BOFIT Weekly Review 04/2016

Indebtedness continued to rise last year in China

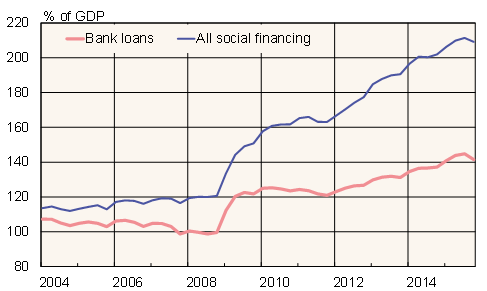

Total social financing (TSF), a broad measure of private debt in China’s economy, grew 12 % y-o-y last year to around 210 % of GDP at the end of December. TSF growth slowed slightly, however, as local governments substituted off-budget debt included in TSF with bonds not counted in TSF calculations. Official figures for central and local government debts are not included in TSF, but off-budget debts are. According to IMF estimates, China’s public sector debt currently stands at around 40 % of GDP (not including off-budget debts of local governments), and continues to rise. Foreign debt (public and private) amounts to about 10 % of GDP, so the total credit stock is about 260 % of GDP.

Two factors underlie the explosion in Chinese indebtedness. First, it has long been cheap to borrow money in China, a situation created by the country’s earlier obsession with investment-driven growth. Even with deregulation of banks’ lending rates, there have been no big shifts in interest rates. Financing remains relatively inexpensive (for state enterprises, at least). The second factor is the massive stimulus programme implemented by the government during the 2008 financial crisis. Stimulus measures involved shoving loans out the doors of state banks to finance investment projects.

As lending has soared, the risk of funding unprofitable ventures has grown substantially. The stock of non-performing loans held by commercial banks, despite growth, remains fairly small, averaging less than 2 % of the overall loan stock. Many observers say the actual share is significantly larger. As the government moving to close excess production capacity in numerous industries, the volume of non-performing loans is expected to continue to rise.

Private sector domestic debt

Sources: Macrobond, PBoC and BOFIT.

China has considerably higher debt levels than most emerging economies, and the increase in indebtedness growth has been rapid since 2008. In many countries, similar booms in lending growth have resulted in financial sector crashes and sharp drops in economic growth. Compared to other countries, however, China has exceptionally large buffers. The state holds massive amounts of assets (e.g. state-owned enterprises), the reserve ratio requirement for banks is high and it still has huge currency reserves to protect the country from external risks.