BOFIT Weekly Review 15/2025

Russian growth slows, increased risks from declining oil prices

Economic growth is slowing

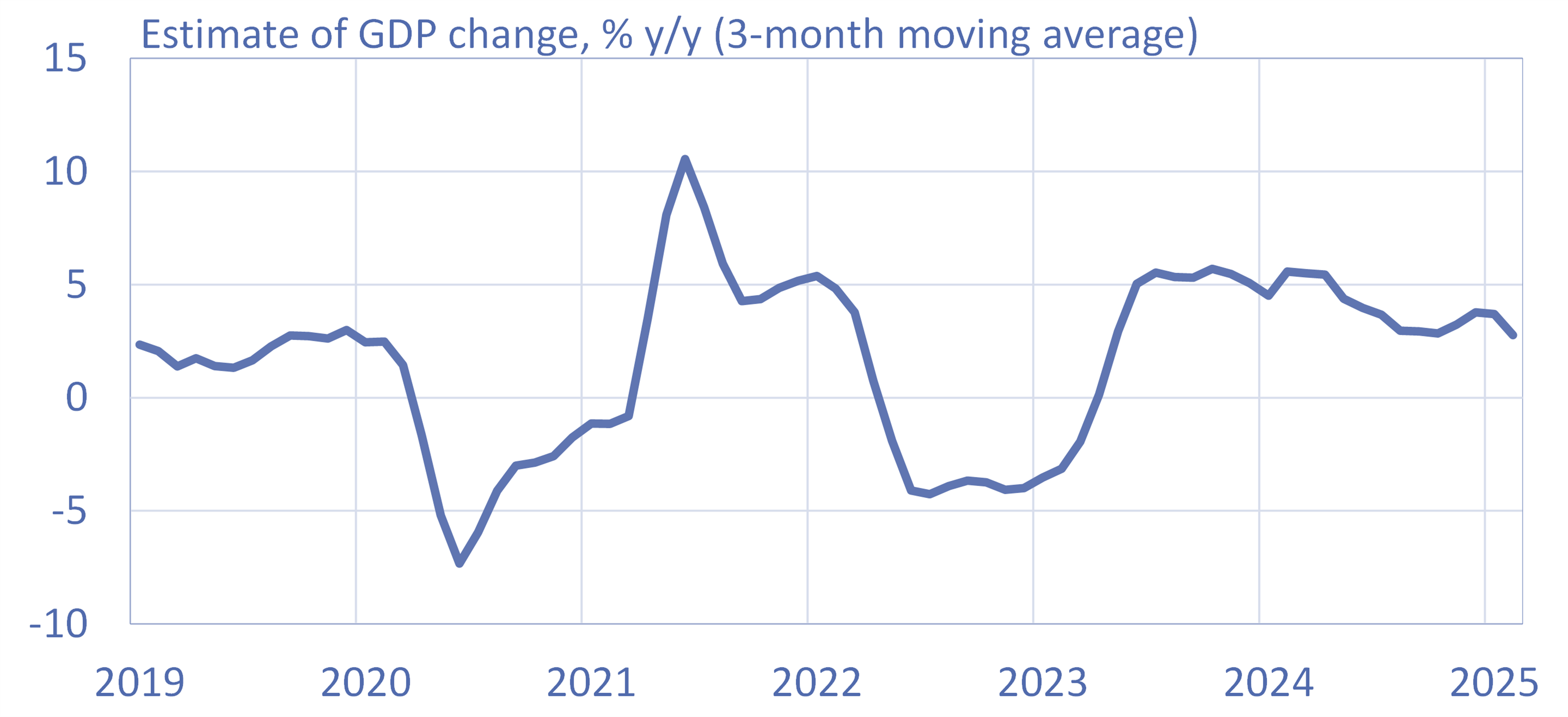

Growth in Russian’s economic output was slowed down in the first two months of this year. The economic development ministry estimates that GDP grew by about 2 % y-o-y during January-February. 12-month growth in February was below 1 %, however, due largely to a high basis reference (February 2024, a leap year, had one extra working day).

Rosstat publishes seasonally-adjusted and workday-adjusted figures for industrial output. This year’s figures show that the output of the mining & quarrying sector (includes oil & gas) contracted in January and declined even faster in February. Mining & quarrying output was down by 5 % y-o-y in the first two months of this year. The international Energy Agency (IEA) estimates that Russian oil production fell by 2 % y-o-y in January-February. Rosstat also reports that manufacturing output stabilised after its December peak during the first two months of this year (seasonally and work-day adjusted terms).

Growth in consumer demand appears to be stalling, with the volume of retail sales essentially unchanged for nearly a year. In annual terms, sales were still up 2 % in February. Based on the figures for new car sales compiled by EAB, car sales have dropped sharply in recent months (seasonally adjusted). The rise in wages remained strong in January as labour shortages persisted. High inflation has nevertheless eroded the purchasing power of wage-earners. Consumer prices in the first two months of this year were up by 10 % y-o-y.

Construction activity supported GDP growth in January and February. Construction growth saw a steep rise in the first two months of this year, climbing by 10 % y-o-y. Construction of residential housing was up by 23 % y-o-y in February.

Russian output growth slowed in the first two months of this year

Sources: CEIC/Russian Ministry of Economic Development, BOFIT.

Budget spending growth stabilises after spiking in January

Preliminary figures released by Russia’s finance ministry show that federal budget revenues grew by 4 % y-o-y in January-March. The ministry noted that oil & gas revenues decreased by 10 % due to lower oil prices and timing of tax payments. Other revenues were up 11 % y-o-y. Oil & gas accounted for approximately 30 % of total federal budget revenues.

Federal budget expenditures in January-March were up by 25 % compared to the same period a year earlier. Spending started off particularly strong in January and then moderated. The burst of spending at the start of the year has resulted to substantial deepening of the federal budget deficit. The deficit for January-March amounted to about 2.2 trillion rubles (1 % of GDP), significantly exceeding the government’s projected deficit for all of this year. The finance ministry noted that the large deficit partly reflected the front-weighting of budget spending and that deficit should moderate as the year progresses.

Rising inflation pressures

The Central Bank of Russia decided at its scheduled March interest-rate meeting to keep the key rate unchanged at 21 %. Although inflation pressures remain high, the CBR board noted a slight easing in the weeks before the meeting due to slowing economic growth and ruble appreciation.

The CBR sees that growth in domestic demand is slowing with respect to both fixed investment and private consumption. Corporate surveys suggest that firms are focusing on completing investment projects in progress. New fixed investment has become less attractive largely due to higher prices for materials and production equipment. The slowdown in household borrowing is reflected in sales figures for cars and consumer electronics.

The CBR still sees the risk of higher inflation as very real and now only expects to achieve its 4 % inflation target in 2026. While the board’s signalling was interpreted as more dovish than earlier, the CBR said that it would still consider raising the key rate at its next meeting should conditions warrant.

Russia not spared from the risks posed by US tariff policies to the global economy

Last Wednesday (Apr. 2), US president Donald Trump declared “Liberation Day,” marked by the introduction of reciprocal tariffs that many observers noted would significantly reduce the pace of global growth. The direct impact of the tariff announcement on Russia has been small, as no new tariffs was imposed on Russia. Russia and the United States have never been major trading partners, and the sanctions of recent years for Russia’s invasion of Ukraine have further diminished most trade between the countries. The tariffs do, however, present risks to the Russian economy with respect to possible changes in commodity markets and effects on Chinese economy. China is currently by far Russia’s largest trading partner.

Global oil prices have dropped sharply over the past week, with the average export price for Russian oil falling below $60 a barrel. This year’s Russian budget assumes an average price for Urals blend crude of about $70. The budget framework also implies that an average oil price of $60 a barrel would lead to a decrease in Russian budget revenues of about 1.8 trillion rubles from the baseline assumption. The government deficit would thus double to around 3.5 trillion rubles, a level almost similar to deficits of recent years. The government should not find financing a larger-than-expected budget deficit this year too challenging. In addition to raising money from domestic bond sales, the government can still access money in the National Wealth Fund. The liquid assets of the National Wealth Fund at the end of March amounted to roughly 3.3 trillion rubles.