BOFIT Weekly Review 6/2025

Hong Kong’s economic outlook is shaped by an ongoing downturn in the real estate sector, US monetary policy, the economic challenges facing mainland China, and geopolitical tensions

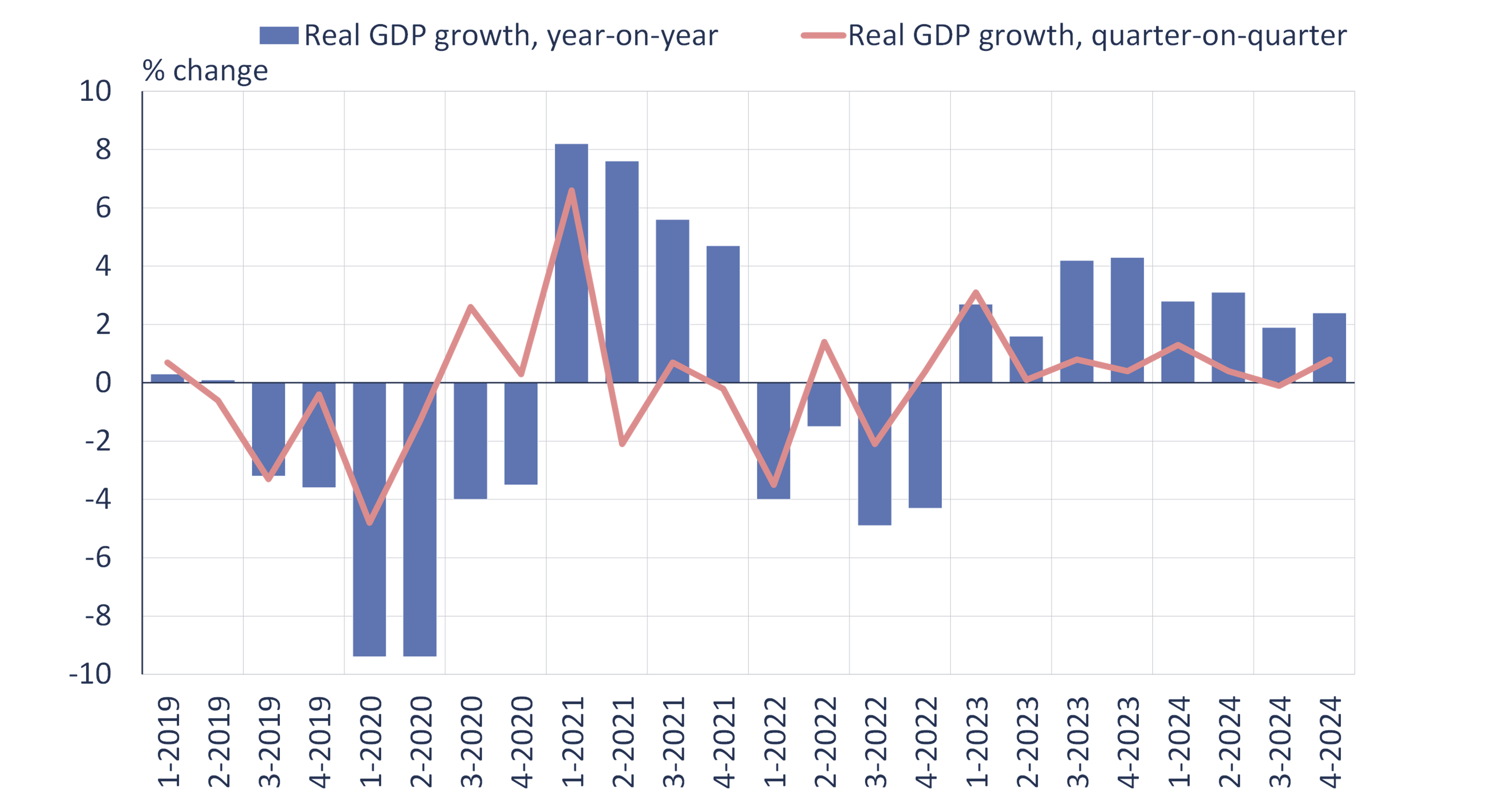

Hong Kong’s economy, which has been in a recovery mode since the end of Covid restrictions, still must struggle with challenging economic conditions and the effects of relatively high US interest rates. Official figures show that Hong Kong’s real GDP growth reached 2.5 % last year following a 3.2 % growth spurt in 2023. The IMF’s Article IV consultation released in January sees Hong Kong’s economy growing by 2.7 % this year. Output grew by 0.8 % q-o-q in the fourth quarter of 2024, a glint of economic revival following a 0.1 % q-o-q contraction in the third quarter. Fourth quarter growth from 4Q23 was 2.4 %.

Although Hong Kong’s post-pandemic inflation has remained subdued (12-month consumer price inflation was just 1.4 % in December 2024 and averaged 1.8 % during 2021–2023), domestic interest rates rose in reaction to the US Federal Reserve’s rate hikes. US monetary policy translates directly to Hong Kong, which uses a currency board mechanism that essentially pegs the value of the Hong Kong dollar to the US dollar. Therefore, Hong Kong’s monetary authorities do not practice independent monetary policy. Now, the Fed’s monetary easing bias will underpin Hong Kong’s economic recovery.

Private consumption remained sluggish in the fourth quarter of 2024, contracting by 0.5 % from the third quarter and by 1.3 % from a year earlier. Economic uncertainty, high interest rates, and the incessant slide in real estate prices (along with the negative impacts on household wealth) have subdued private consumption. At the same time, low numbers of tourists from mainland China have hurt retail sales. The low tourist numbers partly reflect recent appreciation of the Hong Kong dollar against the Chinese yuan. Although Hong Kong’s authorities have recently loosened mortgage rules to give a boost to the sluggish housing market, oversupply continues to put downward pressure on apartment prices. Completed sale prices of privately-owned apartments in December 2024 were down by 7.1 % y-o-y, but the pace of decline is gradually slowing. Real estate prices are down 27 % from their all-time peak in September 2021. Against the muted real estate outlook, households will likely remain skittish in their consumption decisions this year.

Foreign trade will remain the cornerstone of Hong Kong’s economy as the special administrative region is tightly integrated into global supply chains. The value of Hong Kong’s goods and services trade relative to GDP now exceeds 350 %, with goods re-exports playing a large role in Hong Kong’s foreign trade. The 10 % additional tariffs imposed on Chinese imports at the beginning of this month are currently expected to have only a small direct impact on Hong Kong. On the other hand, the price pressures from the new round of tariffs could keep US interest rates higher than earlier projected, thereby hampering the recovery of the Hong Kong economy. Moreover, Hong Kong’s economic prospects are impacted by the geopolitical and trade tensions driving uncertainty, as well as the challenging economic situation in mainland China.

Hong Kong’s on-year economic growth reached 2.5 % last year

Sources: Hong Kong government and BOFIT.