statistics on fixed investment up by about 4.5 %. Fixed investment has also increased since Russia’s unprovoked invasion of Ukraine, although the pace of growth slowed significantly from winter 2021–2022. Investment in April-December 2022 was up in real terms by a couple percent from a year earlier. The subject of fixed investment in Russia was discussed as part of BOFIT’s latest forecast for Russia and as a separate issue at our Russia briefing (in Finnish) streamed last Monday (Mar. 13) from the Bank of Finland.

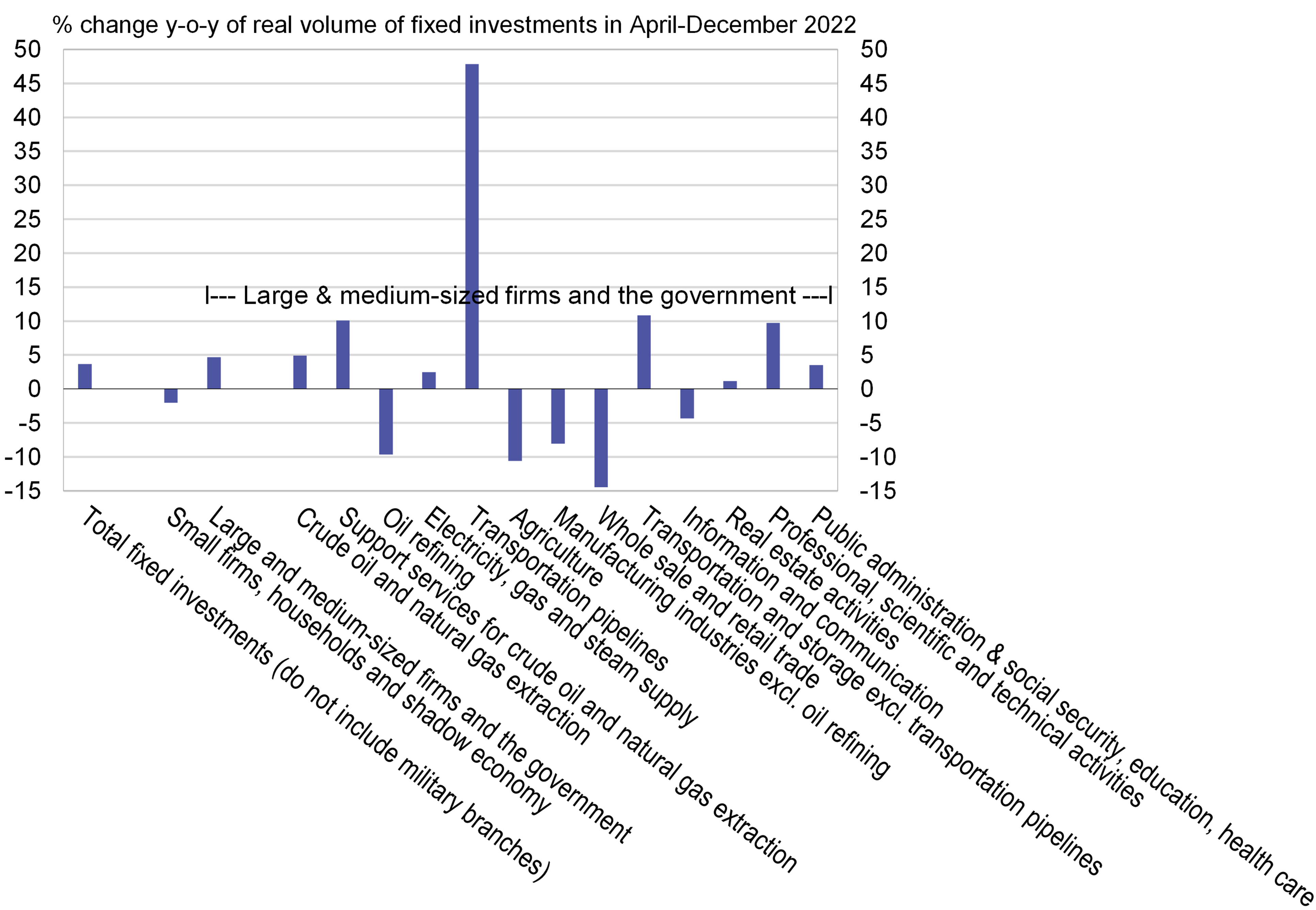

The overall rise in total fixed investment disguises differences in investment performance in several respects. Rosstat’s quarterly figures for fixed investment, which basically cover large and medium-sized firms as well as the government budget sector (77 % of total fixed investment), were up by nearly 5 % y-o-y in real terms in April-December. In contrast, the on-year change in fixed investment of other entities (i.e. small firms, households and shadow economy) in the same period was -2 % by Rosstat’s estimate (a drop slightly similar to that seen in Russia’s previous recessions).

Investment developments vary widely across branches in the wartime economy (Rosstat’s quarterly figures for fixed investment in nearly all branches and industrial branches with large investment account for 85–99 % of annually released fixed investment data while neither of the two data sets covers military branches). Fixed investment in the energy sector increased considerably in April-December. This was especially evident in fields where state-owned enterprises play a central role such as crude oil and natural gas production, pipeline transmission of oil & gas as well as gas distribution. In branches where private firms dominate (e.g. manufacturing, agriculture and commerce), investment contracted sharply during the war. The published partial within-year data on fixed investment that cover 25 manufacturing branches show investment fell in all but five branches, notably including chemicals, metal refining and manufacturing of transport vehicles other than automobiles.

The investment moves for their part indicate that in the course of the war Russia’s leaders and officials increasingly and in different ways influence corporate investment and operations more broadly. Earlier this month president Vladimir Putin issued a decree stating that failure of firms to uphold the conditions of contracts involving government procurement could result in the government taking over the company providing goods or services to the government.

Fixed investments in different branches of the Russian economy have developed quite differently during the war

Sources: Rosstat and BOFIT.

Sources: Rosstat and BOFIT.

Coverage of the quarterly investment data for various types of fixed assets is relatively good in the case of non-residential buildings and different structures (89 % coverage in 2022) as well as machinery, equipment and transport vehicles (72 % coverage). Converting the data published in nominal prices to real volumes of fixed investment requires price data, but reasonable price data are only available for the machinery, equipment and transport vehicles category. On that basis, it appears that investment in this category fell by about 15 % y-o-y during April-December last year.

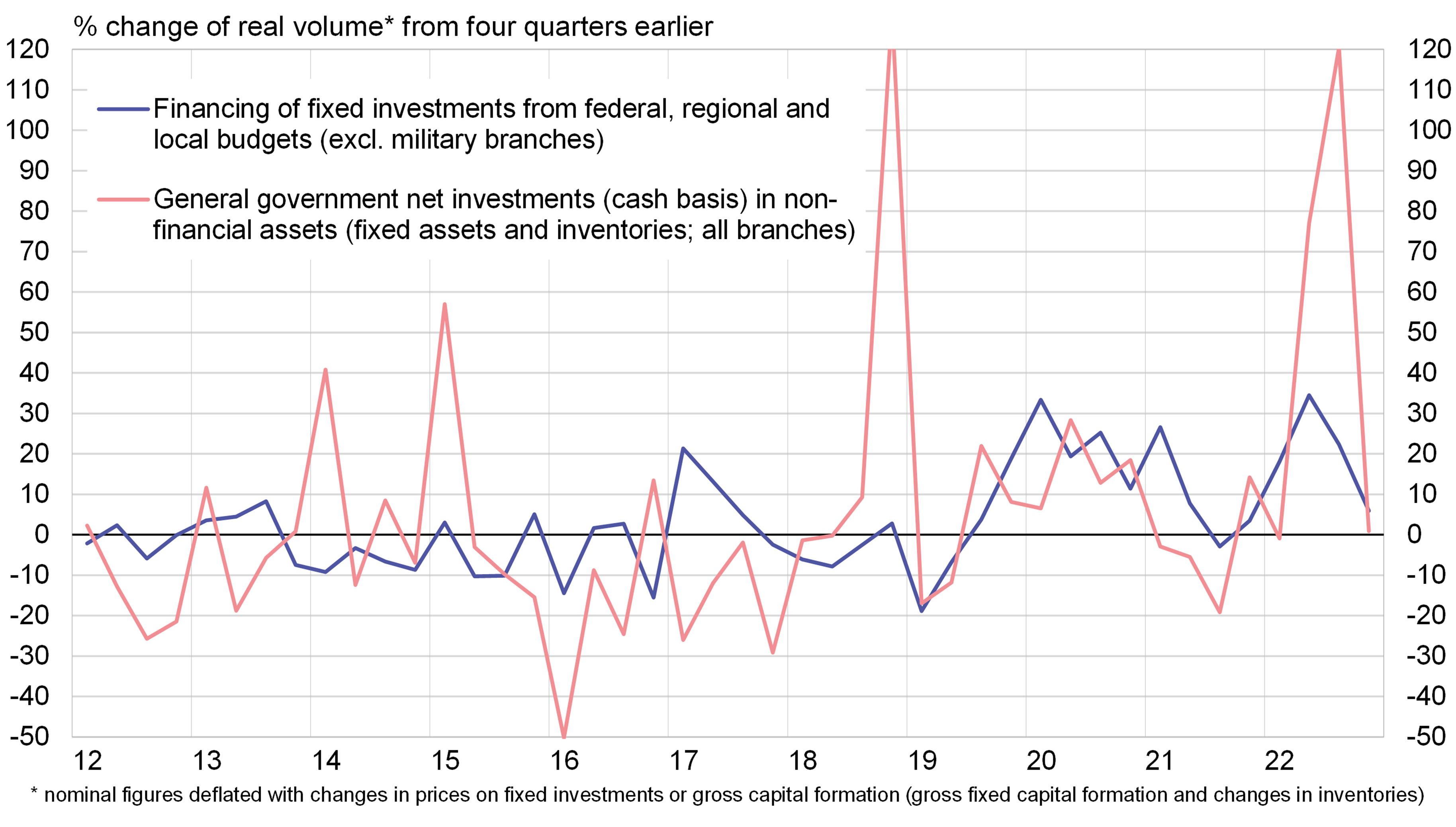

During the war, the government has increased funding to its own fixed investment and joint investments with firms. According to Rosstat’s fixed investment data (i.e. without military branches) show that investment funding from federal, regional and municipal budgets rose by nearly 30 % y-o-y in real terms in April-October. Even with waning budget increases, growth was still over 15 % in April-December. This boost, however, did less to increase investment in state administration and mandatory social security or other mostly state operated branches such as education and healthcare as well as storage and support activities for transportation. Thus, state funding of fixed investments in other branches increased significantly.

Total government spending on the overall investment front has increased much more as general government budget spending on fixed investment and inventories (including military branches) doubled in real terms in the April-October period. This reflects the situation that the government has made an even more brutal push in military investment and inventories.

A comparison of the general government budget spending on investment and total investment (including inventories) in Russia shows that funding of the respective investments from non-government sources (corporations and households) in April-December remained roughly unchanged in real terms from the same period a year earlier. Fixed investments of fully or partly foreign-owned firms, however, dropped by about 25 % even when looking at the available annual data for all of 2022, due, among other things, to the fact that many foreign firms left Russia and ownerships were sold off to Russian investors. The investments of Russian firms as a whole increased.

Perspectives in fixed investment and the related cross-pressures this year and beyond are discussed in our latest BOFIT Forecast for Russia 2023–2024, released this week.

Russian government spending on investments has soared during the war

Sources: Rosstat, Russian Ministry of Finance and BOFIT.

Sources: Rosstat, Russian Ministry of Finance and BOFIT.