BOFIT Weekly Review 13/2025

Latest forecast sees Russian growth slowing in years ahead

On Monday (Mar. 24), BOFIT held its annual Russia briefing (in Finnish) to address Russia’s economy and military capabilities, as well as the impacts of the war on the incomes of average Russians and the economy.

New BOFIT forecast expects Russian economy growth to slow in coming years

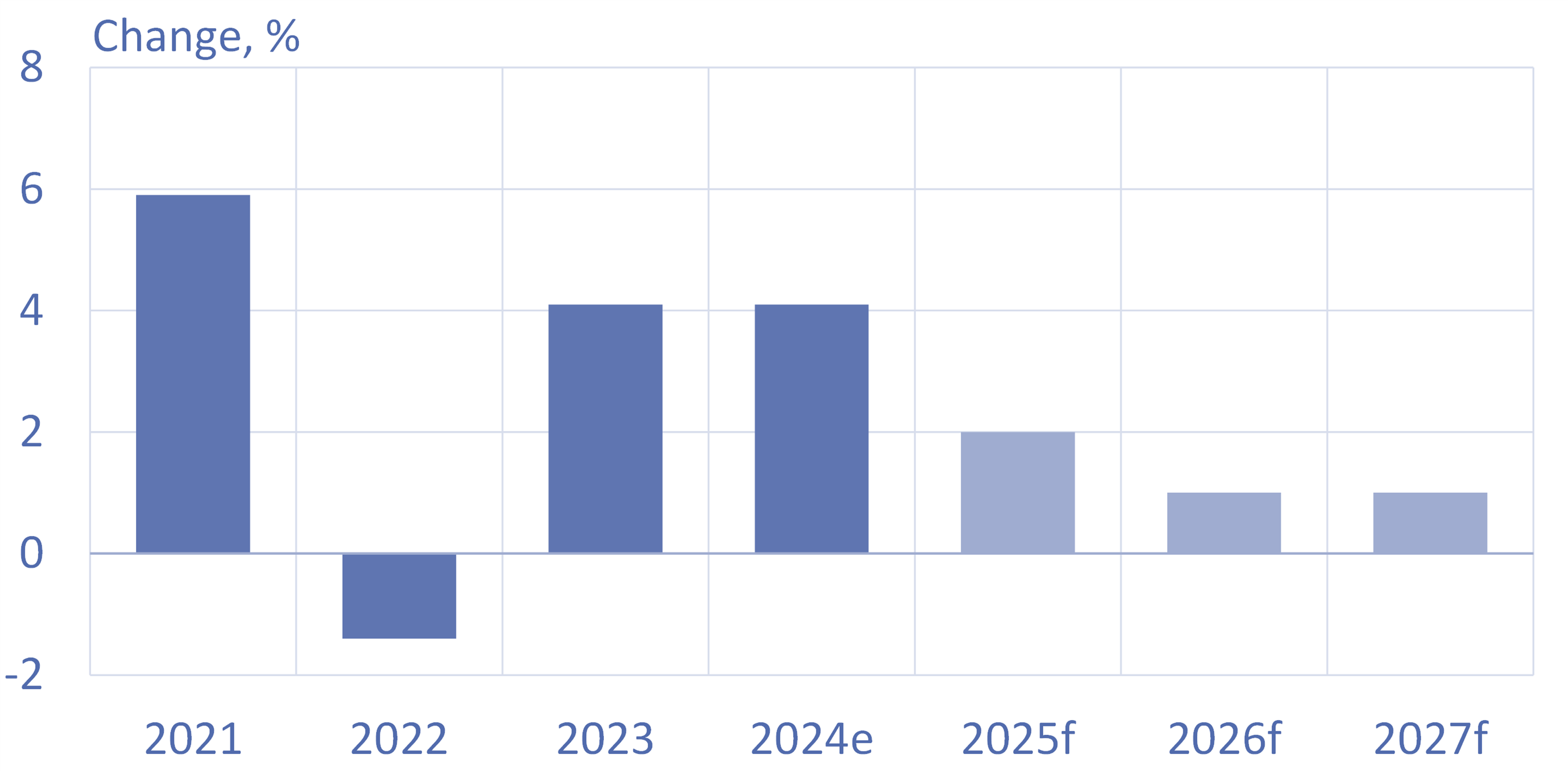

Our latest BOFIT Forecast for Russia 2025–2027 sees the country’s annual GDP growth slowing significantly this year to around 2 % and further to about 1 % p.a. in 2026 and 2027. In recent years, Russian growth has been sustained mainly by large increases in government spending, with most of the increases going to branches supporting the war effort.

Even if the government is planning a large increase in budget expenditure again this year, it must deal with the diminishing returns on spending in fostering growth. Russia is already suffering from acute labour shortages and production capacity constraints in many branches. This situation has worsened the country’s economic imbalances. Inflation has accelerated and consumer prices were up 10 % y-o-y in January-February. The Central Bank of Russia (CBR) was also forced to raise its key rate to a historical high of 21 % last autumn in order to quell inflation.

Private sector demand is forecast to cool down due to high inflation and high interest rates. Particularly private-sector investment prospects are weak. Investment possibilities are limited by soaring borrowing costs, declining corporate profits, rising wage and material costs, as well as tax increases. Private consumption growth is also expected to slow substantially. Wage growth is moderating and high inflation is reducing purchasing power.

Despite slowing growth, Russia can continue to provide the funding of production needed for the war effort. While government finances have been in the red in recent years and deficits should continue in all years of the forecast period, Russia still has possibilities to finance its deficits. The government is planning to cover the deficit by increasing its borrowing from the domestic market and Russia’s National Wealth Fund still holds liquid assets worth nearly 2 % of GDP.

Although growth is expected to slow significantly, a full-blown economic crisis is currently not in sight. The risk that Russia will underperform the forecast are exceptionally large, however, as long as Russia continues to prosecute its war of aggression in Ukraine.

BOFIT’s latest forecast sees a substantial slowdown in Russian economic growth in coming years

e = estimate, f = forecast

Sources: Rosstat, BOFIT Forecast for Russia 2025-2027 (1/2025).

US leadership continues ceasefire discussions with Russia and Ukraine

While a permanent and just peace agreement seems out of reach at the moment, the US leadership has moved ahead with talks on securing a temporary ceasefire. From the viewpoint of Russian economy, a ceasefire could reduce the pressures it faces, especially since economic imbalances would not worsen during a truce period. In the short term at least, the overall economic impacts could remain limited as Russia would retain its capacity to make war.

In connection with the ceasefire talks, Russia is demanding a lifting of sanctions. If sanctions are reduced as part of the ceasefire agreement, Russia could again begin to build up its economic buffers, thereby allowing Russia to prepare for later military aggression.

While European leaders have rejected a lifting of EU sanctions, the US administration has not ruled out discussion on lifting some sanctions as part of a ceasefire agreement. Russia has traditionally had only a tiny economic significance for the US. In pre-invasion 2021, for example, Russia only accounted for 0.4 % of US goods exports and just 0.2 % of American outward foreign direct investment.

Russian wage growth fuelled by war-induced labour shortages

Russian real disposable incomes finally recovered to 2013 levels in 2023 and have since climbed further as the Russian economy has shifted to a war footing. Income trends largely reflect labour shortages that have been worsened by the needs of the military forces at front and emigration. Wages, in particular, are up sharply. The biggest wage gains are in military-industrial branches and regions where Russia’s military industries are located. The Russian Longitudinal Monitoring Survey (RLMS), for example, shows that Russian satisfaction in 2022–2023 rose particularly in regions focused on supporting the war effort (BOFIT Policy Brief 08/2025).

Using Russia’s official definition, about 7 % of the country’s population (10.5 million people) lived below the poverty line in 2024. Last year’s national poverty level was 15,550 rubles a month (155 euros). Observers have criticised Russian poverty statistics for methodological changes and excessively low poverty line definition. Critics contend that there are many more people living in poverty in Russia than indicated by official figures.

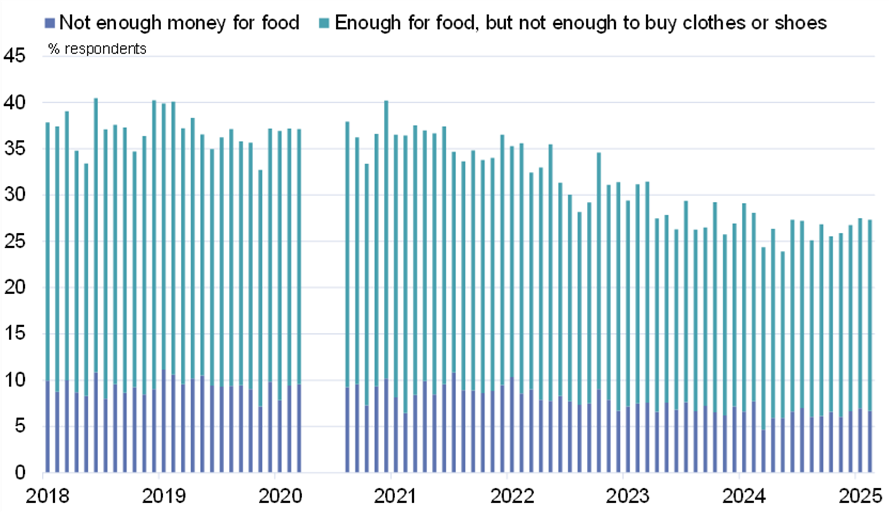

Surveys also suggest that the share of the population living in poverty is greater than official figures indicate. A February 2025 survey commissioned by the CBR found that over a quarter of the population only has enough money to buy food, and that about 7 % of adults are so poor they cannot even afford to feed themselves. By this measure, Russia ceased to make any progress in poverty alleviation last year. The incessant rise in prices of staple items is likely a driving factor in this development.

Survey data suggest that a quarter of Russians only have enough money to cover their spending on food.

Sources: Infom, Central Bank of Russia, BOFIT.