BOFIT Weekly Review 16/2025

Trade war will hit Chinese economic growth

Many institutions have been modelling the possible impacts of tariffs on economic growth using a variety of scenarios. As seen in recent weeks, it is virtually impossible to guess what tomorrow’s tariff regime might be, and many estimates are yet to be updated with the recent tariff rounds. As a general comment, however, tariffs will significantly slow economic growth in both China and the US. The economic damage inflicted increases the higher the tariff levels, the more broadly tariffs are applied and the longer uncertainty persists.

The Budget Lab at Yale, an American research centre, released its April 9 recalculation of tariff impacts for the Chinese and US economies. The study assumes that the universal reciprocal 10 % tariff remains in place during the Trump administration’s announced 90-day pause. Runs on the Global Trade Analysis Project (GTAP) model indicate that tariffs reduce economic growth for both China and the US by a total of 0.6 percentage point, while the impacts on Europe are minor. Calculations by the Kiel Institute with KITE model, updated to April 3, suggest that reciprocal tariffs introduced on April 2 would slow China’s economic growth by 0.6 pp, the US by 1.7 pp and the EU by 0.2 pp within 12 months. In these models, the significant increase in uncertainty is difficult to take into account. The calculations published by the Bank of Finland in March, which were based on the Global Integrated Monetary and Fiscal (GIMF) model, found that not just tariffs, but the uncertainty from the shifting global trade paradigm, strongly affects economic trends by reducing the willingness of firms to take on new investment projects and adding a risk premium to corporate financing plans. Last autumn, the IMF released its own estimates (WEO, Box 1.2). They assume that the US, China and the EU all adopt permanent additional 10 % tariffs on each other and that the US further imposes universal 10 % tariffs on the rest of the world. Calculations using the IMF’s GIMF model found that broadly-applied 10 % tariffs would reduce the economic growth of all economies by 0.4 pp over the long run.

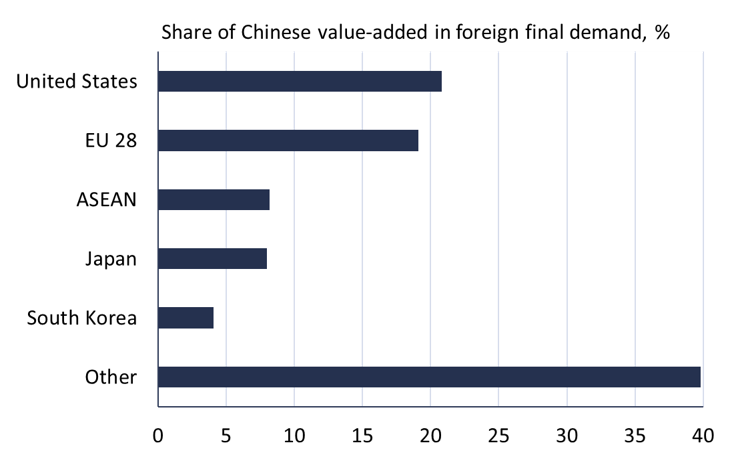

The situation is difficult for Chinese policymakers as exports have been the main engine of economic growth. Since the third quarter of 2024, net exports have accounted for 40 % of GDP growth, a contribution extremely high even in Chinese standards. At the same time, the US is China’s most important final export market. While about 15 % of China’s goods exports go directly to the US, additional Chinese goods also reach the US via third countries. In other words, the US’s role as an ultimate export market is greater than customs figures for goods trade suggest. For example, the OECD figures for value-added trade show that 20 % of Chinese value-added exported abroad was consumed in the US in 2020 and an amount which is 3 % of total Chinese value-added produced that year. The latest twists in the trade war are expected to reduce US-China trade dramatically. China’s export sector is estimated to employ over 100 million people and the US is the final destination for roughly a fifth of exports. Thus, roughly calculated a total cessation of US-China trade would imperil about 20 million jobs in China.

The largest share of exported Chinese value-added in 2020 went to the US, % share

Sources: OECD TiVA and BOFIT.