BOFIT Weekly Review 45/2024

Ukraine’s growth slows; foreign financing remains a critical source of budget funding

Ukraine’s GDP growth depressed by destruction of its energy sector

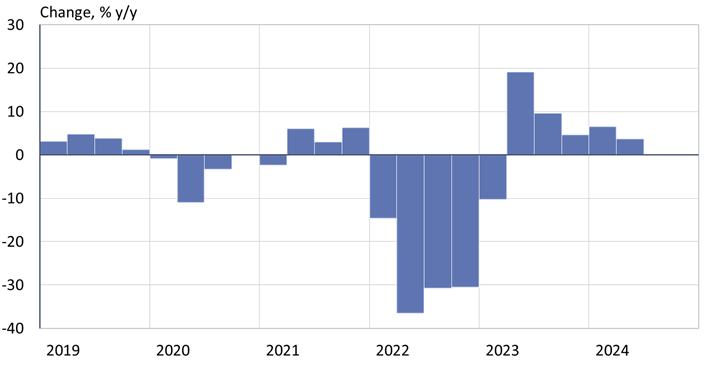

Preliminary figures released by the State Statistics Service of Ukraine show that the country’s GDP grew by 3.7 % y-o-y in April-June. Second-quarter growth was sustained by maritime exports as the Black Sea ports remained open, domestic consumer demand and government-funded reconstruction projects. Growth was distinctly lower than the 6.5 % pace in the first quarter, however. The slowdown in growth largely reflects damage to electrical power generation and distribution facilities caused by Russian bombing, as well as a lack of skilled workers. The International Monetary Fund (IMF) expects Ukrainian GDP growth of 3 % this year and 2.5–3.5 % next year.

Ukraine’s GDP grew in the second quarter, but was well off the first-quarter’s pace

Sources: State Statistics Service of Ukraine, BOFIT.

Electricity production in the coming winter constitutes a significant threat to Ukraine’s economic recovery. Russia is estimated to have destroyed at least 9 GW of Ukraine’s installed electricity capacity. The IMF says the country faces a power deficit of 3–4 GW this winter – even with repairs to the grid, assistance flows and an upward-revised forecast for electricity imports. Electrical power consumption reached roughly 18 GW at its peak last winter. The situation could be aggravated significantly by such factors as a colder-than-usual winter, delays in material assistance to the energy sector or a new wave of Russian bombings.

Another significant bottleneck is the lack of skilled labour. The military needs soldiers and businesses need workers. Ukraine’s prime minister Denys Shmyhal said that about 900,000 Ukrainians have been temporarily exempted from military service. Ukraine’s parliament is currently considering a bill clarifying the conditions of exemption from military service for firms to keep a worker otherwise eligible for military service on the job.

Although Ukraine no longer releases official unemployment figures, a survey conducted by the Info Sapiens research agency concluded Ukraine’s unemployment rate in August exceeded 15 %. Ukraine is planning measures to get workers to leave the informal grey economy and enter the formal employment market so that they pay taxes on their wage income and boost desperately needed government revenues. The UN estimates that the number of Ukrainian living outside the country has remained around 6.7 million in recent months.

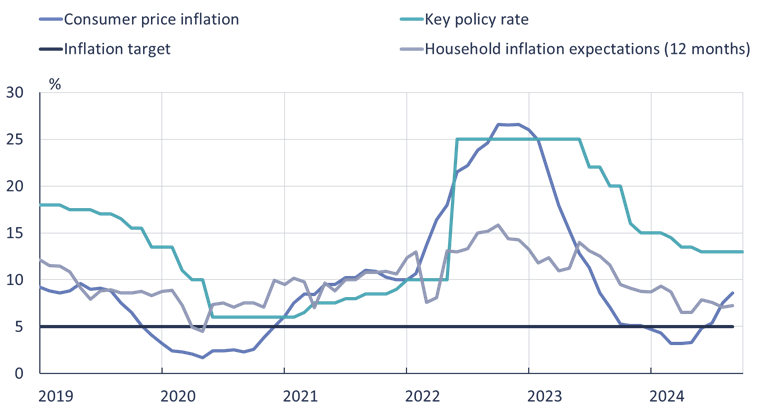

Inflation accelerates due to poor harvests and rising production costs

Consumer price inflation in Ukraine, which has accelerated in recent months, hit 8.6 % y-o-y in September. Big contributors fuelling inflation included rising food prices as a hot and dry summer reduced many crop yields. Rising production costs (due, for example, to higher electricity prices), as well as weakness in the hryvnia’s exchange rate have also increased inflation pressures. The freeze on municipal services rates (water, gas, heat, etc.) has subdued inflation to some extent. The National Bank of Ukraine (NBU) expects inflation pressures to remain high in coming months, due e.g. to increased government spending, the rapid rise in wages and problems related to energy availability. The NBU sees inflation resuming its decelerating trend next spring.

Ukraine’s inflation has accelerated in recent months

Sources: National Bank of Ukraine, BOFIT.

Despite accelerating inflation, Ukraine’s central bank decided at its meeting in late October to keep its key policy rate at 13 % as inflation expectations have not increased. The NBU expects to keep the policy rate at its current level at least until next summer, but is ready to tighten its monetary stance should inflation pressures kick up.

Ukraine requires substantial foreign support to cover its budget deficits

The new budget framework was submitted to the parliament last month. It projects a government spending increase of 8 % in 2025. According to the budget draft, spending on defence and national security represent about 57 % of total spending (26 % of GDP) as the war is expected to continue next year. Government revenues should grow by nearly 20 % next year, largely due to higher tax rates. For example, the military tax component of income taxation will be increased and its coverage extended and the profit tax on financial companies is raised.

With rising revenues, the budget shortfall is expected to shrink next year to 36.5 billion dollars (19 % of GDP). The budget deficit will be largely covered with low-interest loans from partner countries and international organizations. The remainder of the deficit would be funded with domestic bonds. Ukraine’s government debt is expected to hit roughly 97 % of GDP next year and then gradually decline in subsequent years.

Ukraine’s government published its first medium-term budget plan since the February 2022 invasion of the country. The plan extends through 2027. The release of a medium-term budget plan is intended to promote predictability and transparency in the budgeting process during a period of martial law and is a required criterion for participation in the IMF’s Ukraine Extended Fund Facility.

IMF Board approves Ukraine’s next loan tranche

In mid-October, the IMF’s Board approved its fifth review of Ukraine’s lending programme under the Extended Fund Facility (EFF). To be eligible for ongoing disbursal of EFF loan tranches, Ukraine must pass quarterly reviews to ensure it is meeting agreed macroeconomic targets and implemented reforms in conformance with set criteria. With the positive determination, Ukraine became eligible for its next $1.1 billion loan tranche.

The 2023–2027 EFF programme ultimately provides 15.6 billion dollars in inexpensive loans to Ukraine. Ukraine can withdraw up to 5.4 billion dollars in EFF funding this year.