BOFIT Weekly Review 39/2024

Russia plans on increasing government spending next year; fighting inflation could become more difficult

Federal budget revenues and spending set to rise next year

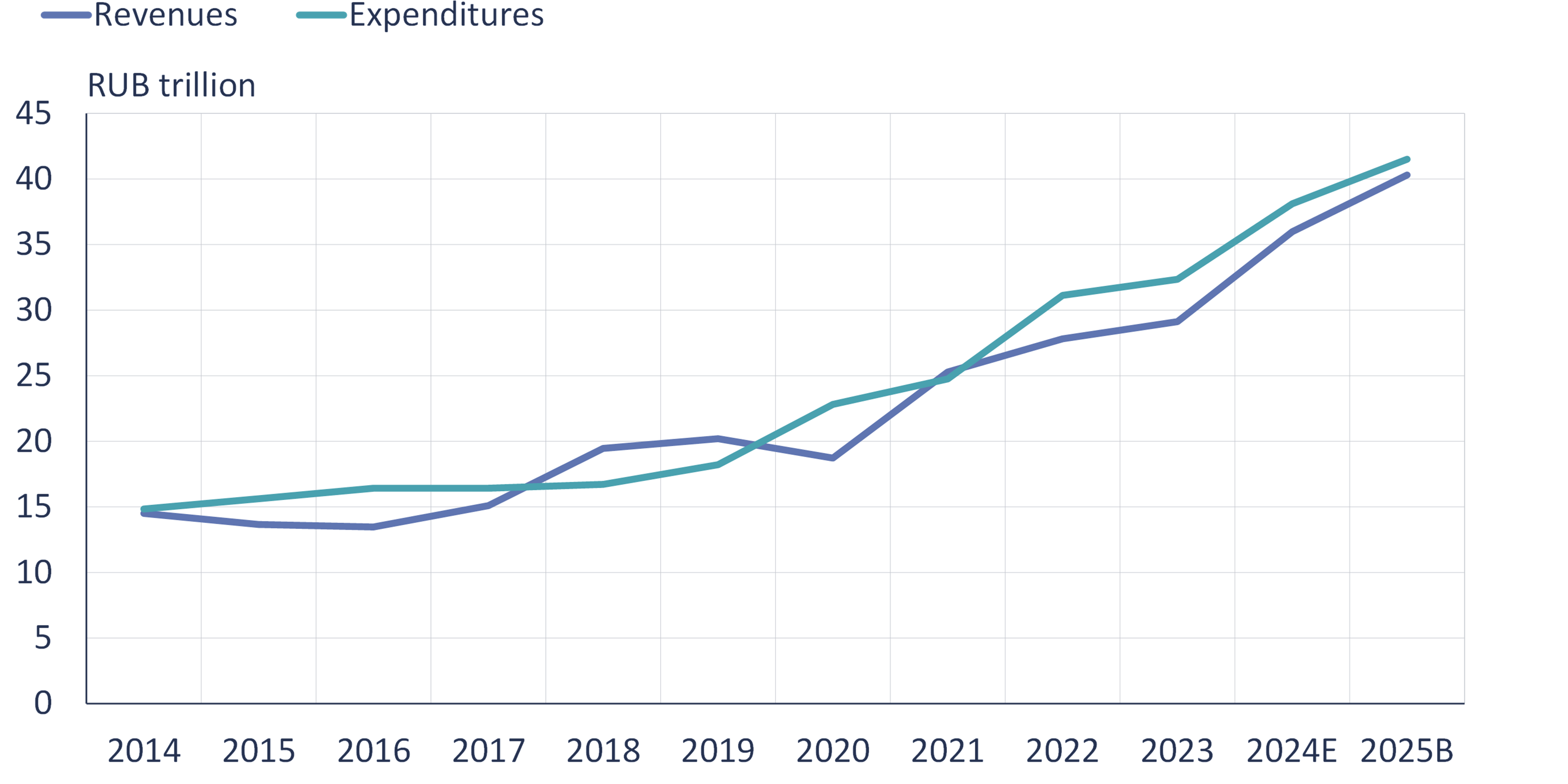

Russia’s new budget framework for 2025–2027 was approved this week by the cabinet and should be submitted to the lower-house Duma by the end of this month. Based on preliminary information, the latest 3-year budget framework departs significantly from earlier plans with respect to 2025. The present framework calls for cuts in federal budget spending next year, while the proposed framework sees a roughly 10 % nominal spending increase from 2024. Bloomberg reports that military spending will account for most of the spending growth (spending in the “defence” category is set to rise next year by 27 % compared to the budget plans for this year). Defence spending next year should top 13.2 trillion rubles ($140 billion).

The proposed budget framework also sees much higher federal budget revenues than earlier anticipated. The increase apparently largely reflects tax hikes approved last spring, the most important of which is the raising of the corporate profit tax from 20 % to 25 % (BOFIT Weekly 2024/25). Thus the war’s cost burden is shifting more on the corporate sector. Budget revenue projections for 2025 assume GDP growth of 2.5 % and an average export price of Russian crude oil of around $70 a barrel. The export price for the 2025 budget is determined as $10 a barrel less than the Brent crude price.

The budget framework sees moderate federal budget deficits in all three years covered. Next year’s budget deficit is expected to come in at around 0.5 % of GDP and rise to about 1 % GDP in 2026 and 2027. As earlier, most of the shortfall will be covered with domestic bond issues. The 2027 government debt is expected to reach 18 % of GDP.

Russia plans to keep increasing federal budget spending next year

Sources: Russian government, Russian Ministry of Finance, CEIC, and BOFIT.

Tougher times ahead for inflation-fighters?

The Central Bank of Russia releases its monetary policy framework for the coming three years every August. The policy framework, which lays out the CBR’s main monetary policy goals, also includes an assessment of the operating environment and evaluates the transmission of monetary policy. The 2025–2027 framework continues to prioritise preserving price stability and the CBR’s inflation target remains at around 4 % p.a. Four scenarios of possible monetary policy operating environments were presented this year.

In the base scenario, Russian GDP growth slows to 0.5–1.5 % in 2025 and begins to recover gradually in 2026 and 2027. Inflation subsides from its current pace of around 9 % p.a. to the central bank’s target rate of 4 % by the end of 2025, a figure that assumes the impacts of a key rate adjustment take 9 to 18 months to work their way through to the real economy. The key rate next year should average 14–16 %. The CBR base scenario anticipated some of the latest changes in the budget framework, expecting no cuts in public sector spending.

In addition to the base scenario, the CBR forecast includes a rosier “positive” scenario, a somewhat weaker “negative” scenario and a global financial crisis scenario. In the positive scenario, increased fixed investment helps domestic suppliers better meet demand. Inflation subsides, making it possible to move to a more accommodative monetary stance faster than under the base scenario. As a result, GDP grows faster than under the base scenario. This benign scenario appears to be closest to the economic development ministry’s forecast, which is used by the finance ministry in drafting the budget framework.

The CBR, however, sees as more likely its first negative risk scenario, whereby government spending rises more than in the base scenario and demand is also fuelled by an increase in credits subsidized by the government. Due to production capacity constraints, domestic suppliers cannot keep up with rising demand. Inflation accelerates, eroding the purchasing power of the support measures. The end result is GDP growth similar to the base scenario, but higher government spending and inflation. As a result, the central bank is forced to hold the key rate higher for longer than in the base scenario. Preliminary information about the new budget framework and other economic support measures point to increasing probability of this type of scenario.

The darkest scenario with an international financial crisis sees global growth stagnating in 2025 and the average price of a barrel of crude oil falling to around $50 for the entire 3-year forecast period. Western sanctions on Russian exports are tightened further and Russia’s export earnings decline sharply. Under this crisis scenario, Russian GDP contracts by 4–6 % in 2025–2026 and begins a feeble recovery in 2027.

Subsidized loans hinder monetary policy transmission

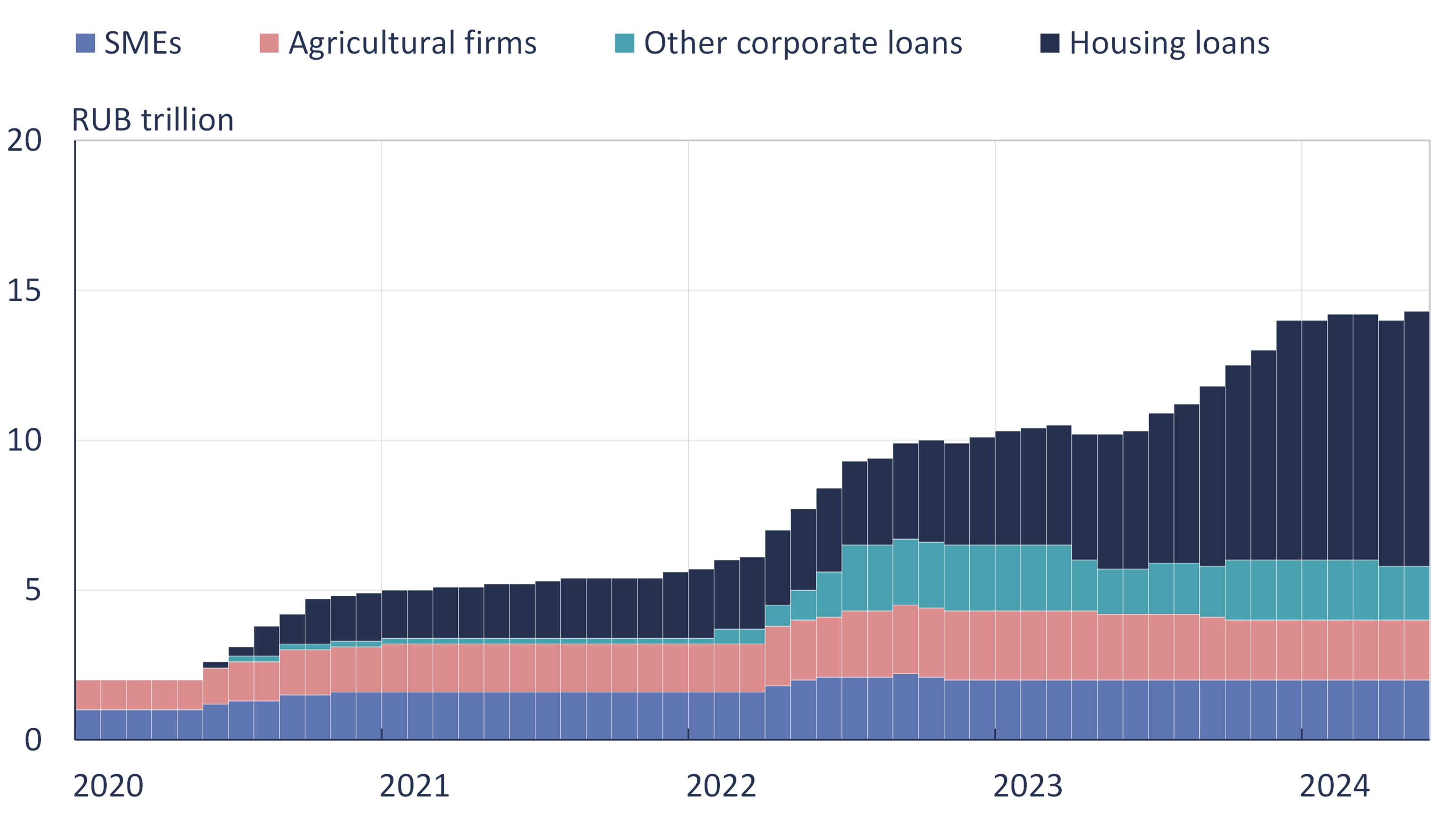

In addition to generous fiscal policies, the government’s other economic support plans could complicate fighting inflation. The CBR notes that government loan subsidy programmes, which have proliferated in recent years, have hindered transmission of monetary policy to the economy. Many support programmes provide loans to borrowers at lower fixed interest rates that are unaffected by changes in the key rate. When a substantial chunk of the credit stock is subsidised, the central bank must raise the key rate more to achieve the same inflation-dampening effect.

Russia widely adopted interest-subsidy programmes in response to the Covid-19 pandemic. As of early 2022, about 10 % of the credit stock received interest support. Eligibility for loan subsidies has since been expanded, with the CBR currently estimating that about 15 % of ruble-denominated loans receive interest subsidies.

Nearly two-thirds of subsidized loans consist of housing loans. The value of subsidized housing loans has nearly tripled since end-2021. Both the central bank and the parliamentary auditing body, the Federal Accounts Chamber, report that heavily subsidised housing loan programmes have driven up housing prices substantially in recent years. In the total household loan stock, the share of subsidized loans is about a quarter.

The stock of interest-subsidised corporate loans rose in the second half of 2022, but has since remained unchanged. While the popularity of fixed-interest loans in general has declined in recent years in Russia, they still represent slightly over half of the corporate loan stock. About half of fixed-interest corporate loans have been issued at rates of 10 % or less. (Following its latest hike in the key rate this month, the CBR’s key rate stands at 19 %.) About a quarter of fixed-interest corporate loans have been issued under a government interest-subsidy programme.

The central bank also estimates that transmission of interest-rate adjustments to exchange rates and transmission of exchange rate changes to inflation have weakened and slowed in recent years as a consequence of sanctions. Sanctions have substantially reduced capital inflows to Russia, the ruble has been increasingly used as an invoicing currency in foreign trade and the share of imports in supply has declined. The CBR estimates that a 1 % depreciation in the ruble’s nominal exchange leads to an acceleration of inflation by about 0.1 %-points and this feeds through to inflation in 12 months. The ruble’s average exchange rate against the dollar has been about 10 % lower this year than in 2023. According to preliminary information, the economy ministry’s forecast assumes an average ruble-dollar rate of 96.5 in 2025, or about 7 % below the average ruble-dollar exchange rate seen so far this year.

The share of subsidized loans has increased in Russia in recent years

Sources: Central Bank of Russia, BOFIT.