BOFIT Weekly Review 46/2024

Regional economies remain troubled despite latest support package aimed at reducing off-budget debt

Standing Committee of the National People’s Congress finally released information about long awaited economic stimulus measures last Friday (Nov. 8) at the end of their week-long meeting. The measures focus solely on paying down off-budget debt of local governments without promising additional funds to support the economy. Markets had been waiting concrete information about fiscal easing after officials led by the central bank in late-September announced monetary accommodation and other support measures for targeted sectors. The markets were disappointed by the government’s thinner-than-expected policy response. Finance minister Lan Foan, however, assured the public that more fiscal stimulus measures were planned for next year.

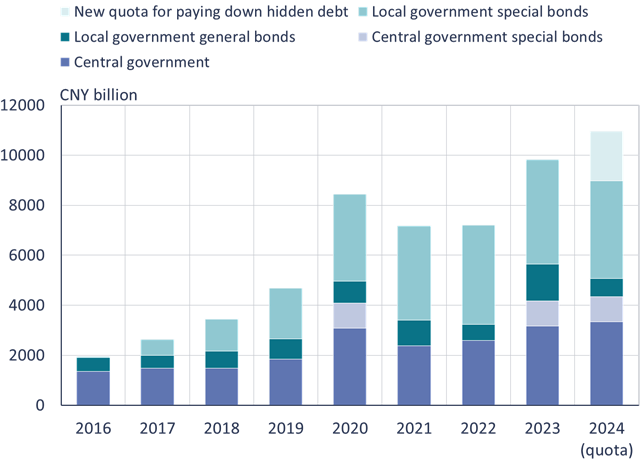

The only new measure introduced is to allow local governments to issue up to 6 trillion yuan in new debt between 2024 and 2026. The funds raised will be used to pay down high-interest off-budget debt acquired through local government financial vehicles (LGFVs) by 2 trillion yuan annually (1.5 % of GDP). Finance minister Lan said that this will help local governments to reduce their annual debt-servicing costs by about 120 billion yuan (under 0.1 % of GDP) that is the only increase in available funds under the newly announced measures. The central government won’t take any new debt, so the financing is done by allowing regions to issue additional “special bonds.” Special bonds are not included in the accounting of budget deficits, and as their name implies, their original purpose was to help finance special infrastructure projects that would eventually pay for themselves through the profits generated by the project. In addition to the 6 trillion quota, finance minister Lan announced that a further 4-trillion-yuan in off-budget LGFV debt would be paid off within five years. No new quotas will be added, however, and these will be financed using the normal special bond quotas for the coming years. Lastly, Lan noted that 2 trillion yuan in off-budget debt taken in 2014–2016 specifically to develop slum areas would be paid off according to their original conditions. He did not specify what assets would be used, but the announcement effectively promises government backing for this off-budget debt.

Increase in China’s local government debt stock has outpaced the central government in recent years

Sources: China’s Ministry of Finance, CEIC and BOFIT.

China’s official assessment of the total amount of off-budget debt diverges considerably from that of other institutional observers. The government opened the door to hidden debt when it turned a blind eye to local governments establishing off-budget LGFVs responsible for many local government expenses as their revenue sources were insufficient to cover costs. Today there are around 18,000 LGFVs in China, of which close to 3,000 have issued bonds in the mainland. Finance minister Lan said local governments currently owe 14.3 trillion yuan (11 % of GDP) in off-budget debt, and that the announced measures should help pay off nearly all of that debt. These official estimates, however, only represent a fraction of actual hidden debt. The IMF estimates that the LGFV debts of local governments currently amount to 66 trillion yuan (50 % of GDP). The amount of debt has grown significantly since 2014, the last time debt was officially audited. Hidden debt in 2014 was put at 8.6 trillion yuan, or roughly 13 % of GDP (BOFIT Weekly 37/2015).

Chinese officials seem now take the regional indebtedness and the related risks more seriously. Since last year, banks have been directed to restructure LGFV debt through loan extensions and reduced interest rates. Unpaid loans do not automatically have to be reported as nonperforming. A debt-swap programme to pay off off-budget debt by issuing new official debt has been in place since 2015. In the early years of the programme (2015–2018), new debt was taken to pay off 12 trillion yuan in hidden debt. The pace has since slowed. The new debt taken last year to pay down hidden debt was about 2 trillion yuan and this year about 1 trillion yuan. Since last year, the paying down of LGFV debt and the restructuring of such debt has focused especially on twelve “high risk” provinces. Many local governments have already reduced their “official” hidden debt, and some say that they are able to pay it off entirely.

In reality, local government off-budget debt continues to rise. The IMF estimates that the debt owed by LGFVs in recent years has been rising at a rate of about 5 trillion yuan a year. The announced measures seem insufficient to break the vicious circle of rising hidden debt and won’t be able to reduce the local government off-budget debt stock.

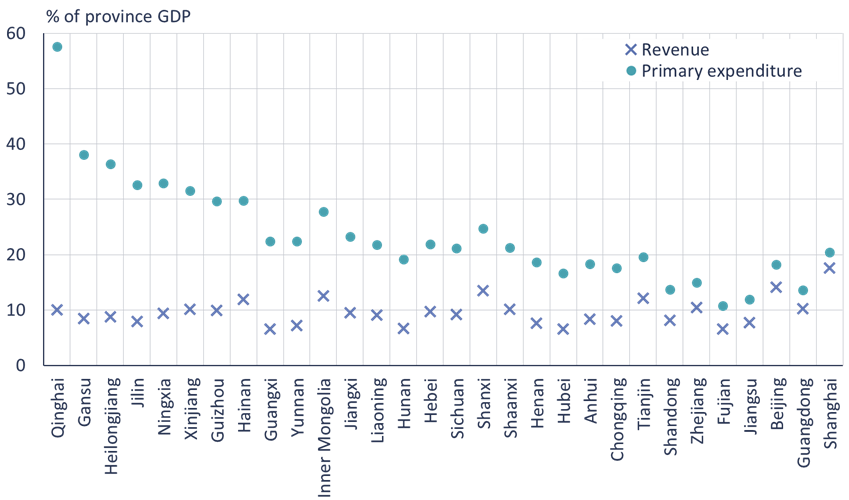

The acquisition of hidden debt is the outcome of China’s governance model, where regions collectively carry a substantially larger share of spending obligations than they can fund out of their revenues. The situation was exacerbated in recent years by the fact that local governments had to bear the such unanticipated costs as covid restrictions and healthcare measures at a time when revenues from their traditional mainstay, sales of land use rights, dropped dramatically. In 2021, local government revenues from land use sales (8.7 trillion yuan) provided 30 % of their total revenue. That share last year contracted to just 20 % (5.8 trillion yuan), and the value of sales of land use rights has continued to shrink this year. In addition, high debt-servicing costs are a drag on regional economies. With increasing financial distress, local governments have been forced to sell off assets. Media reports suggest that many local governments have also reduced the salaries of government workers or postponed payment of wages and invoices.

Without exception, regional revenues before incomes from land use rights and transfers from the central government were lower that primary expenditures in 2023

Sources: China’s Ministry of Finance, China National Bureau of Statistics, CEIC and BOFIT.

The rapid indebtedness has increased the risks of LGFV debts. The domestic banking sector holds most regional on- and off-budget debt. Measures to reduce indebtedness and acknowledge hidden debt by bringing it back on the books not only reduces some of this risk, but also diminishes the uncertainty investors have with respect to LGFVs. Officially announcing to deal with LGFV debt problem and wanting to avoid financial market disruptions indicates that such debt comes with an implicit government guarantee. The official transferring of debt to the budget, however, does nothing to reduce the total size of the debt burden or improve the fragile state of local government finances. Regional responsibility for spending will increase as China’s population ages. Fixing the problem will require comprehensive fiscal policy reforms that include higher taxes and larger spending obligations for the central government. The central government has room to take on additional debt, which is still relatively low (24 % of 2023 GDP). The struggles of China’s regions were also discussed as part of last week’s China briefing (in Finnish).