BOFIT Weekly Review 40/2024

China issues lengthy list of stimulus measures

With the ongoing slowdown in Chinese economic growth, the country’s leadership decided in late September to introduce a diverse stimulus package. People’s Bank of China governor Pan Gongsheng led the policy shift by announcing an easing of the monetary stance and measures to support the struggling real estate sector. A subsequent Communist Party of China politburo press release mentioned the need for more stimulus. The measures revived markets significantly (see BOFIT Weekly 40/2024) just ahead of the week-long holiday kicking off with National Day celebrations on October 1.

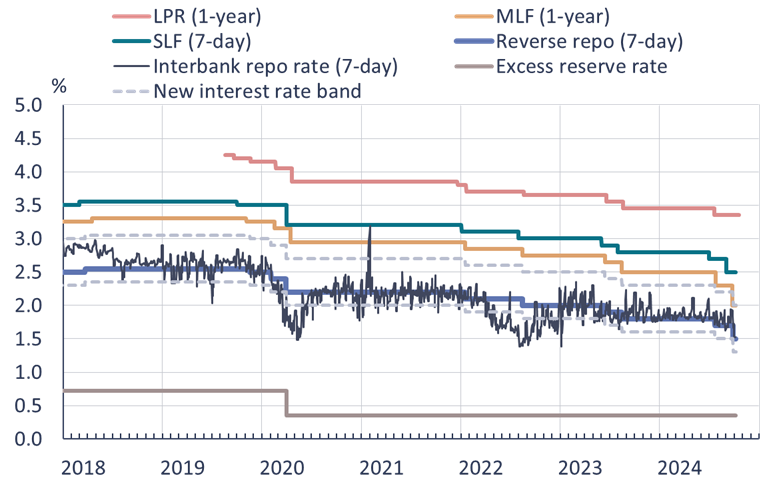

The PBoC began by lowering its policy rates with a 30-basis-point cut in the one-year medium-term lending facility (MLF) rate to 2.0 %. It was followed with a 20-basis-point cut in the main monetary guidance rate, the 7-day reverse repo rate, to 1.5 %. The central bank also lowered the reserve requirement ratio (RRR) for commercial banks by 50 basis points, a move estimated to add a total of 1 trillion yuan to commercial bank liquidity. The reductions in the reserve requirement mean that commercial banks now only have to deposit with the central bank on average an amount equivalent to 6.6 % of their loan stock. In China, RRRs vary from bank to bank, and some commercial banks have already reached the minimum limit of 5 % of the bank’s loan stock. Defying the long-standing convention of not signalling the PBoC’s next policy moves, governor Pan indicated that reserve requirements are likely to be cut again before the end of the year.

The PBoC lowered policy rates across the board

Note: “New interest rate band” refers to the one around the 7-day reverse repo rate proposed in 2024.

Sources: PBoC, National Interbank Funding Center, CEIC and BOFIT.

As part of its real estate sector stimulus, the central bank announced it would phase out the policy of minimum national downpayment percentages for second-apartment buyers. Thus, the national minimum downpayment for any apartment is 15 % of the purchase price. However, the actual downpayment percentages are still set at the provincial level. Most first-tier cities have already announced reductions in the downpayment requirement, although a few cities, including Beijing, still require a higher downpayment percentages for second-apartment buyers (20 %) compared to first-time apartment buyers or those who remain single-apartment owners after selling their old apartment. Moreover, a number of large cities, including Guangzhou, announced that they have also loosened local rules on real estate purchases.

The PBoC further declared that rates on current housing loans are to be cut by 50 basis points. Following a similar move last year, the policy change eventually resulted in lower interest rates. According to the central bank, the weighted average interest rate on housing loans at the end of June was 3.5 %, down from 4.0 % at the start of this year. The interest rate on housing loans has fallen significantly in recent years. At the start of 2022, the average interest rate was 5.5 %. In May, the government announced a 300-billion-yuan lending programme for state-owned enterprises that purchased unsold apartments and refurbished them for use as moderately priced rental housing. Companies showed little enthusiasm for the programme, so the PBoC has now further relaxed the programme’s conditions for commercial banks to cover 100 % (up from 60 %) of loans under the programme. Real estate developers will also get the possibility of extending bank loan maturity dates by an additional 12 months (i.e. until end-2026).

The press release from the meeting of the CPC politburo emphasised that fiscal policy during the contraction phase of the business cycle needs to emphasise stimulus measures and promote consumption. The decline of the real estate sector also need to halt. After the meeting, it was leaked to the press that China plans to issue about 2 trillion yuan in special sovereign bonds at the end of this year. The move requires the approval of the Standing Committee of the National People’s Congress, which has its next scheduled meeting at the end of this month. A similar move of half the size was implemented last year. The additional funds would likely be allocated to provincial governments and to lesser extent measures promoting household consumption.

Officials gave special emphasis to the capitalisation of China’s six largest banks. According to media reports, the proposed capital injection could total as much as 1 trillion yuan. While large banks appear solid, the true quality of their loan portfolios is unknown. Some firms are still allowed to postpone their loan-servicing payments, a policy introduced during the pandemic, while the real estate sector’s three-year crisis must have had an impact on banks’ balance sheets. The net interest margins of commercial banks have also continued to shrink in recent years.

Despite the variety of stimulus measures, their overall impact might be fairly modest, as is the accommodative shift in monetary policy. The biggest problem is weak demand for financing, so rate cuts have had little effect. In addition, the impact of measures to help the real estate sector have yet to be seen. Officials have little to show after two years of fruitless efforts to stabilise the sector, despite it being high on policy agenda. The drop in apartment prices is difficult to stop given the huge supply of empty apartments and programmes to complete unfinished apartments that buyers have already been paid for – all while the population is shrinking. Regional differences in the sector are huge, however. While increased government borrowing supports economic growth the effects are likely to be seen only next year. In addition, many local governments are facing increasingly difficult situation. Local government revenues are generally running below budget forecasts and economic conditions have deteriorated. By some Chinese estimates, the government needs to implement a 10-trillion-yuan support programme to end economic stagnation, which, relative to the current size the Chinese economy, would be on par with the massive 2008 stimulus programme launched during the global financial crisis.