BOFIT Weekly Review 16/2025

China posts surprisingly robust first-quarter economic growth

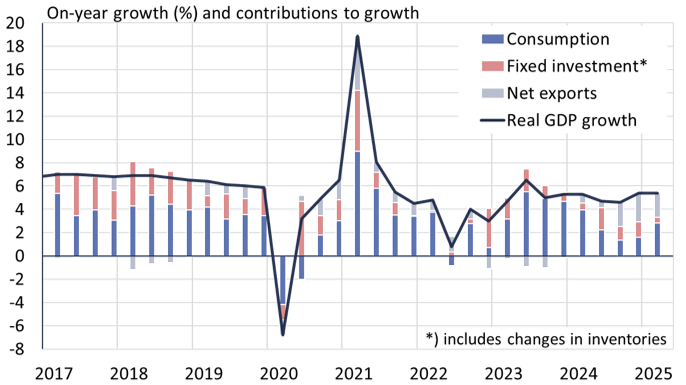

China’s National Bureau of Statistics (NBS) reports GDP growth of 5.4 % y-o-y in the first three months of this year. 2.8 percentage points of the increase came from increased consumption, 0.5 from fixed investment and 2.1 from net exports. According to BOFIT’s alternative calculation of Chinese GDP, growth was somewhat lower, averaging 4.2 % in January-March. Escalation of the US-China trade war, however, has clouded the growth outlook for the rest of the year (see BOFIT Weekly 16/2025).

China’s official GDP figures indicate net exports have been a big driver of growth

Sources: China National Bureau of Statistics, CEIC and BOFIT.

The revival of growth in March was broad-based. Industrial output growth accelerated to nearly 8 % y-o-y, while growth in retail sales rose to around 6 %. The durable goods trade-in programme introduced in March 2024 and expanded this year has succeeded in boosting retail sales. The government-sponsored programme applies to certain home appliances, electronic devices and new car purchases. The value of home electronics sales in March climbed by 35 % y-o-y, while sales of communications devices were up by 29 %. Car sales also turned to growth in March (up 6 %).

Fixed investment growth was strong in the first quarter. Even with a 10 % contraction in construction investment in January-March, NBS figures show that nominal on-year growth in fixed investment exceeded 4 %. Nominal fixed investment in manufacturing was up by 9 % y-o-y and fixed investment overall (excluding construction) was up by over 8 %.

The rate of contraction in apartment sales slowed slightly in the first quarter. The volume of apartment sales in January-March measured by floorspace was down by 4 % y-o-y (down by 3 % in yuan). The NBS reports that housing prices have begun to rise in the country’s biggest cities (Beijing, Shanghai and Shenzhen). The average apartment price on the secondary market in 70 large Chinese cities still continues to decline and was down 7 % y-o-y in March and down 17 % from the 2021 price peak.

Exports remained strong throughout March, with the dollar value of exports up by 12 % y-o-y (up 13 % in yuan), while the value of imports fell. The value of exports in the first quarter was up by 6 % y-o-y. Even exports to the US rose by 5 %. During January and February, the pace of export volume growth outstripped export value growth, suggesting that growth in the volume of exports may have also been higher (though March figures are not yet available).

Prices have been driven down by high production growth and relatively weak domestic demand. Official figures show that nominal GDP growth was again lower than real growth in the first quarter and that the implicit GDP deflator was -0.8 %. Consumer prices fell by 0.1 % in March, while producer prices were down by 2.5 %.

Even if justified by falling prices and weakness in bank lending, monetary policymakers have refrained from easing since last autumn. The stock of bank loans increased by 6.9 % in March (6.8 % in February) and the central bank’s broad measure “aggregate financing to the real economy” (AFRE) rose by 8.4 % (8.2 % in February). At the end of March, AFRE corresponded to 310 % of GDP. Fears of accelerating capital flight and uncontrolled yuan devaluation have prevented policymakers from assuming a more accommodative monetary stance. Since the end of last year, the yuan has lost about 1 % of its value against the dollar and the nominal effective exchange rate (NEER) has fallen by 3 %.

Real on-year change and consumer prices, %

|

2022 |

2023 |

2024 |

3Q2024 |

4Q2024 |

1Q2025 |

|

|

GDP |

3.0 |

5.2 |

5.0 |

4.6 |

5.4 |

5.4 |

|

2022 |

2023 |

2023 |

January.25 |

February.25 |

March.25 |

|

|

Industrial output |

3.6 |

4.6 |

5.8 |

5.9 |

5.9 |

7.7 |

|

Retail sales |

-2.2 |

7.0 |

3.3 |

3.9 |

3.9 |

6.0 |

|

Goods exports |

-1.3 |

4.4 |

13.6 |

12.8 |

0.1 |

n/a |

|

Goods imports |

-6.6 |

3.4 |

1.9 |

-15.5 |

3.9 |

n/a |

|

Inflation |

2.0 |

0.2 |

0.2 |

0.5 |

-0.7 |

-0.1 |

|

CNY-USD rate, avg. |

6.74 |

7.08 |

7.20 |

7.30 |

7.27 |

7.25 |

Sources: China National Bureau of Statistics, China Customs, WTO, CEIC and BOFIT.