BOFIT Weekly Review 11/2025

Economic imbalances weighing on Russia’s output growth

Russia’s stock market has risen and the ruble’s exchange rate has strengthened in recent weeks on prospects of talks on a possible ceasefire. Preliminary Rosstat figures also show Russian GDP grew rapidly last year. Yet, even with these developments, Russia’s structural imbalances are increasingly reflected in its economic performance. Output growth slowed sharply in the beginning of this year. Despite dramatic increases in government spending in recent months, it is becoming more difficult to generate growth in the face of tight capacity constraints. Inflation continues to pick up and the Central Bank of Russia (CBR) must keep interest rates high to restrain inflation. Russia’s foreign trade has suffered in recent months, causing the current account surplus to decline. Even if an agreement on a ceasefire would be achieved, the uncertainty surrounding the Russian economy will continue and the impacts from the war will leave a lasting mark on the Russian economy (for details, see BOFIT Policy Brief 4/2025).

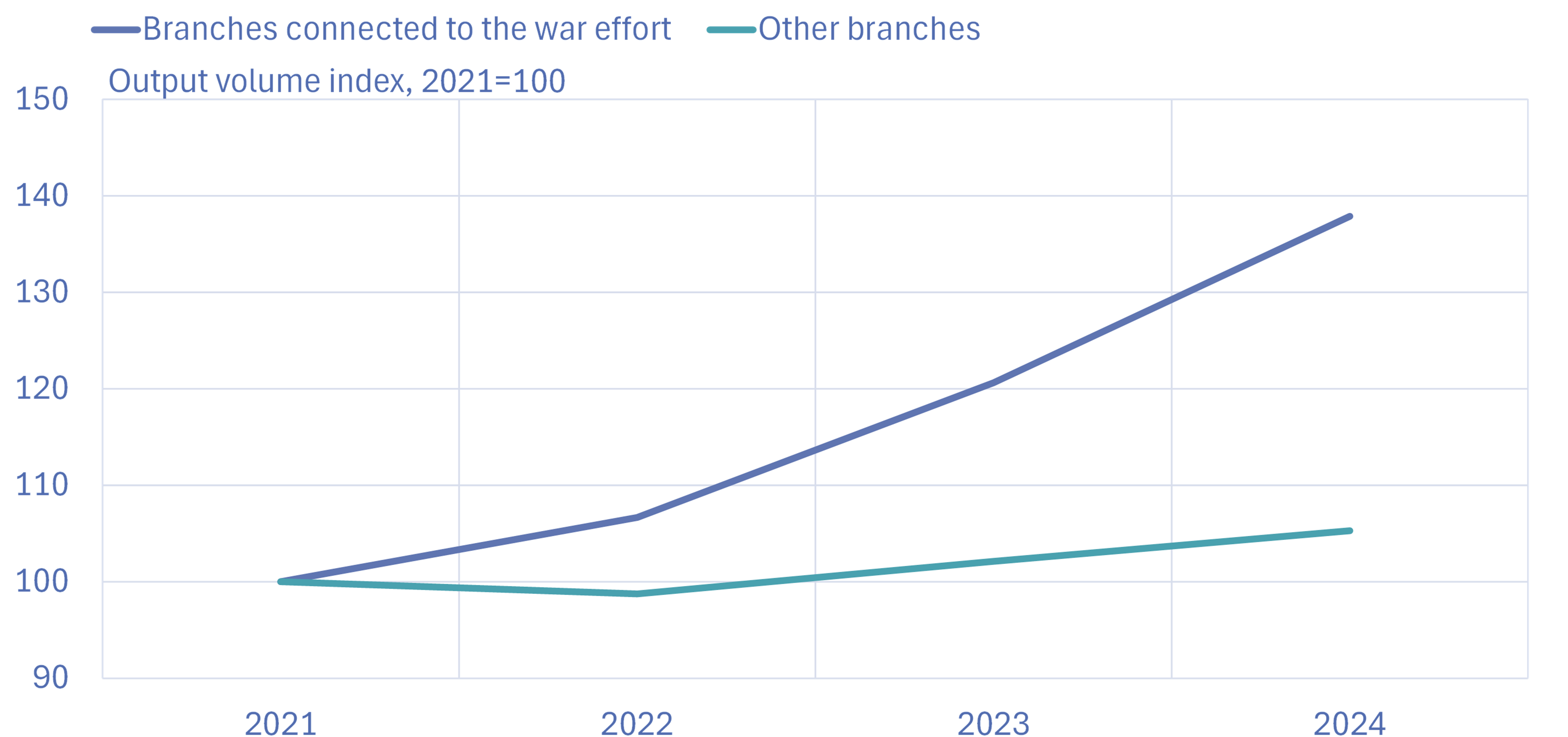

Economic growth last year was again led by branches serving the war effort

Preliminary Rosstat figures show Russian GDP grew by 4.1 % in 2024, beating the predictions of both Russian and international forecasters. Preliminary figures suggest that among demand components of GDP particularly fixed investment grew rapidly last year, by 10 %, even if the aggregated profit of Russian corporations fell by 7 %.

Fixed investment was boosted by robust growth in government spending and public sector support programmes such as subsidized credit for specific firms. Russia’s consolidated budget expenditure grew last year by 18 %, the fastest pace in 15 years. The budget deficit amounted to 3.2 trillion rubles (nearly 2 % of GDP). Government spending and fixed investment was largely channelled to branches supporting the war effort. While war-connected branches have experienced robust growth in recent years, the trend for other parts of the economy has been much more subdued.

The branches connected to the war effort have grown substantially faster than Russia’s other GDP

Note: Branches associated with the war effort include fabricated metal products, computers & electronic products, transport equipment other than motor vehicles, as well as public administration and defence services

Sources: Rosstat, BOFIT.

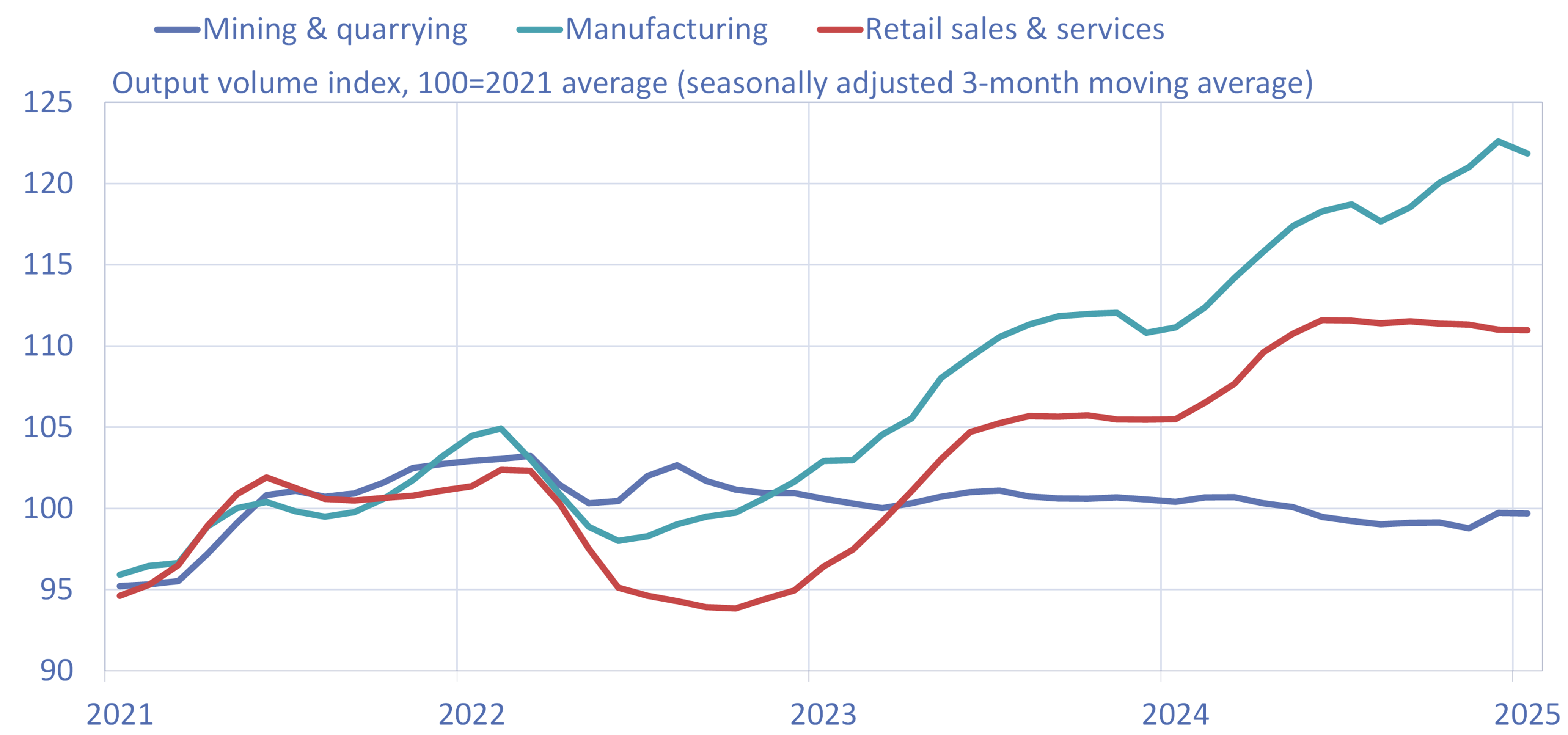

Weaker economic performance this year

Economic output growth slowed significantly in January. Rosstat reports that seasonally-and workday-adjusted industrial output in January fell by 3 % from the previous month. Weakening trends are apparent both in the mining & quarrying sector and manufacturing. High growth for manufacturing branches connected to the war effort also seems to have ceased lately. In contrast, activity in the construction sector has apparently picked up again in recent months.

Growth in consumer demand appeared to fade in recent months despite the rapid rise in wages. Preliminary Rosstat figures show the real average monthly wage grew last year by 9 %. At the same time, the purchasing power of pensions has fallen as the average monthly pension payment declined in real terms by 1 % last year. According to preliminary figures, retail sales and sales of consumer services dipped slightly in January at monthly level.

The latest CBR survey of company and consumer sentiment indicates that the weakening economic trend could begin to stabilise in coming months. Production could enjoy again a temporary burst from a large increase in government spending. All major forecasts for Russia, however, see Russian GDP growth slowing significantly this year. BOFIT’s spring release of the Russia forecast for 2025–2027 will take place on March 24 in conjunction with a Russia briefing (in Finnish).

Trends for many branches in Russia deteriorated in January

Sources: Macrobond, Rosstat, BOFIT.

Huge budget spending increases in the first two months of this year

Preliminary data released by Russia’s finance ministry show that federal budget expenditures rose by 72 % y-o-y in January – the fastest rate of increase during the full-on invasion of Ukraine. The combined on-year growth for January and February amounted to 30 %. The finance ministry reports that spending this year is again front-weighted, implying that some of the growth in January reflects prepayments on government procurements this year. Federal budget revenues increased by 6 % y-o-y in January-February. Revenues from oil & gas contracted by 4 %, while other revenues increased by 11 %.

The federal budget deficit for January-February swelled to 2.7 trillion rubles (1.3 % of GDP). The budget anticipates a deficit of 1.2 trillion rubles for all of 2025. The 2024 federal budget deficit amounted to 3.5 trillion rubles, more than double the 1.6 trillion rubles planned for in the initial budget framework.

As Russia continues to run budget deficits, it has increasingly in recent months drawn on liquid assets from the National Wealth Fund (NWF). As of end-February this year, the NWF held about 3.4 trillion rubles in liquid assets, down from about 9.7 trillion rubles in liquid assets at the end of February 2022.

Inflation climbs

Russian inflation has accelerated further in recent weeks. Consumer prices in February rose by over 10 % y-o-y. Food prices increased by 12 % y-o-y, a faster rise than prices for other goods. Preliminary figures suggest that the rise in prices has continued to accelerate this month.

At its regular monetary policy meeting in February, the CBR board decided to keep the key rate at 21 %, but also signalled that it was considering a further rate hike at its next meeting on March 21. The CBR noted in its statement that it was raising its inflation forecast for this year in response to the higher-than-expected rise in inflation. Inflation is now expected to average 9–10 % this year. The CBR says it still expects inflation to fall to the central bank’s 4 % target level by the end of 2026, but achieving that target requires maintaining tight monetary policy for longer than earlier expected. Thus, the latest CBR forecast sees its key rate remaining at an average level of 19–22 % this year.

Foreign trade has weakened

Russian foreign trade activity has faded, with the value of both exports and imports in recent months declining relative to earlier months. Russia’s current account surplus has also melted.

The structure of Russian foreign trade, however, has largely remained stable. Figures from Russian Customs show that energy fuels remained the most important export product category last year, accounting for 61 % of total exports. Other significant export product categories included metals (15 %) and agricultural inputs such as fertilisers (10 %). With respect to goods imports, the largest category was machinery, equipment and transport equipment, accounting for about half of all Russian goods imports last year. Among other significant import product groups were chemical products (20 %) and foodstuffs (13 %).

Tourism accounts for the largest share of services imports. Rosstat reports that the most popular destinations for Russian tourists outside former Soviet Union countries last year were Turkey (22 % of tourist trips), the United Arab Emirates (7 %) and China (6 %). The number of Russian tourist trips to China doubled last year.