BOFIT Weekly Review 38/2023

No slowdown in Chinese growth in August

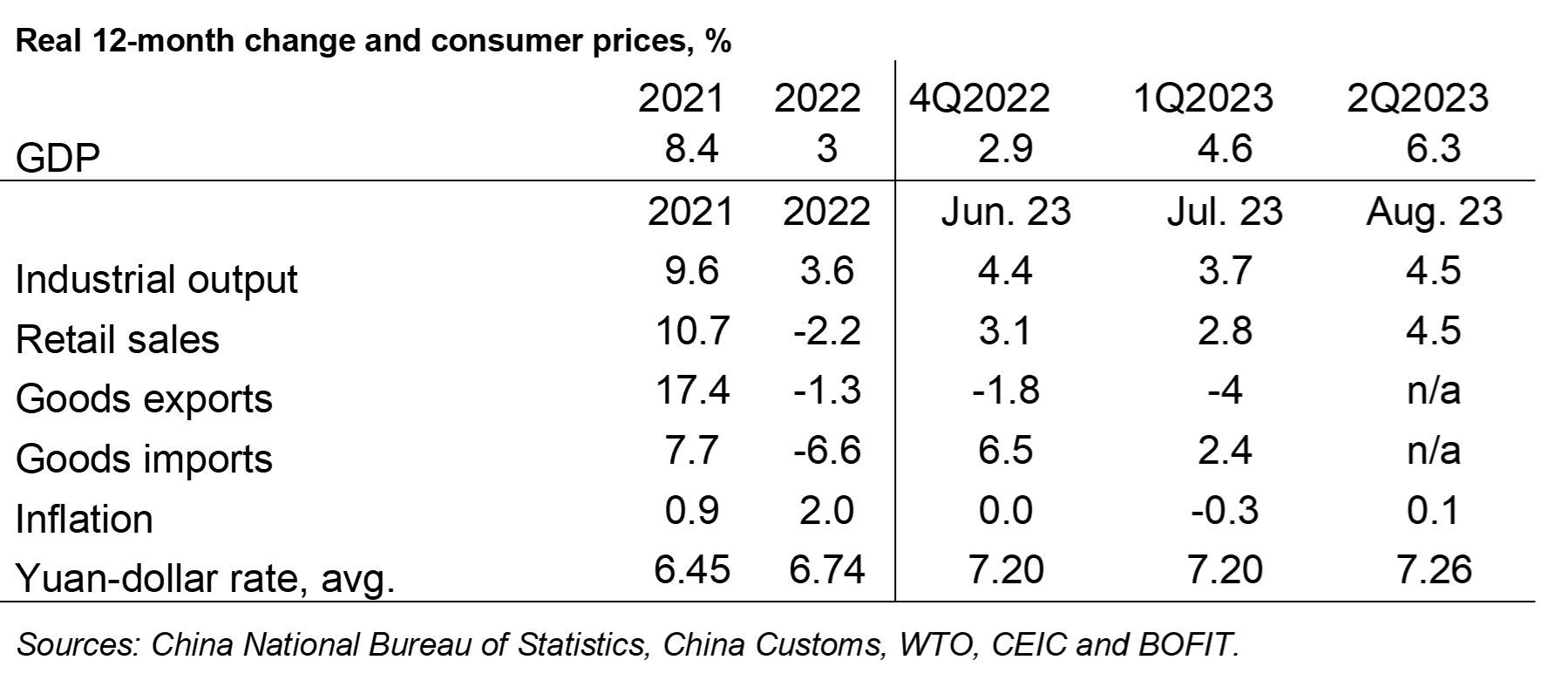

The rapid deceleration in China’s growth in early summer prompted officials to announce a number of measures to support the economy (BOFIT Weekly 36/2023). The growth slowdown seems to have ended in August, when growth in consumption and manufacturing slightly exceeded the pace of previous months. Even with the support measures, however, the pace of growth is not expected to increase much for the rest of the year. Thus, institutional forecasts for China this year continue to be downgraded, with many forecasters now expecting 2023 growth to remain slightly below the government’s 5-percent target.

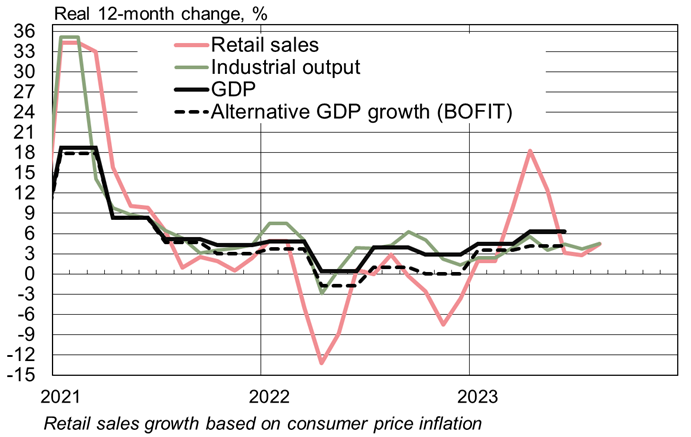

Retail sales, an indicator of consumer demand, revived slightly in August (up by 4.5 % y-o-y in real terms). Growth in June-July remained at 3 % y-o-y . Retail branches (e.g. restaurants) hit hardest by covid lockdowns showed the highest growth. Other branches affected by covid restrictions such as domestic tourism, hotel services and movie theatres have also seen sales soar since the end of lockdowns. In August, the value of car sales increased by 1 % y-o-y, while the sales of home remodelling and interior decoration materials continued to contract (down by 12 % y-o-y). Even if official unemployment figures show no further deterioration, rising uncertainty has motivated households to save more of their incomes. There has been some news reports mention local-level reductions in worker benefits, but the extent of such cuts is still unclear.

On-year industrial output growth accelerated slightly in August to 4.5 % y-o-y. In the May-July period, growth was in the range of 3.5–4.5 %. The differences in growth across branches, however, were quite large. Large industries saw big jumps in output volumes, e.g. chemical industry branches (up 15 % y-o-y ), steel production (+15 %), manufacturing of electrical machinery & devices (+10 %) and car manufacturing (+10 %). On the other hand, clothing manufacture has contracted for over a year (down 10 % in August). The main purchasing manager surveys for China indicated that new domestic orders for manufacturing firms were no longer declining in August, while export orders continued to decline.

While figures on fixed investment trends released by the National Bureau of Statistics were contradictory, standard indicators suggest that nominal growth in fixed investment continued to slow in August. As in previous months this year, fixed investment of state-owned enterprises remained quite strong in August. Launches of new investment projects has declined sharply in recent months, while the investment has grown in projects already in-progress, expansions and machinery & equipment investments. However, capacity utilisation in many industries is at historically low levels in many industrial branches, which has reduced incentive for further industrial investment.

The sharp contraction in construction activity continues. Investment in real estate, measured both in terms of sales volumes measured by floorspace and value, as well as new building starts, all declined in August by about 20 % y-o-y. On a brighter note, the contraction no longer seems to be accelerating. The impact of measures taken during late August and early September to support the housing market will only begin to show up in the statistical data of coming months.

Growth in manufacturing and retail sales both perked up slightly in August

Sources: China National Bureau of Statistics, Macrobond and BOFIT.

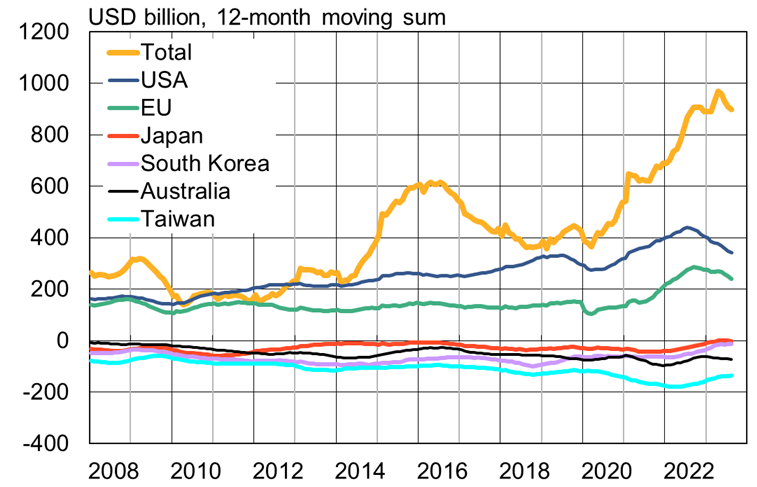

With economic growth slowing in China’s main export markets and a lethargic domestic economy, China’s foreign trade performance in August remained weak. The dollar value of exports was down by 9 % y-o-y and imports by 7 %. Due to exchange-rate fluctuations, the contraction in trade measured in yuan was somewhat smaller. The export and import volume indices for August have yet to be released, but the volume of exports in July was down by 4 % y-o-y. The volume of imports increased (up 2 % y-o-y in July), with drop in the value of imports due to large reductions in import prices. Even with weak foreign trade trends, China’s trade surplus has remained huge. While China’s surpluses with the US and Europe have narrowed, the deficit with developed East Asian economies has simultaneously narrowed.

China’s overall goods trade surplus remains very large

Sources: China Customs, Macrobond and BOFIT.

CHINA CONTINUES ACCOMODATIVE ECONOMIC POLICIES

Following the central governments’ policy changes and instructions, an increasing number of cities in China have announced measures to relax their rules on apartment purchases in order to revive the housing market. However, the most significant measure in the past two weeks, however, has been the People’s Bank of China’s announcement of a 25-basis-point cut in the reserve requirement ratio for banks, effective September 15. The drop in the reserve requirement does not apply to smaller banks, which already enjoy the lowest possible reserve requirement of 5 %. The general reserve requirement was dropped to 10.5 % for large banks and 7.5 % for mid-sized banks. Reserve requirements are further adjusted for individual banks, depending such factors as the bank’s lending structure. The PBoC reports that the weighted average reserve requirement ratio for the banking sector fell from 7.6 % to 7.4 %. The reserve requirement was last lowered in March.

Having already cut rates in August, the PBoC decided this month to keep its main policy rates unchanged. A reduction in the reserve requirement for banks will give a slight boost to banking sector liquidity but not remedy the slack demand for financing. Growth in the PBoC’s measure of aggregate financing to the real economy (includes bank loans, new financing acquired through bond and equity issues, as well as financing provided via the shadow banking instruments) has slowed since the start of the year and was up by 9 % y-o-y in August. Household borrowing demand (mainly housing loans) is lacklustre, with the stock of household loans rising by less than 3 % y-o-y in August.

China’s relatively low inflation rate would allow for even bolder monetary easing. In August, the 12-mongh change in consumer prices was a mere 0.1 %, and July prices were slightly lower than a year earlier. Price inflation in China has been subdued by on-year drops in energy and food (particularly meat) prices. Prices for non-food and non-energy products were up by 0.8 % y-o-y in August. Inflation is currently expected to remain low. Producer prices in China have been falling for about a year and were down by 3 % y-o-y in August. The drop in producer prices has been very broad-based.