BOFIT Weekly Review 31/2015

Output down in most manufacturing branches

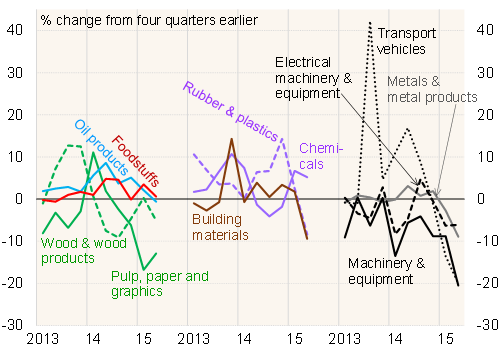

In the second quarter of this year, manufacturing output was down over 7 % y-o-y, a distinct deepening from the start of the year. Lower fixed capital investment, in particular, has meant that falling production of machinery and equipment has now entered its third consecutive year. Production of transport vehicles has also plunged this year, following an earlier boom that observers attribute largely to higher defence spending, The industry and trade ministry reports that Russia’s military-industrial complex output rose 10 % in 2013 and over 15 % in 2014. Production of metals and metal products has contracted considerably this year as well, despite increased metal exports.

Russia’s building-materials industry, as well as the pulp and paper industry, was in a slump. Even the long-booming rubber and plastics industry has fallen.

Despite a sharp reduction in sales of domestic processed foods, food industry production has enjoyed mild growth this year as food imports have declined precipitously. Exports of oil products grew sharply in the first half of the year, but output growth came to a halt due to the domestic recession. Growth in the chemical industry recovered on higher exports this year. Moreover, output of “other chemical products” rose to a boom in the first half. Some observers say this could reflect an increase in the production of explosives (defence spending was up nearly 40 % y-o-y in the first half of 2015).

Output in major manufacturing branches

Source: Rosstat