BOFIT Weekly Review 49/2016

Foreign investors gain new trading link to Shenzhen exchange

The gradual opening of China’s stock exchanges to the world continues, even with new restrictions on capital movements. The long-awaited Shenzhen-Hong Kong Stock Connect trading link launched operations on Monday (Dec. 5), giving foreign investors the ability to invest via Hong Kong in 678 firms on the Shenzhen exchange’s main and SME boards. Brokers and institutional investors can also now invest in 203 firms on the tech-heavy ChiNext board. Many of the 1,850 firms listed on the Shenzhen exchange are “high growth.” The average P/E ratio for Shenzhen-listed firms is 44, compared to 16 for firms on the Shanghai exchange.

Large mainland Chinese investors (investments over 500,000 yuan, approx. €70,000) have access to shares of 417 companies traded on the Hong Kong stock exchange. The amount includes shares of about 100 new (mostly small) firms, while the rest are the same as in the Shanghai-Hong Kong Stock Connect link, which opened two years ago. As with the Shanghai link, the net daily quota for foreign investors (buying minus selling) is 13 billion yuan (€2 billion). The daily quota for mainland Chinese investing in Hong Kong via the Shenzhen exchange is 10.5 billion yuan.

The first day’s trading after the launch of Stock Connect was subdued. The average daily trading volume of foreign investors on the Shenzhen exchange was around 2.2 billion yuan (1 % of the exchange’s daily turnover). Investors from mainland China on average bought shares worth nearly 600 million yuan in Hong Kong. The Shanghai-Hong Kong Stock Connect link accounts for about 1 % of the Shanghai exchange’s daily turnover and 3 % of Hong Kong’s turnover.

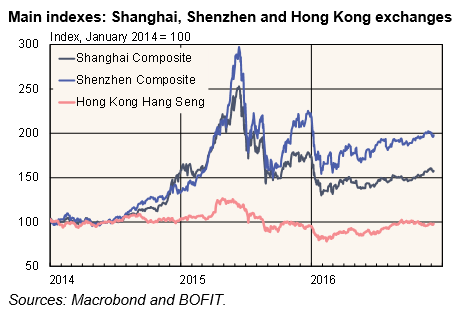

Stock markets in mainland China have picked up since the doldrums of summer. The main indexes of the Shanghai and Shenzhen exchanges are up 8 % from the end of July. Shares of companies listed in mainland China are still on average over 20 % more expensive than the same shares listed in Hong Kong, but the price gap has narrowed. The new Stock Connect link is not expected to significantly reduce the price difference as share prices on the mainland China and Hong Kong exchanges are affected by different factors. In addition, intraday trading and short sales via Stock Connect are impractical, reducing opportunities for arbitrage.