BOFIT Weekly Review 16/2015

Chinese economic growth slows as expected in the first three months of the year

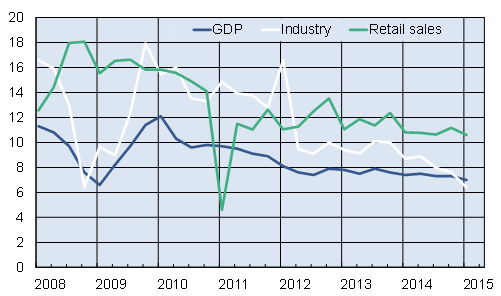

China’s National Bureau of Statistics reports that the country’s on-year GDP growth slowed to 7.0 % in the first quarter of this year, down from 7.3 % in the fourth quarter of 2014. Seasonally adjusted quarterly growth slowed to 1.3 % q-o-q, which corresponds to an on-year rate of 5.3 %.

Nearly every key economic indicator registered the expected lower growth. On-year industrial output growth slowed in January-March to 6.4 %, and last month came in well below 6 %. China witnessed a particularly large slowdown in its mining industry. Growth in electricity production, which is often used as a proxy indicator of total economic output, was close to zero for the first quarter.

Output growth in China, %

Source: Macrobond

In the service sector, output continued to grow by nearly 8 % in the first quarter, almost matching overall growth for 2014. Within the service sector, retail sales climbed 11 % for the first quarter as a whole, although March growth was closer to 10 %. The evolution of China’s production structure has accelerated over the past few years as services have increased their share of GDP. Services now account for about 49 % of annual economic output, surpassing industrial output at 42 % and primary production (mainly agriculture) at 9 %.

Structural change can also be seen on the demand side. Growth in fixed asset investment (FAI) slowed sharply in the first quarter, as e.g. the number of new construction projects (measured in terms of floorspace) fell in the first quarter by about 20 % y-o-y. The evaporation of investment growth has been offset by robust growth in private consumption. Disposable household income increased in the first quarter about 8 % in real terms. Moreover, the employment situation has yet to show any significant weakness, despite the general economic slowdown. The NBS reports service sector growth has helped keep the unemployment rate at around 5 %.

On-year Chinese consumer inflation in March was unchanged from February’s figure of 1.4 %. Producer prices, which have been declining for quite some time, were down 4.6 % in March.