BOFIT Weekly Review 51/2024

China lays out economic policy framework for 2025

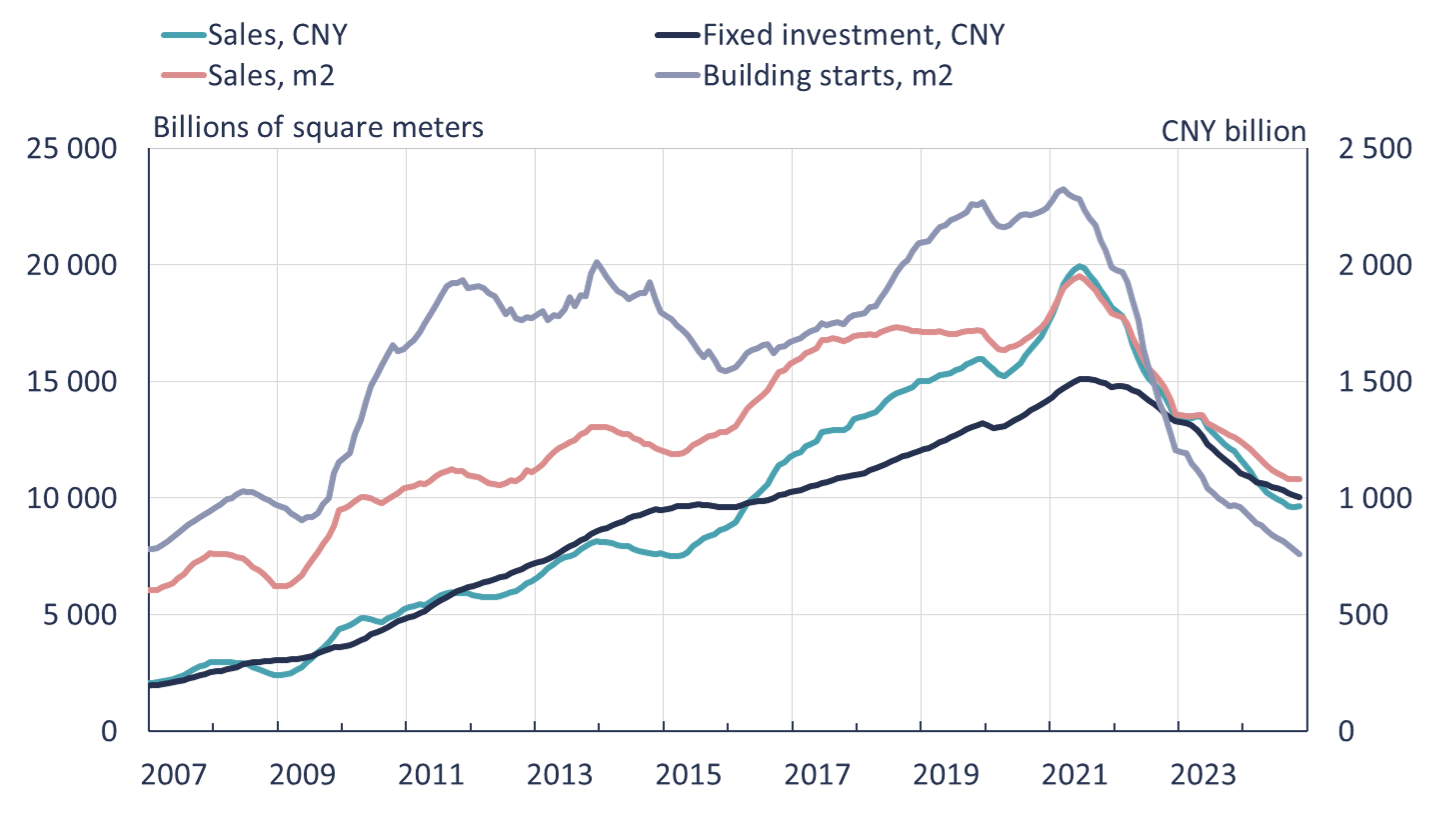

The Chinese economy has posted a relatively weak performance this year. According to BOFIT’s alternative calculation, 12-month GDP growth in January-September may have dipped below 4 %. At the end of September China’s decision-makers announced that they were planning a package of measures to support the economy, which they then followed up with a number of concrete actions (BOFIT Weekly 40/2024). The latest measures, which focus on the real estate sector, appear to be working. On-year apartment sales were up in November for the first time since spring 2023, when the ending of covid restrictions resulted in a temporary burst of housing sales. Growth in retail sales, in contrast, faded in November after a boisterous October. Inflation remains close to zero.

The press release at the conclusion of annual Central Economy Work Conference on Tuesday (Dec. 17) stated that the economic policy stance in 2025 will be more accommodative than this year. The public sector budget deficit will be increased, off-budget “special purpose bond issues” will be conducted, and monetary policy will be eased. At the same time, China will strive to maintain the stability of the financial markets and the exchange rate of the yuan.

Next year’s areas of emphasis have been divided into nine main categories. Among other things, China wants to encourage domestic demand, especially domestic consumption. Employment programmes will get more support and basic pensions increased. Science, technology, innovation and industrial development remain high on the government’s priority list. One way the government will try to move the reforms forward involves altering the public sector framework to give regions greater flexibility in determining their revenues. The government wants to end restrictions on China’s domestic trade and continue opening up to foreign countries in the service sector. The party leadership also wants to see an end to the real estate sector downturn. China’s green transition will be promoted, with the reduction of emissions a major focal point.

While it is difficult to estimate the scale of planned stimulus measures, it is clear that nothing close to the massive 2008 stimulus package is contemplated. Throughout the Xi Jinping era, fiscal policy has been exceptionally loose even in normal conditions, with the result that public sector deficits have ballooned (IMF estimates range from 10 % to 15 % of GDP a year and put government debt above 120 % of GDP). While the public sector budget deficit is set to be increased from this year’s 3 % of GDP, local governments will remain under pressure to reduce their funding raised through off-budget local government financial vehicles (LGFVs), which the IMF estimates to be about 4 % of GDP this year. The prospects for monetary easing have been frustrated by a strong depreciation of the yuan against the dollar in recent weeks. Substantial relaxation of the monetary stance would further weaken the yuan, a situation neither the central bank nor the leadership find acceptable.

The downturn in China’s housing market appeared to stabilise in recent months

Note: Data series are 12-month running sums.

Sources: China National Bureau of Statistics, CEIC and BOFIT.