BOFIT Weekly Review 26/2024

Chinese exports of electric vehicles to Europe have soared in recent years, but planned EU tariffs on electric cars could have an impact

The European Commission announced on June 12 that it was planning to impose additional tariffs on battery-operated electric vehicles (EVs) imported from China. The decision is the result of a Commission investigation launched last autumn on the extent to which the Chinese state subsidises EV industries. Provisional tariffs would kick in on July 4, expediting the urgency of current talks between China and the EU. The tariffs would become permanent on November 2 at the latest if China and EU fail to reach agreement. The proposed tariff range of 17–38 % reflects the level of subsidisation from the Chinese government and cooperativeness of each manufacturer in the EU investigation. A Commission press release, for example, called for a tariff of 17.4 % on BYD, 20 % on Geely and 38.1 % on state-owned SAIC. The new EU tariff comes on top of the existing 10 % tariff on all cars produced outside the EU. In addition to Chinese carmakers, the new tariffs would hit Western carmakers that build EVs in China, (e.g. Tesla, BMW and Volkswagen). The additional tariffs would focus only on battery-operated EVs and would not affect chargeable hybrids. China has criticised the tariffs. Its commerce ministry said on June 17 that it was launching a dumping investigation into pork imported from the EU, apparently in response to the EU announcement of EV tariffs.

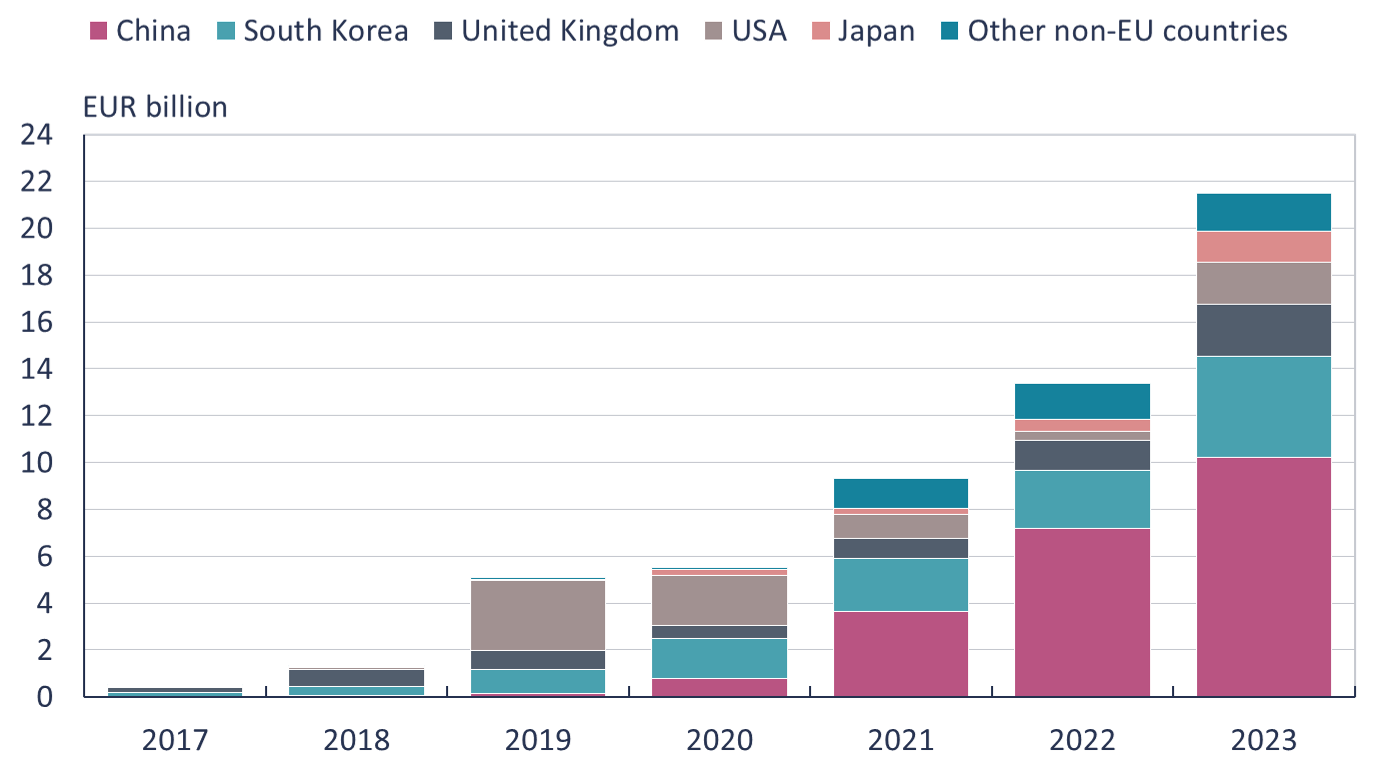

China is the world’s largest producer of electrical vehicles. In 2023, 38 % of China’s EV exports went to the EU. The Kiel Institute estimates that around 20 % tariff on Chinese EV imports to the EU would decrease Chinese EV imports by about 25 % in the short term. The European Automobile Manufacturers’ Association (ACEA) reports that about one in five of the 1.5 million battery-operated EVs sold in the EU were produced in China. However, only about a third of EVs imported from China were Chinese brands. The value of EVs imported from China last year exceeded 10 billion euros, and represented about 2 % of the value of the EU’s total goods imports from China. China’s share has risen rapidly. In 2022–2023, China accounted for half of EV imports into the EU in value terms. EU tariffs could force makers of cars produced in China to raise their prices, which would slow the EU’s green transition or at least make it more costly.

The EU’s imposition of tariffs on Chinese EVs could also accelerate plans of Chinese carmakers to build plants in Europe, particularly carmakers hit hardest by tariffs. According to a recent MERICS report, China has made significant investments in the EV field in Europe in recent years and levels of investment are expected to increase further. In 2023, the EV investment of Chinese companies in the EU countries amounted to 4.7 billion euros – and represented about 70 % of total Chinese foreign direct investment in the EU. For example, the Chinese battery manufacturer CATL has already built a battery factory in Germany and is currently constructing a massive battery factory in Hungary. The Chinese companies AESC and Svolt also have plans to build battery factories in Europe. With respect to EV manufacture, both Geely (owner of the Volvo brand) and BYD are constructing or planning to build EV plants in Europe. The big European winner in attracting Chinese EV investment is Hungary, which scooped up over half of Chinese EV investment in 2022 and 2023. Germany and France followed with significantly smaller combined investments.

The Commission’s proposed tariffs do not apply to car parts, including batteries. Chinese companies have a strong position in battery manufacture. Six of the world’s ten largest EV battery-makers are Chinese (with the largest being CATL and BYD). According to the market research firm SNE Research, their combined market share last year exceeded 60 %. Outside China, nearly 40 % of the installed battery capacity in EVs is of Chinese origin. SNE Research figures show that CATL this year became the market leader outside China as well. CATL batteries are also used in EVs imported to Europe, including Tesla Model 3 and Model Y vehicles, as well as BMW, Mercedes-Benz and Volvo models. The three top South Korean battery manufacturers (LG Energy Solution, Samsung SDI and SK On) have a combined market share outside China of nearly 50 %.

Value of electrical vehicles imported into the EU, 2017–2023

Sources: Eurostat and BOFIT.