BOFIT Weekly Review 18/2024

China’s real estate sector continues to sink

Figures released by the National Bureau of Statistics show that in January-March building starts (measured by volume, square metres of floorspace), contracted by 30 % y-o-y, while the volume of building projects in progress fell by 10 %, the value of construction investment by 10 %, the volume of apartment sales by 20 % and the value of apartment sales down by nearly 30 %. While NBS data reflect a general continued drop in apartment prices this year, the official data on housing prices are questionable. Some unofficial sources report large price drops, but NBS figures indicate that new apartment prices nationally have on average only fallen by 5 % and that prices in secondary markets are only down by about 10 % from their peak in autumn 2021. China’s megalopolises are generally in a better position than small and mid-sized cities, many of which have seen net population decreases as people move away.

China’s real estate downturn began in 2021 after officials imposed strict “three red lines” debt rules on developers in an effort to reduce overheating in the sector (BOFIT Weekly 6/2021). China last year tried to halt the real estate sector’s slide with multiple measures like relaxing developer debt rules, providing targeted lending to sector participants, increasing construction of subsidised housing and refurbishing of “urban villages,” as well as increasing the role of state-owned builders in the sector (BOFIT Weekly 6/2023). Several cities have announced their own measures, including making it easier to buy and sell apartments and support for local builders. This year authorities introduced “white lists”, where local governments select real estate projects that are entitled to easier bank financing. While many measures have certainly helped the sector, they have been insufficient to prevent the sector’s demise.

Debt rules and the subsequent collapse of the housing market have thrust dozens of developers into financial difficulties. At least thirty builders have defaulted on their debts, and many are already on the path the bankruptcy or reorganisation. A Chongqing court last week ordered the restructuring of the Jinke Property Group. The decision marked the first time a domestic court in China has ordered the reorganisation of a large real estate developer. Some developers have been ordered to be liquidated outside mainland China, but it remains unclear what such rulings imply. In late January 2024, for example, a Hong Kong court ordered liquidation of Evergrande assets even though most of the troubled developer’s assets are located in mainland China. For the time being, the sector’s problems seem to have been reflected only slightly in the banking sector. While the stock of non-performing receivables of the real estate sector have increased a bit, the ratio of non-performing receivables in the economy as whole has fallen according to the banks’ financial reports. The true quality of bank lending portfolios, however, is unknown as in China it is customary to roll-over non-performing loans and issue new loans to pay off the old loans.

The contraction of China’s real estate sector might still continue in coming years. A recent IMF staff report, for example, suggests that the sector might return to growth only in 2028. Housing demand is reduced by China’s shrinking population, a slowdown in urbanisation and the fact that the apartment stock is relatively new (two-thirds of Chinese live in apartments built after the year 2000). The falling size of the average household is the sole positive trend driving housing demand. The supply-side issues include a need to shed the stock of unsold apartments, a large stock of sold but unfinished apartments, and it is likely that investors will reduce their stocks of apartments. Regional differences, however, are worth noting. The IMF report suggests, for example, that construction needs in Beijing and Shanghai should remain at roughly the same levels as in 2019–2021, while need for additional construction in provinces such as the Jilin and Liaoning provinces in northeastern China, as well as Beijing’s port city of Tianjin should be minimal over the next ten years.

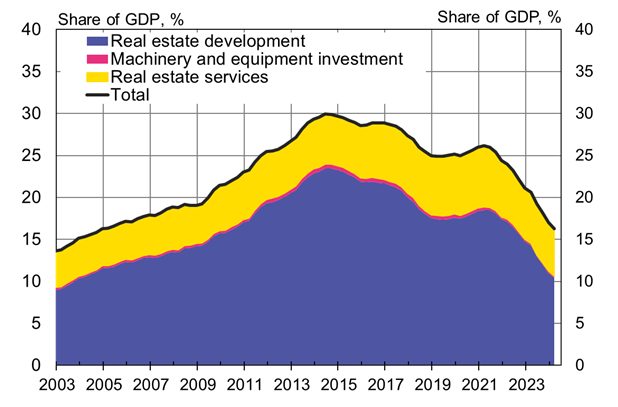

The contribution of real estate-related activities as a share of GDP may already have fallen from 30 % to 16 %

Sources: China National Bureau of Statistics, CEIC, Rogoff & Yang 2021 and BOFIT calculations.