BOFIT Weekly Review 3/2015

Russian interest rates surged late last year

In order to calm inflation and capital exports, the Central Bank of Russia last year raised its key rate (the 7-day repo credit rate) six times. Over the course of last year, the key rate climbed from 5.5 % to 17 %.

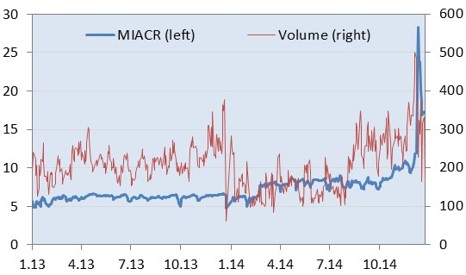

Market interest rates increased in response to CBR hikes in its own steering rates. The one-day Moscow Interbank Actual Credit Rate (MIACR) rose above 17 % at the end of the 2014, having started the year just over 6 %. During the ruble’s collapse in mid-December, the one-day MIACR briefly hit 28 %.

1-day Moscow Interbank Actual Credit Rate (MIACR) and lending volume, RUB billion, 2013–2014

Source: CBR

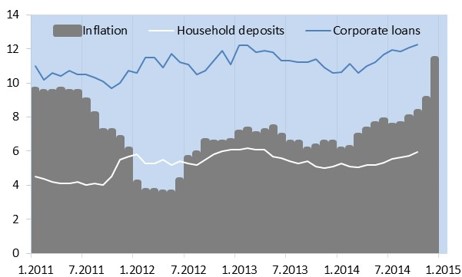

CBR interest rate hikes have increased borrowing costs for banks, forcing them in turn to raise lending rates. Corporate loans at the end of December carried interest rates of as much as 20–30 % p.a. Given the rise in interest rates late last year, real lending rates (inflationary impact removed) could soar and further erode possibilities for corporate borrowing.

Banks have also increased their deposit rates in an effort to retain current assets. For the first time in a long while, real deposit rates are positive in some cases.

Interest rates for household deposits of less than a year, corporate loans of over a year, as well as 12-month inflation, %

Source: CBR