BOFIT Weekly Review 07/2025

Strong growth in Russian bank lending continued last year

Corporate borrowing driven by reduced access to international financing and generous interest-subsidy programmes

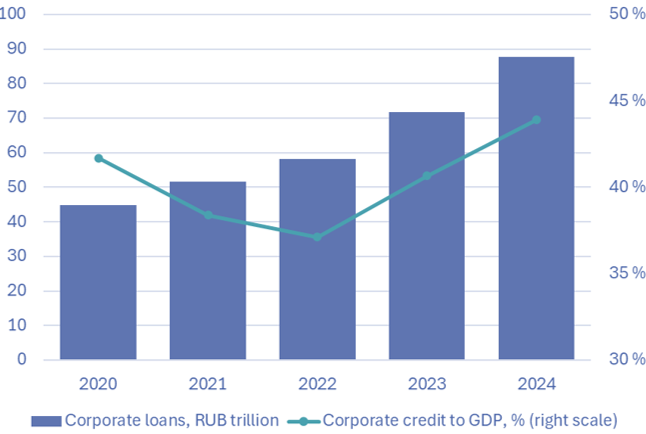

Russia’s stock of corporate loans at the end of last year was valued at roughly 87.8 trillion rubles, a 20 % increase from the previous year. The growth was slightly less, 18 %, when adjusted for exchange-rate fluctuations. The rapid increase in corporate borrowing has persisted since autumn 2022, with especially high growth in corporate credit in 2023. The pace of growth stabilised in 2024, but was still up by about 20 % for the year.

In 2023–2024, the corporate loan stock grew nominally by about 50 % to around 30 trillion rubles (300 billion euros). A driver of the rapid growth in corporate borrowing was the drying up of access to international financing opportunities. Between mid-2022 and the end of 2024, Russia’s corporate sector foreign debt declined by around $122 billion. Both corporate cash flows and increased borrowing from domestic banks were used to pay down foreign debt. Some domestic debt has also been converted to rubles, with the result that the share of foreign-currency loans in the corporate loan portfolios of banks has contracted rapidly. The share of forex loans in the corporate lending stock fell from 30 % at the beginning of 2022 to 14 % at the end of last year.

Bank lending has also been accelerated by demand growth reflecting government spending on public projects, as well as lavish loan-subsidy programmes. The range of interest-support programmes available target groups such as small and medium-sized enterprises (SMEs) and companies in various manufacturing branches. While lending has grown particularly fast in branches that directly support the war effort (defence industries and certain research & development branches), they represent a bit less than 10 % of the total loan stock. The Central Bank of Russia (CBR) has long warned that rapid growth in subsidised lending fuels inflation and increases credit risks in the banking sector.

At the end of October, the CBR raised its key rate to a record 21 % in an effort to calm inflation and stem the rapid growth in lending. Transmission of the rate hike signal to loan interest rates, however, is a slow process; a large share of even the market-based loans are fixed-rate loans. Over the past three years, the share of adjustable-rate loans has grown from around 30 % to nearly 60 %. In November, the average interest rate on corporate loans for less than a year slightly exceeded the key rate (22.8 %) while the average rate on loans for one year or longer was significantly below the key rate ( 15.7 %). Russia’s ruble overnight interbank rate (RUONIA) has generally remained below the key rate level, indicating an abundance of liquidity in the interbank space.

The corporate loan stock has grown rapidly relative to the size of the Russian economy. As of end-2024, the corporate loan stock corresponded to 44 % of GDP, a 3-percentage-point increase from the end of 2023.

The stock of corporate loans in Russia grew rapidly throughout the 2020–2024 period

Sources: Central Bank of Russia, BOFIT.

Growth in household borrowing slowed sharply at the end of last year

Much of the recent slowdown in growth reflects changes in government subsidies for housing loans that went into force in July 2024. Programme lending conditions were tightened and interest subsidies were reduced. As a result, on-year growth in household borrowing slowed from around 30 % in the first half of the year to just 10 % in the second half. For all of 2024, a total of 4.9 trillion rubles in new housing loan were granted, a 40 % decrease from 2023. The demand for market-based housing loans is quite small; 80 % of all housing loans granted last year were subsidized. In December 2024, the average interest rate on housing loans was 8.5 %.

Housing loans represent slightly over half of the total stock of household borrowing. The high growth in other household credit (mainly car loans and consumer credit) slowed in the second half of 2024. Growth in consumer loans was quelled by rate hikes and tightened macroprudential policy measures. Rapid growth in car loans came to an abrupt end at the beginning of October after car prices jumped due to a hike in the vehicle recycling fee.

The rapid growth in the loan stock has largely been funded by strong growth in customer deposits held in bank accounts. Household bank deposits grew especially fast, by 26 % in 2024, in response to growth in nominal wages and higher interest rates paid on deposits. For the banking sector overall, customer funds slightly exceed the banking sector’s total loan stock.

The current robust on-year growth in bank lending began in mid-2022

Source: Central Bank of Russia, BOFIT. Annual change in nominal loan stock without exchange-rate corrections or securitisation of housing loans.