BOFIT Weekly Review 21/2015

Investment growth slowed significantly in the first four months of the year

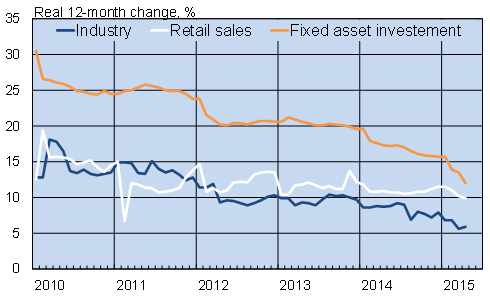

Growth in fixed asset investment (FAI) has slowed significantly all year, and was up just 12 % y-o-y in January-April. In comparison, FAI climbed 17 % y-o-y in the first four months of 2014. Falling growth in real estate investment caused by cooling in real estate markets particularly depressed investment growth.

Indeed, FAI growth, which was still above 20 % y-o-y in late 2013, has not been this tepid in at least a decade. The slowdown in growth reflects both China’s cooling economy, and perhaps more importantly, on-going structural changes in the Chinese economy. The focus of Chinese economic activity continues to shift from manufacturing and primary industrial investment to consumption and services. As a result, FAI’s significance is gradually waning as the Chinese economy evolves.

Several other indicators also point out to slowing economic growth in the first part of the year. For example, industrial output was up just 6 % y-o-y. While electricity production bounced back from a slight dip in March, the April level was nearly unchanged from a year earlier. On the other hand, retail sales, up 10 % y-o-y in April, grew faster than the economy and disposable incomes. Retail sales growth slowed only slightly in the first months of the year.

The April reading of the purchasing manager index (PMI) suggested a small rebound in industrial output. The PMI also tells of structural shifts in the economy; the service sector outlook remains strong, while new export orders are poised to fall.

Industrial output, retail sales and fixed investment

Source: Macrobond