BOFIT Weekly Review 50/2024

Half of the cars built and sold in China still only have internal combustion engines

The China Association of Automobile Manufacturers (CAAM) reports that production exceeded 21 million passenger cars and production volumes were up by 3 % y-o-y in January-October. The annual production volume is about to hit a new record of about 27 million cars. This year 53 % of cars manufactured in China are powered by only internal combustion engines (ICEs), 25 % are pure battery electric vehicles (BEVs) and 22 % plug-in hybrids (PHEVs) or self-charging hybrids (HEVs). China’s largest manufacturer, BYD, produced over 3 million cars in the first ten months of this year. Next came Volkswagen, Chery and Geely, each producing roughly about 2 million cars. Among the foreign manufacturers, Toyota produced about a million cars and Tesla with over 700,000 units. Most major international carmakers have production facilities in China. In addition to passenger vehicles, China produces about 4 million commercial vehicles a year.

Most cars made in China are also sold in China. According to the CAAM, about the same amount of passenger cars were sold in China as produced. Of that, over half of the cars sold were powered by internal combustion engines, while about a quarter were pure EVs and over a fifth hybrids. Sales of cars with internal combustion engines are currently down by over 10 % y-o-y, while sales of EVs are up about 10 % this year (although that growth is half of last year’s growth). Sales of PHEVs have enjoyed explosive growth this year above 80 %.

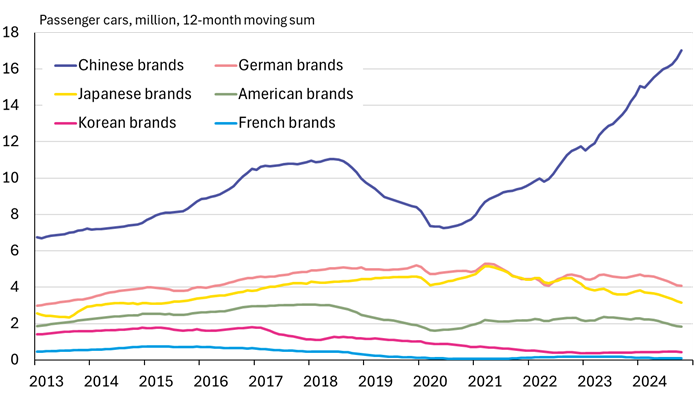

Chinese car-buyers are increasingly likely to go with domestic car brands. The CAAM reports that sales of Chinese brands rose by about 20 % y-o-y in January-October. At the same time, sales have become extremely challenging for foreign carmakers. For example, sales of German brands were down by 15 % y-o-y, French brands down by over 30 %, Japanese brands down by 20 %, and American brands down by 25 %. Only South Korean brands saw increased sales (up 8 % y-o-y this year), reversing a long downward trend in sales in China. Competition among Chinese carmakers is intense, thanks in part to the juicy government subsidies available to EV makers. The subsidies have been so attractive that they have brought in a range of new players to the car business, including for example the 5G network maker Huawei and smartphone giant Xiaomi. The fight to secure a foothold in the new industry is so cutthroat that many carmakers tolerate operating losses. BYD, for example, is rumoured to have asked its subcontractors and suppliers to cut their prices by 10 % at the start of 2025.

China also supports car manufacturers directly by subsidising car purchases. For example, consumers have enjoyed this year a “scrapping reward” introduced last April that gave owners a rebate of 10,000 yuan (about 1,300 euros) for scrapping their old vehicle and purchasing a new electric car or 7,500 yuan (about 1,000 euros) if they buy a new car with a small internal combustion engine (engine volume of 2 litres or less). The rebate amounts were doubled in July. China’s big cities have encouraged the shift to EVs through such incentives as free registration and licence plates, while keeping registration of ICE vehicles expensive and time-consuming. Big cities have also imposed a variety of restrictions on ICEs typically involving licence number digits (e.g. days or times cars can enter the city). EVs, in contrast, are not subject to such restrictions.

Chinese carmakers are focused increasingly on export markets. China Customs reports that in the first nine months of this year, China exported 4.5 million passenger cars and imported 3 million cars into the country. About 1.4 million of the exported cars were pure EVs. Russia has emerged as the top export market for China, but also the Middle East, Latin America and Europe are important export destinations. Many Chinese carmakers now also have manufacturing operations abroad. Most are sited in emerging economies, particularly Russia and countries in Southeast Asia and Latin America. Chery produced its first European plug-in hybrid this autumn in Barcelona, Spain. BYD is currently building its own plant in Komárom, Hungary. The plant is scheduled to start production at the end of 2025.

Sales of Chinese passenger car brands are up strongly in China, while foreign brands are struggling

Sources: China Association of Automobile Manufacturers, CEIC and BOFIT.