BOFIT Weekly Review 41/2024

Russia’s economic growth slows further in August; BOFIT forecasts lower growth in the years ahead

GDP growth slowed in August

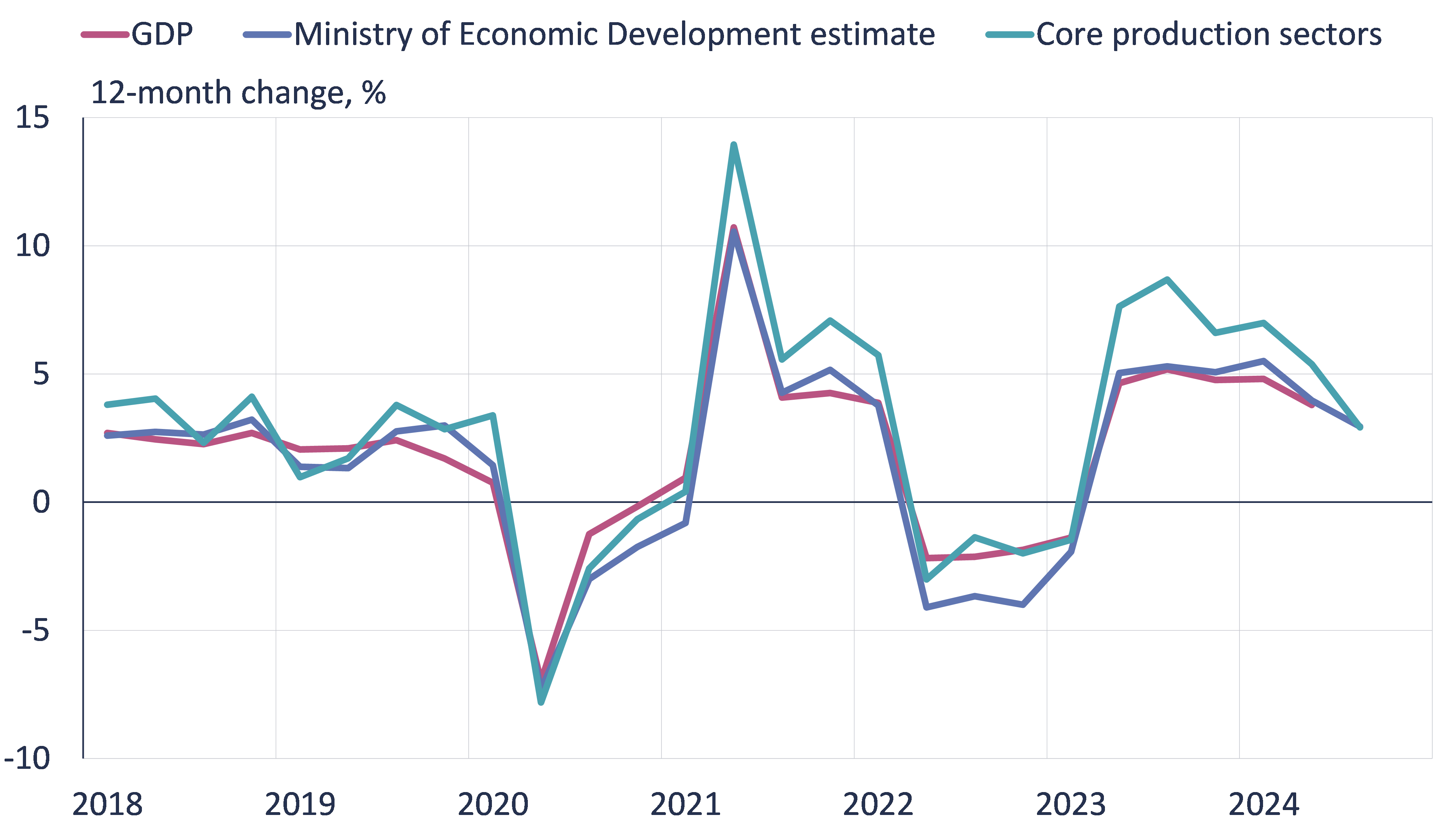

The preliminary estimate of the economic development ministry and the official indicator for output of core sectors of the economy show Russia’s 12-month GDP growth slowed further in August. The August figures were the weakest since the recession following immediately after Russia’s 2022 invasion of Ukraine.

The slowdown in output growth was anticipated. Producers face labour shortages and stretched levels of capacity utilisation in many branches. Company costs have also risen in the face of wage pressure and higher prices for production inputs. Increasing consumer prices, in turn, erode purchasing power. The Central Bank of Russia (CBR) has raised its key rate to 19 % which restrains credit growth.

Development has weakened in nearly all main sectors of the economy. In August, agricultural production was a key drag on output growth, as it contracted by 15 % y-o-y. Agriculture minister Oksana Lut explained that lower grain harvests this year reflect unfavourable weather conditions and Ukraine’s military incursions into southern Russia. This year’s grain harvest could undershoot previous official forecasts. 12-month growth in retail sales and other consumer-driven services continued to slow in August. The trends were similar also for both industrial production and construction. August 12-month growth in construction was close to zero.

Preliminary indicators show Russian GDP growth continued to slow in August

Note: The indicator for core production sectors comprises agriculture, industrial production, construction, wholesale & retail sales, as well as goods and passenger transport volumes. Both the core-sector indicator and the Ministry of Economic Development estimate are three-month averages (except for the latest observation that covers July-August).

Sources: Rosstat, CEIC, BOFIT.

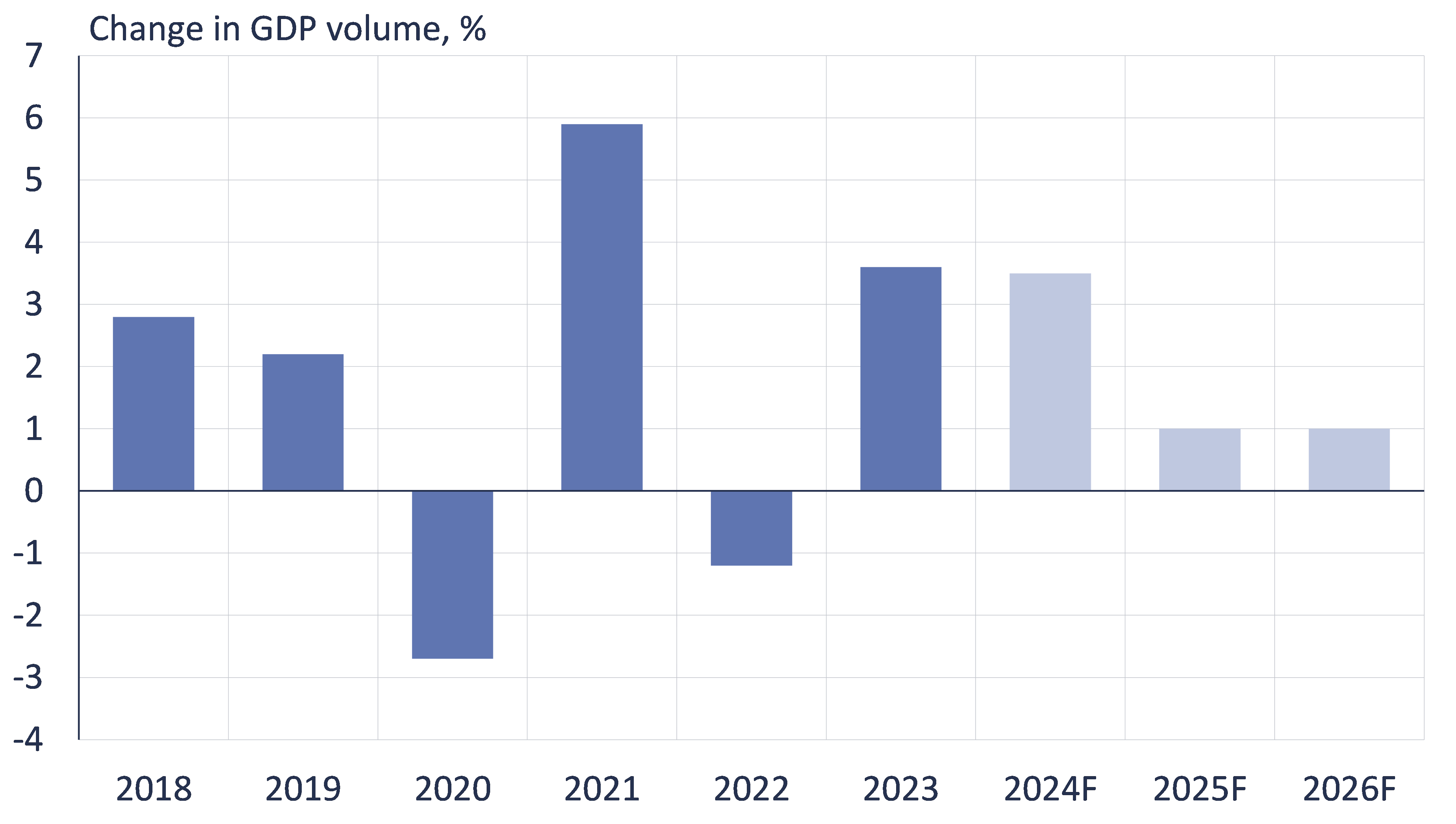

BOFIT expects Russian GDP growth to slow to around 1 % next year

BOFIT’s updated Forecast for Russia 2024-2026 sees GDP growth on a slowing trend as Russia can no longer overcome capacity constraints. Although we still expect overall GDP growth of 3.5 % this year, annual growth should slow to around 1 % in 2025 and 2026. Russian growth continues to be boosted by state support, as public spending increases further. Household consumption also continues to grow, but growth is expected to slow next year. Growth in private sector investment is limited by multiple factors, including rising costs, higher interest rates and tax increases. Russia’s export volumes should remain at their current levels throughout the forecast period. While import volumes are expected to decrease a bit this year, they should stabilise over the coming years.

As long as Russia pursues its war of aggression in Ukraine, there are substantial downside risks related to Russia’s economic outlook. Russia’s government finances remain dependent on oil earnings, which means that declines in the export price of Russian oil would hamper government efforts to support the economy through increased public spending. Even in that case, the government will stick to war spending as the needs of war are the priority also in Russia’s economic policy. GDP growth could turn out higher than expected if government spending would grow even more, but such a move would also exacerbate the country’s economic imbalances.

BOFIT expects growth of the Russian economy to slow to around 1 % p.a. in 2025 and 2026

Sources: Rosstat, BOFIT.

Russia plans to further boost government spending next year

The Russian government’s 2025–2027 budget framework was submitted to the lower-house Duma at the end of September. The budget plan has been adjusted upwards, particularly with respect to revenues and expenditures in 2025. The estimates for 2026 and 2027 are still subject to much uncertainty. For next year, the budget framework assumes GDP growth of 2.5 %, consumer price inflation of 4.5 %, an average export price of $70 a barrel for Russian oil and an average exchange rate of 96.5 rubles to the dollar.

In the latest three-year budget framework for Russia’s state finances (consolidated budget that includes federal and regional budgets, as well as state funds), revenues are expected to rise by 14 % next year. In line with tax hikes entering into force at the start of next year, most revenue growth is expected to come from increases in income and sales taxes. The corporate profit tax will rise from 20 % to 25 %, value-added taxes (VAT) will be extended to cover small firms, and slight income tax increases will hit the top income brackets. Most of the new revenues generated by the tax increases will flow directly to the federal budget. Government revenues from oil & gas earnings are expected to decrease slightly next year, representing 27 % of federal budget revenues and 14 % of consolidated budget revenues.

The government expects to increase consolidated budget spending by 10 % in 2025. As in recent years, defence has garnered the heftiest spending growth, while other major spending categories will see only modest nominal increases. Accounting for inflation, however, most major non-defence expenditure categories will experience no real growth. In recent years, military-related spending has taken a much larger slice of the budgetary pie, while other major spending categories such as social policy and education have seen their relative shares decrease.

The budget framework shows a moderate deficit for the three years period. This year’s deficit is expected to double from earlier projections to around 4 trillion rubles (2 % of GDP). The 2025–2027 deficits are expected to average 2 trillion rubles annually (1 % of GDP). The total framework deficit for 2025–2027 would therefore amount to about 6 trillion rubles, all of which would be covered through government borrowing. At that level, Russia should have little problem financing its entire budget deficit. Russia’s National Wealth Fund also holds roughly 5 trillion rubles in liquid assets.

There are also risks related to the proposed budget framework, which is fairly optimistic in several of its assumptions. Economic growth could be lower than forecast and inflation could rise more than expected. A drop in Russia’s oil export price or reduction in Russia’s oil production volumes would cut Russia’s budget revenue. The government could also decide to increase spending if it feels the course of the war or the slowing economic growth demands it. Russia’s latest budget framework is assessed in this new BOFIT blog post .

Russian consolidated budget revenues, expenditures and net imbalances, 2021–2027 (F = forecast, B = budget framework)

| 2021 | 2022 | 2023 | 2024F | 2025B | 2026B | 2027B | |

|

Revenues, RUB billion |

48,082 | 53,033 | 59,034 | 68,877 | 78,178 | 82,966 | 87,394 |

| growth, % | +10% | +11% | +17% | +14% | +6% | +5% | |

|

Expenditures, RUB billion |

47,062 | 55,182 | 62,984 | 72,864 | 79,920 | 84,928 | 89,833 |

| growth, % | +17% | +14% | +16% | +10% | +6% | +6% | |

| Surplus/deficit, RUB billion | 1,020 | -2,149 | -3,950 | -3,987 | -1,742 | -1,962 | -2,439 |

| % of GDP | 0.8 | -1.4 | -2.3 | -2.0 | -0.8 | -0.9 | -1.0 |

Sources: Russian Ministry of Finance, BOFIT.