BOFIT Weekly Review 47/2024

Russian output growth slows, inflation remains high

Russian GDP growth slowed significantly in the third quarter

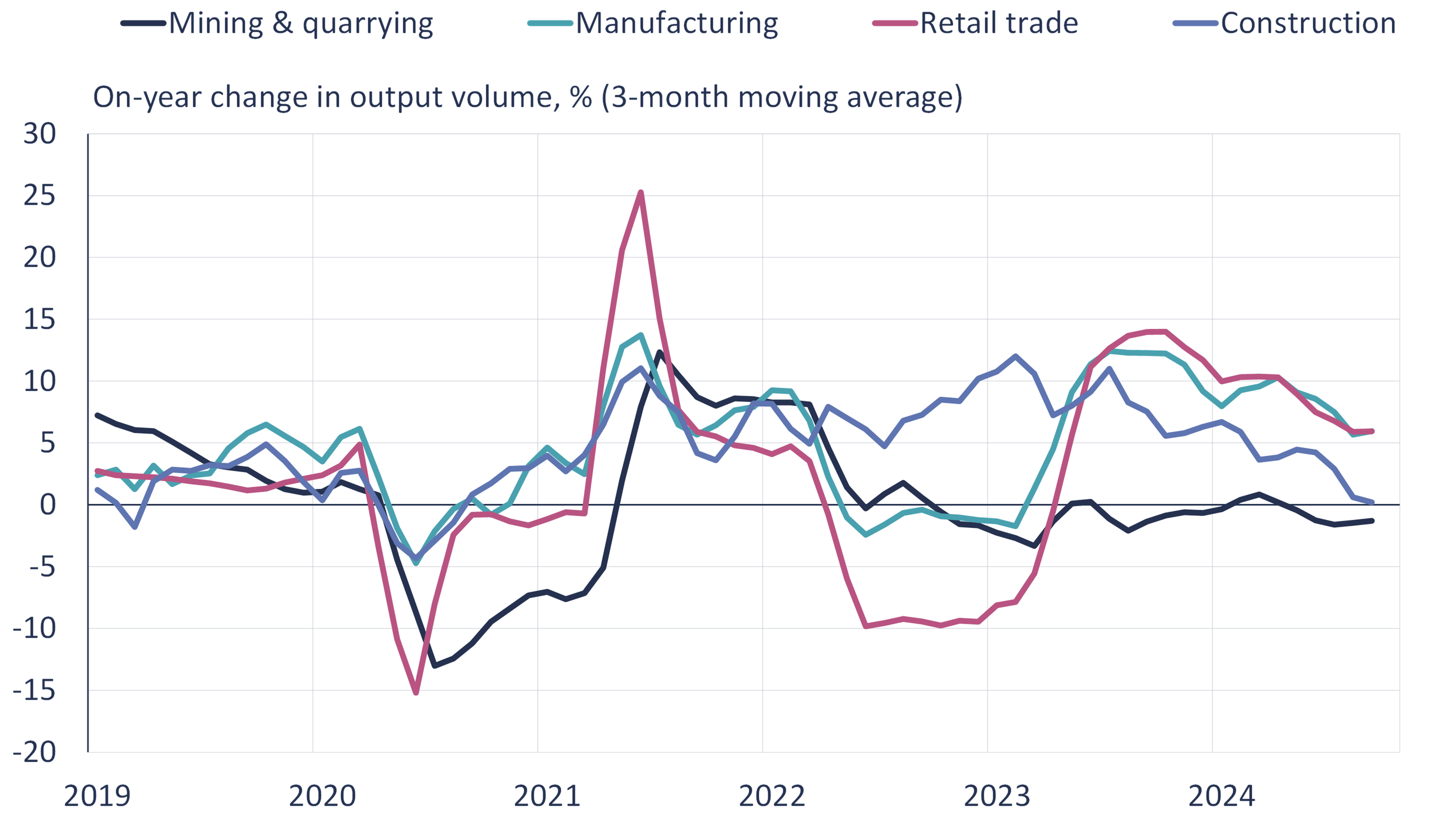

Rosstat’s preliminary estimate puts Russian GDP growth in July-September at 3.1 % y-o-y. GDP growth has slowed significantly this autumn. All core sectors have shown weaker growth in recent months compared to the first half of this year.

The slowdown in GDP growth has largely been driven by pressures from the mining & quarrying and construction sectors. On-year output of mineral extraction industries (includes oil & gas) has fallen in recent months, while on-year growth in construction is practically zero. Agricultural output also contracted in the third quarter. GDP growth has still been supported by manufacturing and retail sales, but growth has slowed also in these branches. Manufacturing growth, in turn, has been driven mainly by industries related to war.

Output growth has slowed in all core sectors of the Russian economy in recent months

Sources: Rosstat, CEIC, BOFIT.

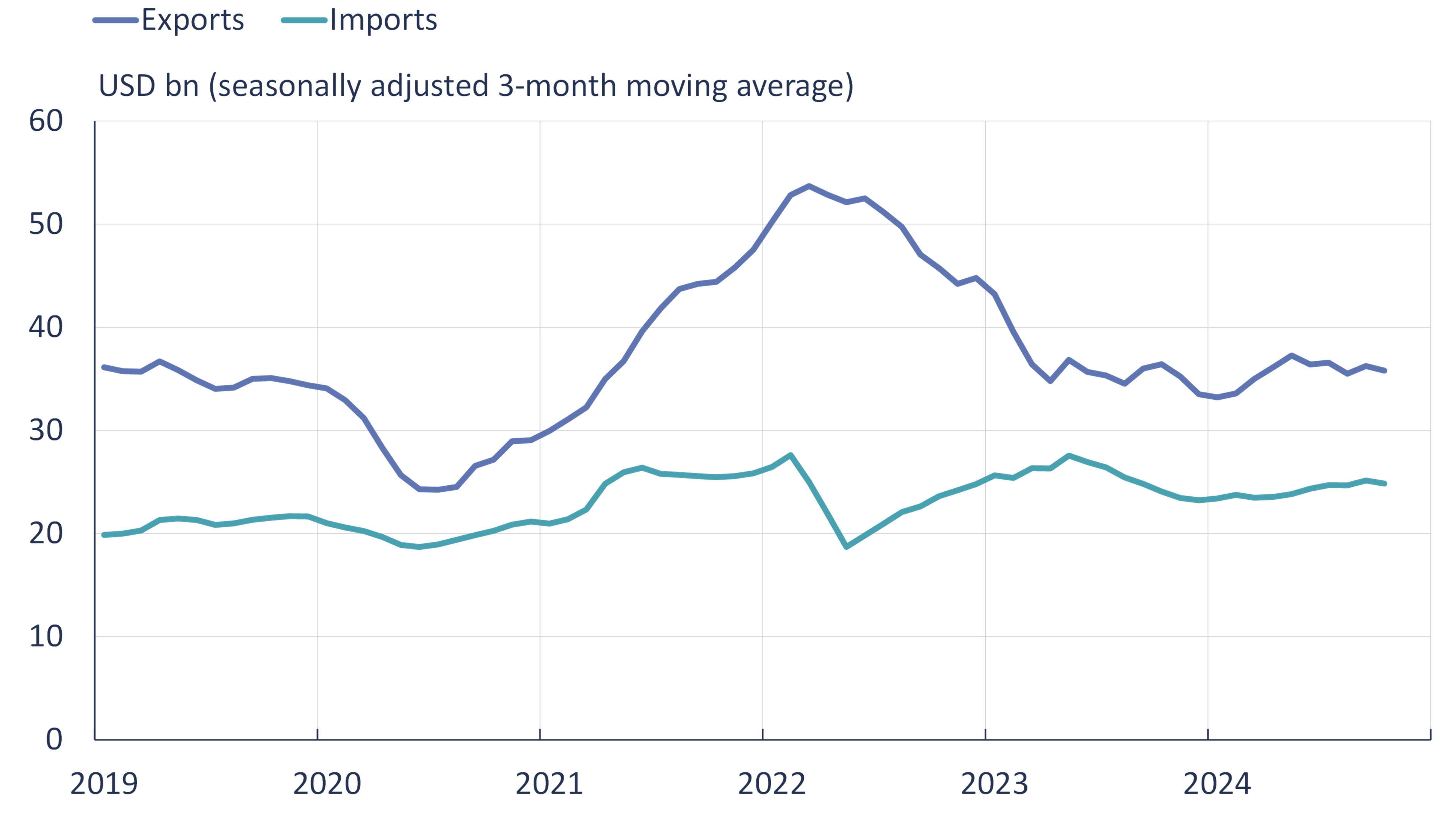

Higher oil prices fail to boost Russian export earnings or support the ruble

Russia’s export earnings have remained fairly stable this year. According to the CBR’s preliminary estimate, the value of goods exports in January-October amounted to $350 billion, about the same level as in 2023. The International Energy Agency (IEA) estimates that the average export price of Russian crude oil in the first 10 months of this year was around $70 a barrel, a modest increase from $63 a barrel in the same period a year earlier. The export volumes of crude oil and petroleum products have decreased slightly in recent months. Russian oil production has contracted and exports of petroleum products have been limited by Russia’s ban on exports of gasoline imposed in the beginning of August. The value of services exports in January-October grew by about 1 % y-o-y to $34 billion.

While Russian goods imports have risen slightly in recent months, year-to-date imports are down. For the January-October period, the value of imports was $240 billion, a 5 % decrease from a year earlier. The contraction in imports reflects slowing demand growth, ruble depreciation, as well as complications caused by sanctions. On the other hand, the value of services imports grew in January-October by 7 % y-o-y to $67 billion. Rapid growth was seen in imports of information technology (IT) services, the value of which was up by 22 % y-o-y. IT services, however, only represented 5 % of total services imports. About half of services imports came from tourism and foreign travel, which was up 13 % y-o-y.

With shrinking imports, Russia’s current account surplus has grown this year. The January-October surplus amounted to $60 billion. The CBR reports that some of the surplus was diminished by dividend payments to foreign investors. The bulk of these dividend payments, however, are subject to capital controls, which means they never actually leave Russia. The financial account side figures of the balance-of-payments show that Russia’s net assets abroad also have increased this year. This phenomenon largely reflects sanctions obstacles facing Russian firms attempting to repatriate their export earnings.

Despite higher oil prices and a growing current account surplus, the ruble’s exchange rate has weakened this year. In November, the ruble-dollar exchange rate has been about 7 % lower than a year earlier. This week the value of the ruble reached the level of 100 rubles per dollar for the first time in over a year.

The value of Russian goods exports and imports has remained fairly steady in recent months

Sources: Central Bank of Russia, CEIC, BOFIT.

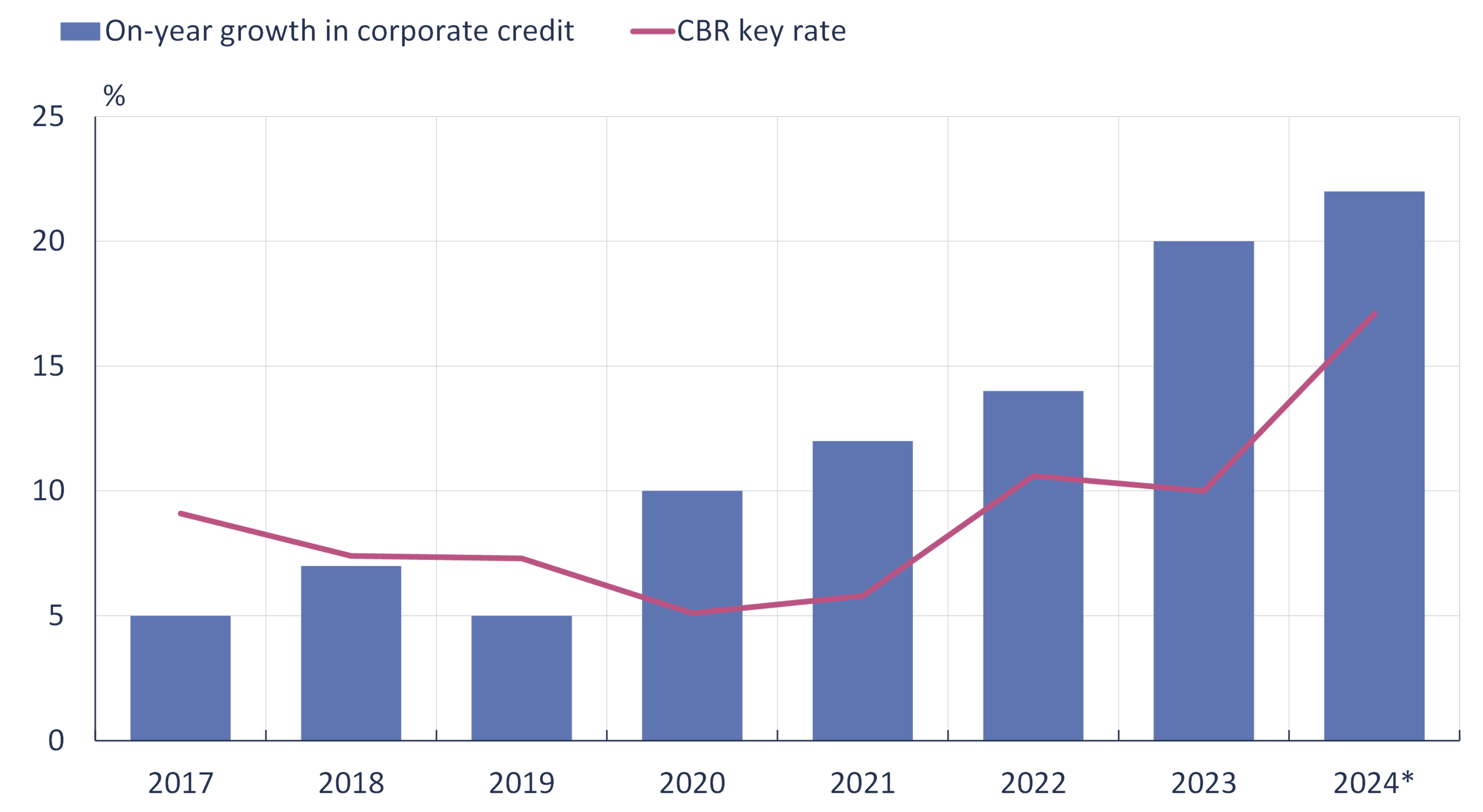

Inflation remains elevated

Rosstat reports that consumer prices rose by about 9 % y-o-y in October. Price increases vary considerably depending on the product or service in question. During the past 12 months, substantially higher than average price increases have seen certain types of medicine, staple foods such as potatoes, butter and eggs, foreign travel, as well as prices for nursing services and funeral services. Prices of some goods are even slightly down from a year ago, including buckwheat groats, certain household appliances and hygiene products. A CBR survey suggests that the assortment of daily consumer goods available in Russian retail outlets has substantially changed after Russia’s invasion of Ukraine and following sanctions. Imported goods now mainly come from emerging Asian countries, while imports from Europe and other advanced economies have decreased. Russian consumers have in general shifted to buying less expensive and lower quality consumer goods. The share of private-label products of retail chains has sharply increased.

The CBR has aggressively raised its key rate in recent months in its efforts to fight inflation. At its October rate meeting, the CBR board signalled that the key rate, which currently stands at an all-time high of 21 %, could go even higher in December. The high rate level has stirred criticism in Russia rising complaints that high borrowing costs reduce production growth and depress capital investment by firms. CBR governor Elvira Nabiullina this week defended the tight monetary stance at a Duma hearing, noting corporate borrowing growth remains brisk despite the aggressive rate hikes of recent months. When the transmission of monetary policy is impaired, the key rate has had to be raised more aggressively. The CBR’s November business survey also found that corporate inflation expectations continue to rise and currently stand at their highest level since spring 2022. Ruble depreciation also adds to inflation pressures.

Growth in corporate borrowing remains high even with Russia’s tightened monetary policies

*January-September

Sources: Central Bank of Russia, CEIC, BOFIT.