BOFIT Weekly Review 06/2025

New twists in US-China trade war; American firms operating in China see good bilateral relations as essential

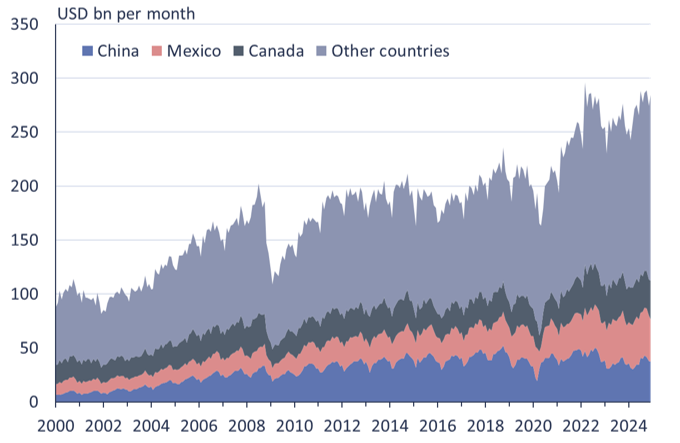

Last Saturday (Feb. 1), United States president Donald Trump announced that he was imposing, effective February 4, an additional 25 % tariff on Mexican and Canadian products (10 % on Canadian energy), as well as an additional tariffs of 10 % on Chinese products. Canada and Mexico each negotiated 30-day reprieves with the US to delay implementation of the new tariffs. China did not negotiate, preferring to let the new tariffs take effect on Tuesday (Feb. 4). The new tariffs cover over 40% of US goods imports based on last year’s data. In the first eleven months of 2024, over 13 % ($400 billion) of US goods imports came from China. President Trump also signed an executive order eliminating the exemption from tariffs on goods imports valued at less than $800. Mail-order duty-free goods imports have boomed in recent years, and over half of such goods are shipped from China. The US also implemented harsher restrictions on exports of advanced microchips and AI-related technologies to China prior to Trump’s inauguration.

A February 2 press release from China’s finance ministry states that the latest retaliatory tariffs, which go into effect on February 10, place a 15 % additional tariff on American liquefied natural gas (LNG) and coal, and a 10 % tariff on crude oil, farm machinery, pickup trucks and other vehicles with large-displacement combustion engines. China said it plans to submit the matter to the World Trade Organization (WTO). China also announced it was tightening permitting rules for exports of certain critical materials and had launched an anti-trust investigation into American tech giant Google (Alphabet). Media reports indicate that the American chipmaker Intel may also face official scrutiny. The owner of the Calvin Klein brand PVH and the genetic testing company Illumina were added to China’s “unreliable entity” list.

Most of the costs of US import tariffs are likely to be borne by American households and businesses. For example, the latest calculations from the Peterson Institute for International Economics see the new tariffs costing a median US household $1,200 a year. In contrast, the impacts of tariffs on the Chinese economy are expected to be modest. After Trump launched the trade war with China in his first term, companies responded by moving parts of their production chains to third countries such as Vietnam to avoid additional tariffs. The latest moves are likely to reinvigorate this trend.

Increased US-China tensions affect American firms operating in China. Nearly 90 % of member responses to the latest China Business Climate Survey of the American Chamber of Commerce in China (AmCham China) stated that American firms operating in China see bilateral relations of China and the US as “extremely important” or “very important.” Over 60 % of responding firms said the deterioration in relations poses the biggest challenge to their businesses. The second-largest worry this year was increased competition with Chinese firms. Despite the challenges, two-thirds of respondents said they were not considering moving production out of China, and nearly half said that China still ranked among their top three investment destinations. Plans vary across branches, however, with firms operating in advanced technologies and R&D typically more likely to have already decided to leave or are considering leaving China.

Canada, China and Mexico together provide over 40 % of US goods imports

Sources: US Census Bureau, CEIC and BOFIT.