BOFIT Weekly Review 16/2025

US-China trade war increases uncertainty surrounding global trade and production chains

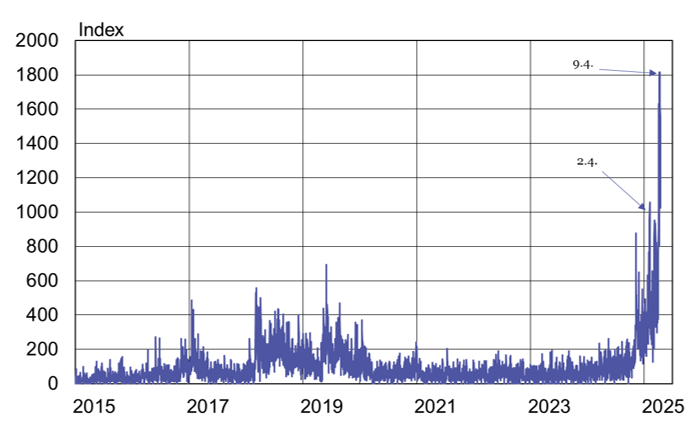

The “Liberation Day” tariffs announced by US president Donald Trump on April 2 (BOFIT Weekly 14/2025) only stayed in force for a few hours before the administration retreated to its original 10 % baseline, allowing tariff and grant affected countries a 90-day reprieve to conduct further trade talks. China, however, refused to back down, driving China and the US to implement even higher tariffs on each other. The cumulative average tariff imposed by China on certain US goods is now 125 %, while the US tariff on many Chinese goods has risen to 145 %. China’s government noted that it would be futile to impose further additional tariffs as the current tariff level effectively has killed off most imports from the US. The Trade Policy Uncertainty Index rose to record levels, climbing to around 1,800 points with the intensification of the trade war. During Trump’s first term as president, the index peaked at just over 600 points.

The Trade Policy Uncertainty Index recently hit record levels

Sources: Matteo Iacoviello, Macrobond and BOFIT.

Last Friday (Apr. 11), the Trump administration announced it was exempting smartphones and certain electronic products from China tariffs, only to further qualify the announcement on Sunday (Apr. 13) that the exemptions were only temporary. US commerce secretary Howard Lutnick stated that electronics products would be included “within a month or two " under semiconductor tariffs. Despite the temporary nature of the waivers, big consumer electronics companies such as Apple, which manufactures over 80 % of its products in China, breathed a sigh of relief. On Tuesday (Apr. 15), the Chinese government ordered national airlines to halt their new plane deliveries from US-based Boeing. The US announced earlier that it would be eliminating the duty-free exemption for small goods packages from China with a declared value of less than $800. The duty-free exemption is currently slated to end on May 2.

The United States government has indicated willingness to negotiate if China takes the first step in initiating talks. It is unclear, however, whether the Chinese leadership is ready to extend the hand of friendship across the Pacific. The current situation is incredibly sketchy, particularly with respect to China’s exports and international production chains. Even with a significant drop in tariff levels, trade barriers put pressure on Chinese industry to find alternative markets for their excess production. In practice, prime targets are the wealthier economies in Europe, Canada and elsewhere. Even so, average living standards and relative size of most alternative markets are insufficient to fully make up for lost US exports.

Production chains are likely to become more dispersed than ever. According to a recent IMF working paper on the impacts of US-China tariffs on Vietnam, the 10–25 % tariffs imposed during the first Trump administration prompted Chinese exporters to shift a significant amount of their final goods processing to Vietnam. In contrast, the high “Liberation Day” tariffs, even if they have been delayed for 90 days, will apply to most Asian economies, including Vietnam. In recent years, Apple, for example, has transferred some of its production to India as part of efforts to diversify its production chains. President Trump’s senior trade advisor Peter Navarro has demanded, among other things, that Vietnam and Mexico prevent attempts by Chinese companies to evade tariffs by moving products through third countries. The US has launched official talks with Vietnam, with decoupling from China likely included in Washington’s list of demands for Vietnam to be eligible for lower tariff rates.