BOFIT Weekly Review 35/2015

Chinese oil import volumes up 10 % this year

The slowdown in economic growth has yet to be seen in China’s oil imports. In the first seven months of this year, China imported 194 million metric tons of crude oil, an increase of 10 % y-o-y. Imports soared in June and July, when China’s imports of crude oil were up 28 % y-o-y. Due to the sharp drop in oil prices, the value of oil imports in dollar terms was down 40 % y-o-y in January-July.

Most of the growth in China’s oil imports comes from a conscious effort to increase the national strategic reserves. The International Energy Agency (IEA) believes that demand for oil will exceed consumption for some time as China continues to add to its new strategic reserves.

In the January-July period, imports of crude oil from Russia amounted to 23 million tons, i.e. 12 % of China’s total oil imports. Oil imports from Russia, measured by volume, increased faster than oil imports from the other major oil producer. Crude oil imports from Russia in January-July were up over 30 % y-o-y. At the same time, imports from Saudi Arabia were up 10 %, while imports from Iran and Angola declined. The value of oil imports from Russia fell 28 % in dollar terms in the period.

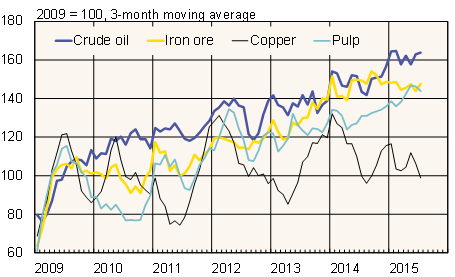

Commodity imports to China by volume

Source: Macrobond

Imports of many other commodities declined. Measured by volume, coal imports in the first seven months of the year were down 34 % y-o-y and copper 9 %. The volume of imported iron ore remained roughly unchanged from a year earlier. The on-going structural changes in China, even without a significant economic slowdown, will impact China’s imports. Most affected are those commodities needed earlier during China’s rapid infrastructure build-out. For example, imports of copper as well as iron ore and coal used in manufacture of copper and steel have fallen on the slowdown in construction.

Excess domestic capacity (e.g. in the steel industry) also affects commodity imports. China wants to reduce overcapacity and increase production efficiency. This will be manifesting in the reshaping of domestic production. Reduced emissions targets have also led to at least temporary shuttering of the worst polluting factories.