BOFIT Weekly Review 30/2023

IMF raises its forecast for global economic growth

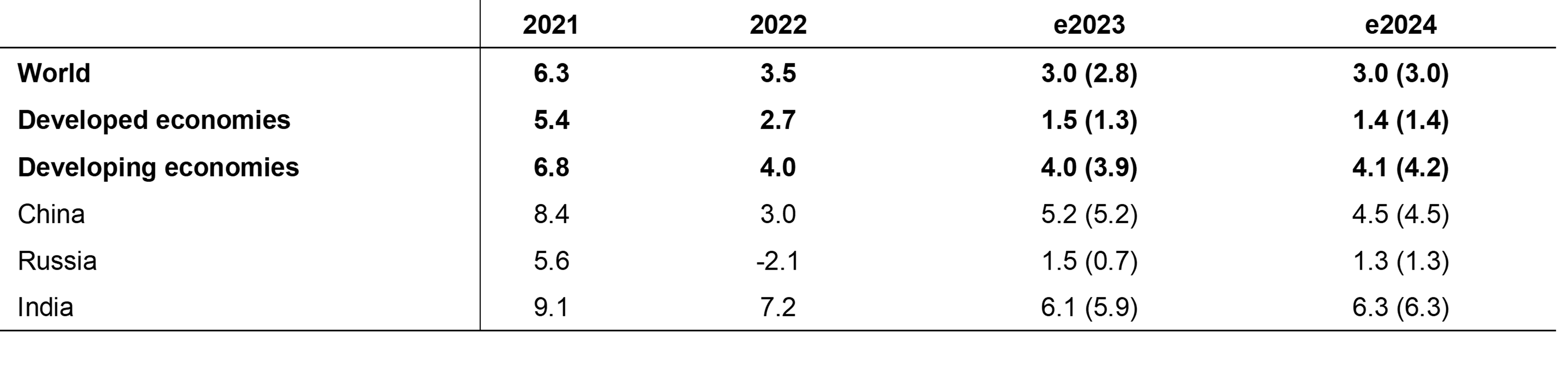

In its latest World Economic Outlook released this week, the International Monetary Fund now sees annual global growth reaching 3.0 % both this year and next. Thanks to a better-than-expected start of the year, the July forecast was adjusted by 0.2 percentage point upwards from the previous April forecast. On-year growth will still come in below last year’s figure (3.5 %) as well as the long-term (2000–2019) average of 3.8 %. In developed economies, growth is expected to slow from 2.7 % last year to 1.5 % this year. In contrast, economic growth in developing countries this year is expected to remain at the same level as last year (4.0 %). There is, of course, considerable variation across developing countries.

Higher-than-expected global growth has been sustained by the recovery in consumption of services after the ending of covid-era restrictions. However, it starts to reach pre-pandemic levels, so the pace of growth should slow. In contrast, the slowing of growth in industrial output and fixed investment has been most pronounced in developed economies, a situation that reduces export demand for developing economies.

The IMF forecasts for China 5.2 % growth this year and 4.5 % next year. After fast growth in the first quarter of the year, economic activity has unexpectedly slowed in recent months (see China weekly review this week). The IMF raised its growth outlook for Russia to 1.5 % due to fairly strong growth in the first half, while it expects Indian growth to come in at 6.1 % this year. The Asian Development Bank also released its 2023 economic outlook last week. The ADB’s forecast for China closely aligns with the IMF, anticipating 5.0 % growth this year and 4.5 % next year. The ADB expects somewhat higher growth for India: 6.4 % this year and 6.7 % next year.

The IMF points out that any slower-than-expected abatement of inflation poses a risk to global economic growth. While energy and food prices have fallen from their 2022 highs, core inflation, which excludes volatile food and energy prices, has remained stubbornly high. On the bright side, a faster-than-expected drop in inflation would grant central banks an opportunity to relax their monetary stances, thereby improving the global growth outlook. In addition to worries about inflation, the IMF identified the threat to global economic growth from effects of potential heating-up of the war in Ukraine and larger-than-expected impacts from El Niño ocean surface warming to food production.

IMF’s July GDP growth projections, % (April 2023 figures in parentheses)

Source: IMF World Economic Outlook, July 2023

Source: IMF World Economic Outlook, July 2023