BOFIT Weekly Review 17/2025

Investment patterns reflect Russia’s war of aggression

Rosstat’s national accounts figures show that the volume of fixed capital investment in Russia rose by 6 % last year. The April growth figure represents a downward adjustment from the 10 % preliminary estimate at the start of the year. Investment has grown exceptionally fast in Russia in recent years, with the investment rate rising to 22 % of GDP, a historical high by Russian standards. Last year’s investments were valued at around 40 trillion rubles ($430 billion). Of that sum, Rosstat estimates that about 20 % came from small business investments or investments not directly tracked by statistics officials. This hard-to-track share appears to have decreased slightly in recent years.

Although the growth figures for investment look fairly promising on the surface, detailed assessment reveals a different picture. Investment growth has been highest in branches and regions closely related to the war effort. The government has played a huge role in the growth of investment both directly and indirectly. Russian investment growth largely reflects the government’s preference for spending on the war effort rather than an attractive operating environment for private firms and laying foundations that foster future economic growth.

Investment has increased rapidly in branches supporting the war effort

The lion’s share of fixed investment last year again went to construction, with housing construction accounting for 12 % of total fixed investment and other construction about 40 %. Machinery & equipment represented 35 % of fixed investment. The share of investment in intellectual property again increased slightly last year to 6 %.

Looking at investments by branch, the highest growth in recent years has included manufacturing branches involved in the war effort, air transport, publishing and information services, as well as gambling and betting services. The value of investments last year in manufacturing branches closely tied to the war effort more than doubled from pre-invasion 2021. Some part of the high growth can also be attributed to rapidly rising prices.

The chemical industry led growth among the largest individual branches. This reflected e.g. large petrochemical projects such as the massive polyethylene plant (Baltic Chemical Complex), which is under construction in the Leningrad region under a Gazprom/RusGazDobycha partnership, as well as the joint venture of Sibur and Chinese Sinopec of a polyethylene and polypropylene plant (Amur Gas Chemical Complex) in the Amur region. The weakest investment growth in recent years has included the forest industry and a range of consumer-driven branches such as clothing and furniture manufacturing.

Oil & gas production now accounts for its smallest share of fixed investment in over a decade, falling to just 9 % of investment last year. Despite this, the average growth in investments in oil & gas industries in recent years has been substantially higher than earlier.

Investment and financing from abroad have dried up

The share of budget spending as a source of financing for fixed investment rose sharply in 2022 and 2023. Last year, however, the share of direct budget financing in investment fell back to 17 %. Companies last year financed 57 % of their fixed investments out of pocket, the highest level in 25 years. Bank lending also played a larger role last year, rising to 11 % of fixed investment financing, similar to pre-invasion levels.

Based on ownership, about a quarter of investment last year was made by entities with public ownership. In practice, it is likely that the investment shares of the public sector are much higher through companies indirectly owned by the government or companies closely involved with government. Due to various ownership arrangements, many state-owned firms in Russia are classified as private firms in official statistics.

Based on a 2023 Forbes ranking, Russia’ five largest investors accounted for nearly 20 % of total investment, and all of those top five were either directly or indirectly owned by the Russian government. The largest investors were gas giant Gazprom, national oil company Rosneft, state railways RZD, Atomenergoprom (a state holding company for Russia’s civil nuclear industry), and national power grid operator Rosseti. In addition, the government also supports certain large investment projects with off-budget financing arrangements such as assets from the National Wealth Fund. National Wealth Fund assets have been disbursed, for example, to the Baltic Chemical Complex and Amur Gas Chemical Complex projects.

The investment contribution of foreign firms and financiers has evaporated to nearly nothing in recent years. In 2024, foreign bank loans and foreign direct investment (FDI) each accounted for just 0.02 % of investment financing. The share of investments made by foreign-owned firms was just 1.5 %. The share of foreign firms has not been this low since 2000.

Volga and Far East Federal Districts lead investment growth

Investment growth at the regional level in recent years has been highest in the Volga Federal District, where a sizable part of Russia’s military-industrial capacity is located, as well as in the Far East Federal District, which is home to many large investment projects related to resource extraction and transport. The pace of investment growth has been considerably slower in the traditionally important Central Federal District, which includes Moscow, and the Urals Federal District, which includes large energy-producing regions (particularly natural gas production on the Yamal-Nenets peninsula), as well as several regions in the Northwestern Russia Federal District.

The Leningrad region, which surrounds the city of St. Petersburg, is the exception of the Northwestern Russia Federal District. It is one of the Russian regions where fixed investment has risen fastest in recent years. Other large regions where investment growth has been particularly high include the Khabarovsk and Amur regions in the Far East Federal District, as well as the Tatarstan and Sverdlovsk regions in the Volga Federal District. Investments have risen particularly fast in some of the small regions in the Siberia and Far East Federal Districts, where miliary industries are located (e.g. the Buryatia Republic). On the other hand, investment in the Ingushetia Republic has contracted in recent years. Growth has also been weak in many regions of Northwestern Russia e.g. due to problems with forest industries (e.g. the Komi and Karelia Republics).

Investment growth expected to slow this year

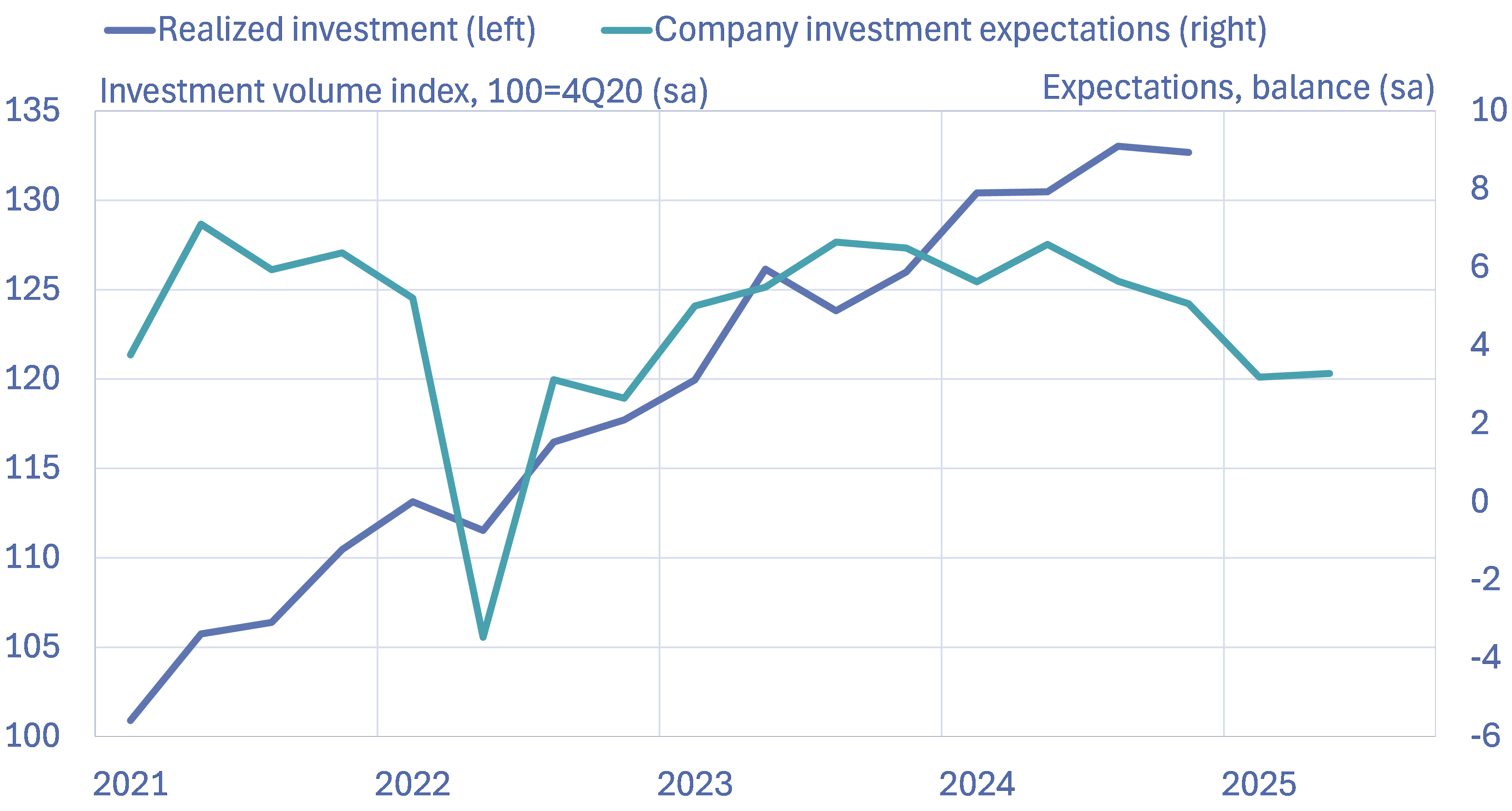

Investment growth slowed considerably late last year. The Central Bank of Russia’s latest company survey, conducted this month, found growth has slowed further since the start of the year. Firms expect the more moderate investment trend to continue in the months ahead. Companies involved with construction and car sales were most pessimistic about their future investment prospects.

The investment outlook for this year has been degraded by multiple factors. Corporate profits have declined and borrowing costs have risen. Company costs are up due to the rapid rise in wage and material costs. The tax burden on firms has also increased this year, largely the result of the entry into force of an increase in the profit tax at the start of this year. In addition, the business environment has weakened from earlier due to ever greater government involvement in the economy (for example, government seizures of companies have increased). The CBR’s April corporate survey also revealed that respondents were much more likely to mention uncertainty about economic trends as a major factor holding back their investment plans.

The CBR expects investment growth to slow substantially this year. The CBR forecast published in February predicted fixed investment growth of 0–2 % this year and next. According to the April report by the international forecast aggregator Consensus Economics, Russian fixed investment is expected to grow on average by 2.7 % this year and 1.7 % next year.

Investment growth in Russia has stabilised with firms expecting lower investment growth this year

Sources: Rosstat, Central Bank of Russia, BOFIT.