BOFIT Weekly Review 20/2016

Swings in yuan-dollar exchange rate get larger

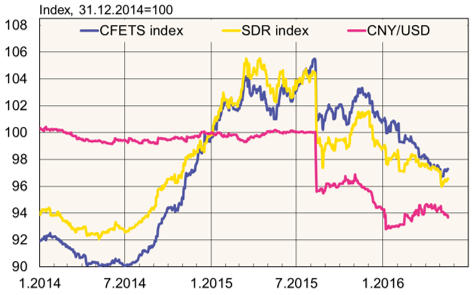

Last August’s foreign exchange overhaul was designed to allow larger swings in the yuan-dollar exchange rate. The People’s Bank of China has accomplished this goal to some extent as the volatility in both the yuan-dollar exchange rate fixing and the USD/CNY market exchange rate has increased significantly since August. At the same time, yuan volatility against multi-currency indexes has decreased.

The PBoC began last December to publish three multi-currency exchange rate indexes (the CFETS index, which comprises 13 currencies; the IMF’s SDR index based on four major currencies; and the BIS index of 40 currencies). Commercial banks that submit price proposals on which the central bank bases its daily dollar-yuan “fixing” rate have been instructed to take into account market price at the end of the previous day’s trading and the yuan’s trend against all three main indexes. This request is impractical in many respects as the proposed dollar reference exchange rate submitted by reporting commercial banks would have to take into account the yuan’s movements against all index currencies. Yuan’s dollar fixing rate has closely followed the market exchange rate since the reform was introduced.

Despite the PBoC’s goal of broadening market perspective on yuan exchange rate, forex markets remain largely focused on the yuan-dollar exchange rate. Some of this is natural; e.g. the vast share of yuan trading is conducted in relation to the dollar. Moreover, the central bank’s CFETS index is an arbitrary construct with no other practical application.

The needs of a country with a large, rapidly developing economy that is opening up and deregulating capital movements are best served by a flexible exchange rate regime. China has declared its plans of shifting to a freer exchange rate regime, so recent improvements in flexibility are welcome. The current situation still allows for managed increases in flexibility.

Yuan-dollar rate with CFETS and SDR multi-currency indexes

Sources: Macrobond and BOFIT