BOFIT Weekly Review 38/2024

China starts raising retirement ages for men and women

Last Friday (Sept. 13), the Standing Committee of the 14th National People’s Congress approved changes to statutory pension ages. Starting next January, the pension age will be raised by on average three months a year over the next 15 years. The transition ultimately lifts the statutory old-age pension eligibility from 60 to 63 years for men, from 55 to 58 for women in office jobs, and from 50 to 55 for women performing physically strenuous labour. Pension eligibility will also eventually require that the person seeking to collect a pension has paid into the system for 20 years, adding five years to the current 15-year requirement. Starting on January 1, 2030, this additional contribution requirement will be implemented in annual six-month hikes. Postponing retirement, however, will not become mandatory. People in the working life who have made pension payments for the requisite period may retire up to three years before they reach the new statutory pension age (but not earlier than the old statutory pension age). Employees may also delay their retirements up to three years with employer permission.

The reforms follow China’s decades-long debate on increasing the retirement age. Last July, the third plenary session of the CPC’s 20th Central Committee put the issue on the reform agenda. The overall pension system had been unreformed since 1950, when the life expectancy at birth of an average Chinese was 44 years (currently 78 years). The gradual and voluntary transition to higher retirement ages is still insufficient on its own to fill the gaps in China’s pension system and blunt the economic impacts of a rapidly ageing population. Due to China’s modest old-age social security, most workers already must work after they reach the statutory retirement age. Such employees are entitled to collect both wages and pension payments simultaneously. OECD figures for 2017–2022 show the average age at which Chinese men leave the labour market is 65.5 years (OECD average 64.4) and women at 60 years (OECD average 63.1).

It has long been recognized that China’s current pension system is inadequate to deal with the burden of a rapidly ageing population. China’s pension system is based on three pillars: a public basic pension component, voluntary contributions from employers and individual pension savings programmes. Most of the accumulated pension assets are controlled by public pension funds administered at the provincial level. With the rapid depletion of these funds, provinces with poorer and more elderly populations are already relying on income transfers from wealthier provinces. In addition, a considerable amount of stakes in state-owned enterprises have been transferred in recent years to the national social security fund, with part of dividends of these firms used to fund the basic pension fund. The state-run Chinese Academy of Social Sciences estimates that the money in the basic pension fund would have been completely drained by 2035 under the old system. Few people yet have private pension savings, however, so the government is encouraging their adoption through such incentives as tax breaks and a broadened set of available investment products.

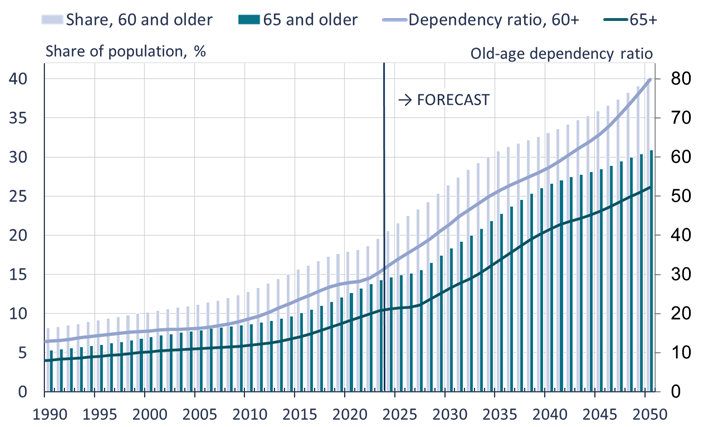

Given that the Chinese population is shrinking and ageing (BOFIT Weekly 6/2024), raising the pension age was necessary. China’s population has been declining since 2022. The old-age dependency ratio, the number of elderly people relative to those of working age, is rising dramatically. China currently has 3.3 persons between the ages of 15–59 for every person over the age of 60 (2.5 for the US). The UN’s latest population projection sees China’s old-age dependency ratio declining to 1.5 by 2045 (2.0 for the US). Given that eldercare facilities and services are scarce in China, the CPC has launched a “silver economy” initiative to provide services for the ageing population.

With pensioners constituting an increasing share of the Chinese population, the old-age dependency ratio has also soared

Sources: UN Population Prospects 2024 and BOFIT.