BOFIT Weekly Review 02/2025

While government support measures revived Chinese stock markets in late 2024, IPOs were scarce

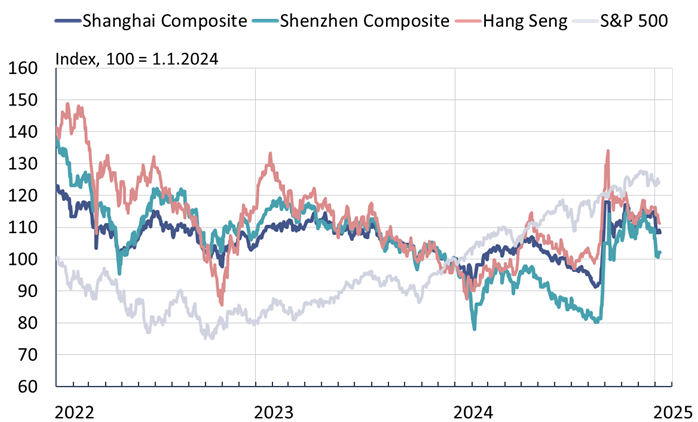

China’s main stock markets, boosted by the September announcement of official measures to the markets, rose in the final months of last year. The Shanghai stock exchange’s main index (Shanghai Composite) ended the year up 24 % from mid-September, and the Shenzhen exchange’s main index (Shenzhen Composite) was up 33 %. For all of 2024, share prices were up by 13 % in Shanghai, 7 % in Shenzhen and 16 % in Hong Kong (Hang Seng). Even with government intervention, China’s indices lagged average growth of global markets. The FTSE All World was up 18 % and the US S&P500 climbed 23 %. China’s stock markets are facing a downdraft at the start of this year. Share prices fell by 4 % in the first six trading days of 2025.

Share prices on mainland and Hong Kong exchanges fell at the start of the year after healthy gains in the final months of 2024

Sources: Macrobond and BOFIT.

The People’s Bank of China, which is responsible for stock market support measures, now has its new swap-facility programme in place (BOFIT Weekly 40/2024). In the PBoC’s first swap in October, securities companies, insurers and funds were provided a total of 50 billion yuan ($6.9 billion) to be invested in publicly-traded Chinese stocks. Another 55-billion-yuan tranche of financing was offered on January 2nd. The central bank also provides state banks with cheap funding to be granted to firms and large owners for repurchase of their own shares. News reports at the end of last year claimed that such buy-back loans totalled around 50 billion yuan. Market participants and firms have been asked to support markets in other ways as well. According to Chinese news media, over 2,100 mainland China firms last year reported a total of 166 billion yuan in buybacks of their own shares. The buyback action in mainland China was led by surveillance equipment manufacturer Hikvision, while internet giant Tencent has bought large lots of its own shares on the Hong Kong exchange.

The official support measures and strongly-worded government advice revived stock markets in the final months of last year. The trading volumes on mainland China bourses in the October-December period were much higher than earlier in the year. Investors also actively opened new trading accounts. Official “encouragement” and state asset injections into the stock markets, however, do not provide a sustainable solution to market stabilisation or constitute rational economic policy. Investor confidence in China remains weak and the corporate business environment challenging. Since the drop in share prices at the start of the year, the Chinese stock markets again relied on official intervention. Chinese stock exchanges called upon funds to refrain from dumping shares in order to support the stock market.

The number of initial public offerings last year on mainland China exchanges, however, was significantly lower than in the previous years. As a result, both the United States and India surpassed China in terms of the value of new IPOs. In 2022 and 2023, mainland China was the largest IPO market in the world. Deloitte analysts estimate that that the number of new IPOs in mainland China last year amounted to only about a third of the number in 2023 and that their total value (68 billion yuan) was only about a fifth that of 2023. The drop in IPO activity reflects the government’s regulatory changes introduced last April tightening listing conditions requiring companies seeking an IPO to demonstrate, among other things, better profitability than earlier required. Counter to earlier changes that sought to make listing decisions more market-based, official oversight of listings will now be intensified. Hundreds of firms withdrew their listing applications after the change. IPOs were already restricted earlier to support the markets. Officials in China typically limit IPOs when shares are on a downward trend as they appear to think that new share issues will accelerate the slide in stock prices.

There are many factors contributing to uncertainty about the Chinese economy and Chinese stock markets. They include the health of the domestic economy and weak domestic demand, as well as concerns about greater geopolitical and trade tensions with Donald Trump’s return to the White House, the rapid drop in interest rates, deflation fears and increased depreciation pressures on the yuan. China’s Communist Party seems to again be responding to weak market conditions with stepped-up propaganda. Media outlets and economic actors have been ordered to limit their commentary to upbeat economic and market news, as well as report with a positive tone on party successes in pursuing and achieving economic targets.