BOFIT Weekly Review 04/2025

China’s economic growth accelerated in the fourth quarter of 2024, but many sectors struggled with weak demand

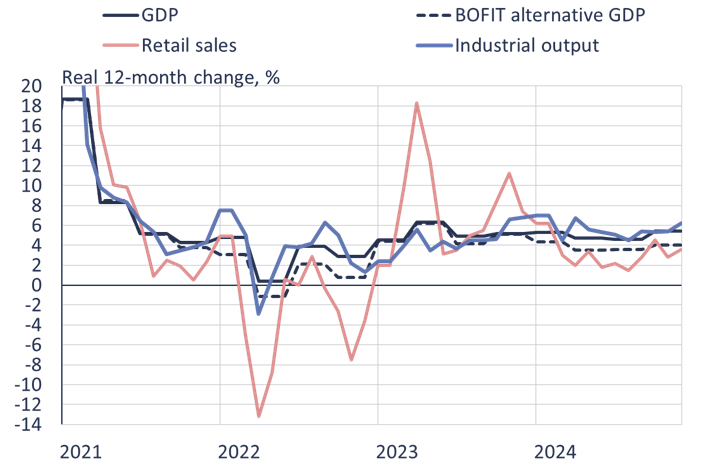

GDP growth accelerated in the fourth quarter of last year to 5.4 % y-o-y (from 4.6 % in the third quarter) according to National Bureau of Statistics (NBS) official figures. As a result, GDP growth for all of 2024 nailed the government’s official 5 % target. Strong end-year export performance supported growth, with exports accounting for nearly half of total economic growth in fourth quarter (2.5 percentage points of growth came from net export growth). For all of 2024, official statistics show that 2.2 percentage points of growth came from increased consumer demand, as well as 1.5 percentage points from net exports and 1.3 percentage points from increased investment demand. BOFIT’s alternative GDP calculation, however, suggests China’s actual GDP growth last year was probably lower than the official figures. GDP growth likely averaged around 4.1 % in the fourth quarter (3.6 % in the third quarter) and 3.9 % for all of last year.

The Chinese government appears on course to target “about 5 %” GDP growth again this year. While the official growth target will not to be announced until the plenary session of the National People’s Congress in March, China’s provinces have already declared their growth targets. Some of China’s biggest coastal provinces (Guangdong, Jiangsu, Shandong and Shanghai), which typically have growth targets that align with the national GDP growth target, are targeting 5 % growth. Half of China’s provinces reduced their growth targets for this year, with only Tianjin setting its target higher than last year. The weighted average provincial growth target still fell only marginally from 5.4 % last year to 5.3 % this year. Hitting the 5 % target could prove difficult and result in weaker confidence in official statistical reporting. The government wants to ease monetary and fiscal policy this year, but room for stimulus measures largely depends on regional economic conditions and the possibilities for local governments to take on additional debt to support growth.

Higher export demand and increased capacity boost industrial output towards the end of last year, while retail sales growth remained weak

Industrial output grew over 6 % y-o-y in December. Output was boosted by strong export demand and production in advance of the Chinese New Year holiday week (Jan. 28-Feb. 4), or 13 days earlier than last year. Even if China’s fixed investment data are extremely spotty, they reveal that investment in industrial capacity clearly outpaced fixed investment generally. The NBS reports that industrial investment last year grew by 12 % in nominal terms, even with a 2 % decline in construction investment. Investments in electrical power, gas, water and heating networks grew rapidly, along with fairly strong growth in manufacturing investment (up 9 %). Nominal investment in the services sector fell by 1 %, while investment in agriculture rose by 3 %.

Industrial output growth significantly outperformed growth in retail sales last year; BOFIT’s alternative calculations show GDP growth again fell below China’s official figures

Note: Estimates of real growth in retail sales are based on consumer price inflation.

Sources: NBS, Macrobond and BOFIT.

Conditions in the real estate market remain dire. The volume of apartment sales measured in floorspace in December was again down from a year earlier (the on-year volume of apartment sales was up in November). In 2024, the volume of apartment sales measured in floorspace fell by 13 % y-o-y and 17 % measured in value. The value of real estate investment fell by 11 %.

In March 2024, China launched a rebate programme to boost sales of durable goods to support domestic consumption demand. Households and firms are eligible for government rebates for the exchange of certain used equipment, household appliances and vehicles for new versions. The typical rebate was 15 % of the sales price. The rebate for exchanging a used car for a new all-electric or hybrid automobile was increased in July to a maximum of 20,000 yuan (2,600 euros) and up to 15,000 yuan for a low-emission vehicle with an internal combustion engine. The government announced in December that its trade-in programme had incentivised the purchase of 49 million home appliances and over 5 million new cars. Oversight of the programme has been delegated to local governments, so the consumer products eligible for rebates can vary from province to province. The central government has allocated assets to local governments for this purpose. The purpose of the trade-in programme is largely to encourage consumers to bring their purchase decisions in the durable goods market forward, and the real economic impacts of the programme have been small. Retail sales last year grew by just over 3 % y-o-y in real terms. The value of home electronics sales grew by 12 %, but the value of car sales fell slightly. The trade-in programme has been extended this year to include e.g. rice cookers, microwave ovens, smartphones and tablets. The rebate for purchase of some products is as much as 20 % of the price and up to 2,000 yuan (264 euros) for household appliances and 500 yuan (66 euros) for digital devices. Support is also available to firms in certain fields. For example, the rebate on swapping out an old bus for a new electric bus can run as high as 80,000 yuan (10,600 euros) per vehicle.

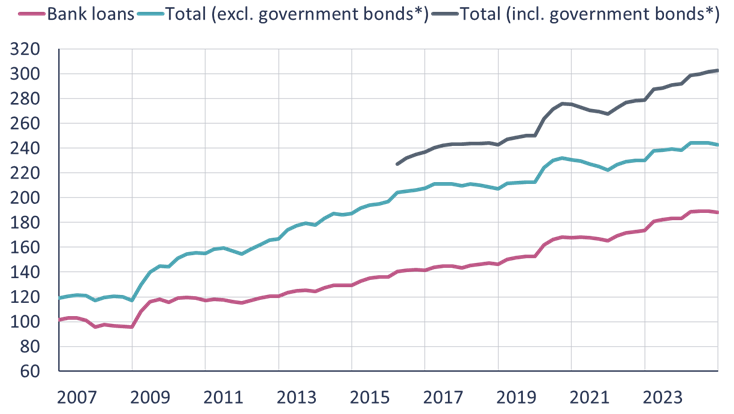

Growth in the loan stock slowed last year, but China’s debt-to-GDP ratio continued to rise

China’s stock of domestic bank loans grew by 7.2 % in 2024, a clear slowdown from the above-10 % growth in 2023. Lending to households, in particular, was tepid, and the stock of household loans grew by just over 1 %. The slowdown reflects weakness in housing sales as housing loans constitute the biggest chunk of household borrowing. The People’s Bank of China’s broad measure of domestic debt, aggregate financing of the real economy (AFRE), grew by 8 % last year. Growth was particularly strong in provincial and local government borrowing (up 16 %). The stock of shadow banking sector instruments such as entrusted loans, trust loans and banker’s acceptance bills did not change from 2023.

Although growth of the loan stock slowed, it still grew considerably faster than nominal GDP. At the end of last year, the stock of bank loans equalled 192 % of GDP (187 % in 2023). AFRE also grew faster than the economy, standing at year’s end at 303 % of GDP (292 % in 2023). Nominal economic growth last year was 4.2 %, i.e. the GDP-deflator was clearly negative. China’s headline inflation was also very low, with consumer prices up by just 0.2 % last year. Producer prices fell by 2.2 %.

China’s total domestic debt-to-GDP ratio continued to climb last year

*) Bond issues of central government and local governments. The IMF estimates that China’s actual public debt amounted to 124 % of GDP at the end of 2024.

Sources: PBoC, CEIC and BOFIT.