BOFIT Weekly Review 44/2024

China’s economic growth settled in third quarter

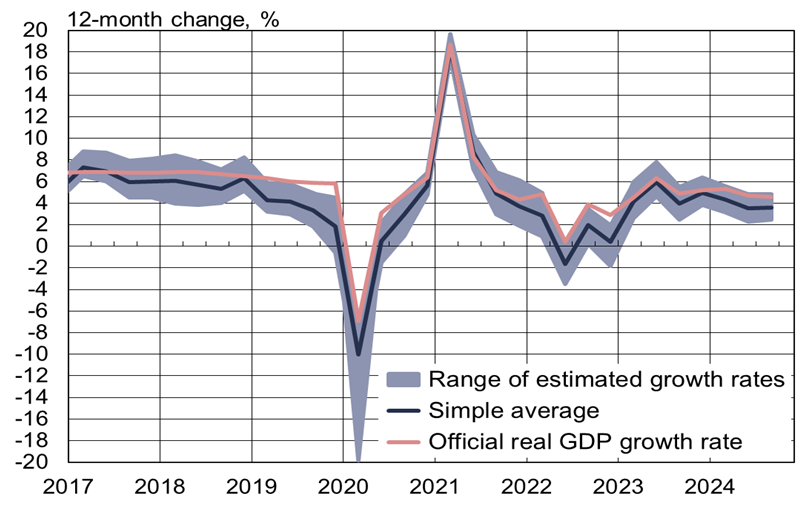

China’s National Bureau of Statistics (NBS) reports that real GDP grew by 4.6 % y-o-y in the third quarter, a slight deceleration from 2Q growth of 4.7 %. BOFIT’s alternative calculation of Chinese GDP suggests growth may have been much lower, as the average calculation for both quarters was below 4 %. Strikingly, the NBS reports that on-quarter growth picked up in the third quarter (up 0.9 %) compared to the second quarter (up 0.5 %), even though its own monthly growth indicators for the third quarter suggested weaker growth than in the second quarter. Our autumn update of the 2024–2026 Forecast for China will be released on Monday (Nov. 4).

China’s official estimate of real GDP growth and BOFIT’s alternative estimates

Sources: China National Bureau of Statistics, Macrobond and BOFIT.

Net exports accounted for an inordinate share (nearly half) of third-quarter GDP growth. The volume of Chinese goods exports has experienced robust growth (around 15 % y-o-y) in recent months. Export prices, however, have been falling overall, so growth in the value of exports has been lower than growth in export volumes. The strongest markets for Chinese exports are located in Southeast Asia and Mexico. Studies, however, suggest that many of the products shipped to these regions eventually end up in the US or EU. While exports have performed well, weak domestic demand has restrained import growth. Moreover, China’s massive investment in development of its high-tech branches and production capacity diminishes import demand to some extent.

Growth in domestic consumer demand remained fragile, contributing only slightly more than 1 percentage point to economic growth. Although surveys suggest consumer confidence continued to decline in September, real on-year growth in retail sales perked up a bit from previous months. Consumer demand has been hurt by the weak labour market and ongoing slide in apartment prices (which directly reflects on Chinese household wealth, which is largely tied up in real estate). Even with this year’s support measures, the sharp contraction in the real estate sector continues. Real estate investment declined by 10 % y‑o-y in September, the volume of sales measured in terms of floorspace was down 10 % y-o-y and there were 20 % fewer building starts than a year earlier. Even if the rate of contraction remains high, it is a bit lower than in the first half of this year.

With fixed investment growth fading in the third quarter, it added just over one percent to GDP growth overall. While the real estate construction has been contracting, in investment growth overall was supported by expansion of production at state-owned companies and infrastructure projects. The categories showing the biggest increases in investment included foodstuffs, municipal infrastructure, various transport services, accommodation and catering, as well as production of trains, ships and planes.

China is introducing a new round of stimulus measures to boost the domestic economy, help struggling sectors of the economy and deal with near-zero inflation (BOFIT Weekly 40/2024). In late September, the PBoC cut several policy rates and lowered the reserve requirement ratio for commercial banks. As a follow-up of the policy rate cut, the lending prime rate (LPR), which is used to set bank loans, was reduced by 25 basis points in early October. The one-year LPR currently stands at 3.1 %, while the reference rate for housing loans of over five years is 3.6 %. The PBoC has signalled that more actions could be coming before the end of the year. The government also noted in late September that fiscal policy measures were needed to boost the economy. Despite media speculation on the nature and scale of such measures, the government has yet to reveal any specific plans. The finance ministry announced that the proposed measures would be spelled out at a press conference next Friday (Nov. 8).