BOFIT Weekly Review 40/2024

Markets react positively to Chinese stimulus measures

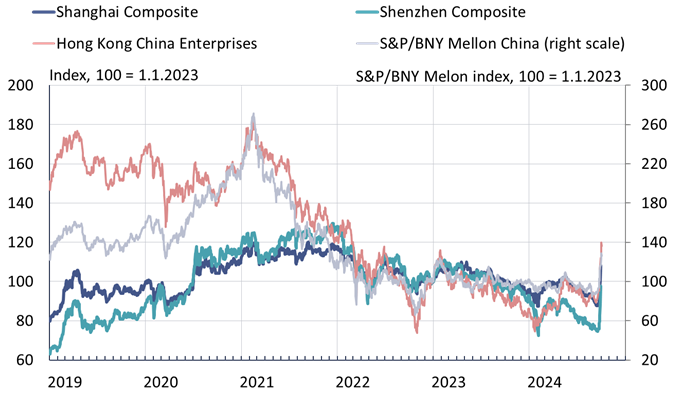

Share prices of Chinese companies skyrocketed last week after officials announced new stimulus measures (see BOFIT Weekly 40/2024). On Monday (Sept. 30), the Shanghai Composite Index, the exchange’s main index, was up 21 % from the previous week. The Shenzhen Composite Index was also up 29 %. Markets have been closed since Tuesday for the 7-day National Day holiday week (October 1–7). Trading ahead of the holiday week was brisk. Daily trading volumes on mainland exchanges were nearly double the pace previously this year.

The PBoC’s list of policy announcements last week included the launch of new monetary policy instruments designed to support mainland stock markets. A novel “swap facility” instrument aimed at institutional participants such as funds and insurance companies provides liquidity by letting institutions exchange with the central bank more risky and less liquid assets such as shares for liquid low-risk assets such as treasury bonds. The initial scale of the facility will be 500 billion yuan (64 billion euros) and the PBoC says it could be expanded as needed. The funds obtained from the swaps can only be invested in the stock markets. The programme is likely directed at China’s “national team” of large state-backed investors, the front-line group of market participants most called upon to support the country’s stock markets when market performance is considered too weak by the officials. The PBoC’s other new instrument is designed to provide banks with funds that they can then lend to firms and large shareholders to finance share buy-backs. 300 billion yuan (38 billion euros) has been earmarked for this programme.

Although there is no detailed information or terms publicly available about both the swap and share buy-back programmes, investors at the moment seem to believe in these and other support measures to revive equity markets. Mainland China stock markets have suffered from weakness in recent years, with no market recovery after China’s reopening in the wake of covid lockdowns and restrictions in the third year of the pandemic. Prior to last week’s rise, average share prices were still well over 30 % lower than at the start of 2022.

Share prices of Chinese firms listed outside the mainland have also perked up significantly. On Thursday (Oct. 3), Hong Kong’s Hang Seng index was up by 22 % and the Hong Kong Chinese Enterprise Index of mainland firms listed in Hong Kong up by 24 % from the previous Monday (Sept. 23). Notably, Chinese developers listed in Hong Kong have seen their shares prices soar (up 52 %). Their value, however, have plummeted during the past over three years and is still on average 75 % lower than in spring 2021. The S&P/BNY Mellon China Index, which comprises the depositary receipts representing shares of Chinese firms traded on US exchanges, is up by 34 % in 1,5 weeks. As the officials ceased publication of daily updates on share purchases and sales in August, there is no information available on how the latest measures have affected the foreign investors in mainland China exchanges via the Hong Kong Stock Connect programme. The decision, which followed a drop in foreign investment, probably reflects official efforts to divert attention from this unwelcome trend.

In addition to Shanghai and Shenzhen bourses, the share prices of Chinese firms have also risen in Hong Kong and the US

Sources: Macrobond and BOFIT.

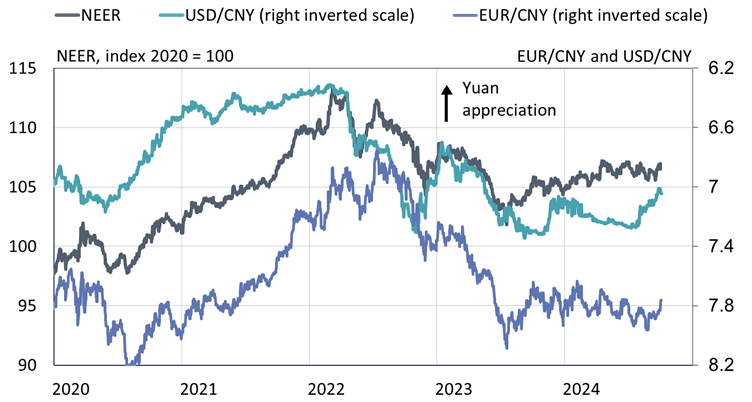

In foreign exchange markets, the yuan has strengthened against the US dollar since early July, reflecting the dollar’s general weakness. On Monday (Sept. 30), one dollar bought 7.01 yuan, a 4 % decrease from the dollar’s July peak. China’s nominal effective (trade-weighted) exchange rate (NEER) is at roughly the same level as in July, however. The yuan-euro rate has also remained more or less unchanged this year. Chinese officials and market participants focus on the dollar rate and the central bank most closely controls the yuan-dollar rate. The recent dollar strengthening has allowed the PBoC to ease its monetary stance. In the first half of this year, PBoC had to limit the yuan’s decline against the dollar. Monetary easing at the time could have exacerbated the depreciation and comes with an additional risk of capital flight.

Although the yuan has strengthened against the dollar in recent months, its trade-weighted nominal effective exchange rate (NEER) has remained quite stable

Sources: Macrobond, BIS and BOFIT.