BOFIT Weekly Review 37/2016

No big changes in Chinese economic trends over the past months

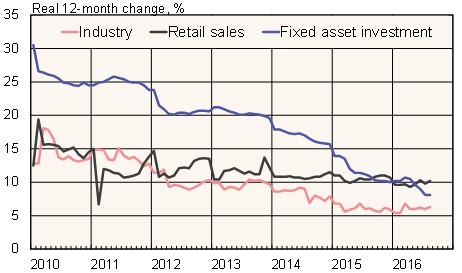

Industrial output growth accelerated slightly in August to over 6 % y-o-y, with retail sales growth climbing above 10 % y-o-y, an increase from July. The rapid slowdown in fixed asset investment (FAI) that had raised concerns in recent months moderated in August; private and public investment growth were both up from July. Infrastructure and real estate construction received the most investment. Monitoring investment developments is, however, getting even fuzzier than before. Apparently, due to the government campaign last year to buy huge amounts of shares to prop up stock prices, a large group of previously privately controlled shareholding firms are now classified as public, which distorts the picture concerning the development of both private and public investments.

The value of China’s imports rose 2 % y-o-y in August, the first positive growth figure since autumn 2014. The long-term drop in the value of imports reflects the decline in global commodity prices as Chinese figures show that import volumes rose 3 % y-o-y in the first seven months of the year. While the value of exports was down 3 % y-o-y in August, the volume of exports in January-July was up by 3 %.

Price trends are not a cause for concern for policy makers. Consumer price inflation slowed a bit in August to 1.3 % while producer prices, which have fallen for 54 months in a row, were down less than 1 % y-o-y in August. On month, however, producer prices have begun to rise.

Even if growth in electrical power production accelerated to nearly 8 %, which should suggest an improving economic outlook, the overall economic picture remained decidedly mixed. Figures on freight and passenger traffic suggest a substantial slowdown has occurred this year. A People’s Bank of China company survey found that corporate confidence in the economy and their view on the business climate have fallen this year to levels lower than measured in 2008–2009. Moreover, even part of the pickup in industrial output was due to transient factors such as the halving of the sales tax on small cars. The tax cut expires at the end of this year.

Industrial output, retail sales and fixed investment in China

Source: Macrobond.