BOFIT Weekly Review 48/2024

China’s domestic consumption picked up in October, rapid goods exports growth continued and balance-of-payments figures reveal increase in services trade

Even if China’s latest round of stimulus measures has been less than many had expected, China National Bureau of Statistics (NBS) reports that the economy perked up a bit in October. Real growth in retail sales exceeded 4 % y-o-y, well up from this summer’s roughly 2 % pace. Sales of home appliances soared (up 45 % y-o-y) thanks to a government-sponsored trade-in campaign announced in late August. Car sales were also somewhat stronger than in previous months. Growth of other major economic indicators such as industrial output and fixed investment, however, remained at levels similar to previous months. Headline and core inflation continue to be close to zero.

Exceptionally strong exports have been a bright spot in China’s economic performance this year. China Customs reports that the volume of goods exports in October was up by 17 % y-o-y, and that the value of exports rose both in dollar and yuan terms by slightly over 10 %. In dollar terms, the value of goods exports grew by 16 % y-o-y to ASEAN countries, by 13 % to EU countries, and by over 10 % to Mexico. The growth in goods exports to the US has accelerated in recent months, hitting 8 % y-o-y in October. Incoming US president Donald Trump has said that he will increase the tariffs on Chinese products immediately after he returns to office on January 20, 2025. This situation will likely accelerate exports of Chinese products in the last two months of this year as American buyers build inventories ahead of new tariffs. Exports in the machinery & equipment category have been particularly strong, while export growth of passenger cars has faded somewhat. The number of electrical vehicles exported in October was down by 11 % from October 2023, when a record number of EVs was exported.

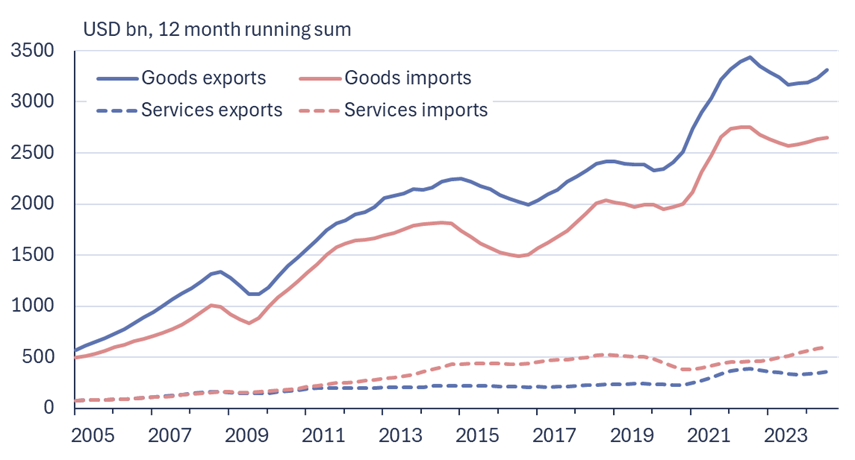

China’s goods and services trade according to balance-of-payments statistics

Sources: SAFE, CEIC and BOFIT.

Goods imports, on the other hand, only grew slightly, a reflection of weak domestic demand in China. The volume of imports has contracted throughout the year, and growth in the value of imports has been fairly sluggish (around 2 %). Goods imports from the EU have been particularly weak having contracted by about 5 % in the first ten months of this year. China Customs reports that imports from Finland have declined this year by 10 % in dollar terms. In contrast, China’s imports from the US have soared in recent months. As a result, year-to-date imports this year are at roughly the same level as last year.

Strong services growth in china’s foreign trade

Balance-of-payments figures released by China’s State Administration of Foreign Exchange (SAFE) show rapid growth in services trade this year. In January-September, both imports and exports of services grew by 10–15 % y-o-y in dollar terms. Services, however, only represent a small share of China’s foreign trade. The value of services exports in January-September was $277 billion, a bit less than a tenth of the value of goods exports. Transportation services accounted for nearly 30 % of services exports, followed by nearly 30 % for other business services, over 15 % for telecom services and 10 % for spending by temporary foreign visitors in China. The spending of foreign visitors in China has experienced impressive growth this year, even exceeding the pre-pandemic level of 2019. China’s officials have helped revive tourism by granting visa-free passage to China for people from select countries (including Finland). Starting this week, visa-free travel to China for select countries has been extended to stays of up to 30 days.

China buys more services from abroad than it sells to other countries. In the first nine months of this year, services imports were worth $458 billion, or about a fifth of the value of China’s goods imports. Some 40 % of services trade represents the spending of Chinese travellers and other temporary visitors abroad, while less than 30 % represents transportation services and 10 % procurement of other business services. The increased spending on services by Chinese residing temporarily abroad or tourists has recovered to roughly the pre-covid levels of 2019.

Thanks to a massive goods trade surplus, China’s showed a strong current account surplus ($240 billion for January-September, an amount equal to 1.8 % of GDP). This situation translated into large flows of foreign currency into China, i.e. China is selling far more goods and services to the world than it is purchasing. To balance the large current account surplus, the financial account shows net outflow from China. Balance-of-payments figures show that in January-September outward foreign direct investment flows from China amounted to around $140 billion, or about the same amount as in the same period in 2023. The FDI outflow has been boosted by the decisions of some foreign entities to exit or reduce their presence in China ($13 billion in January-September). Some of the money flowing out of China was portfolio investment or other investment such as loans and trade credits.