BOFIT Weekly Review 38/2024

Still no signs of economic recovery in China

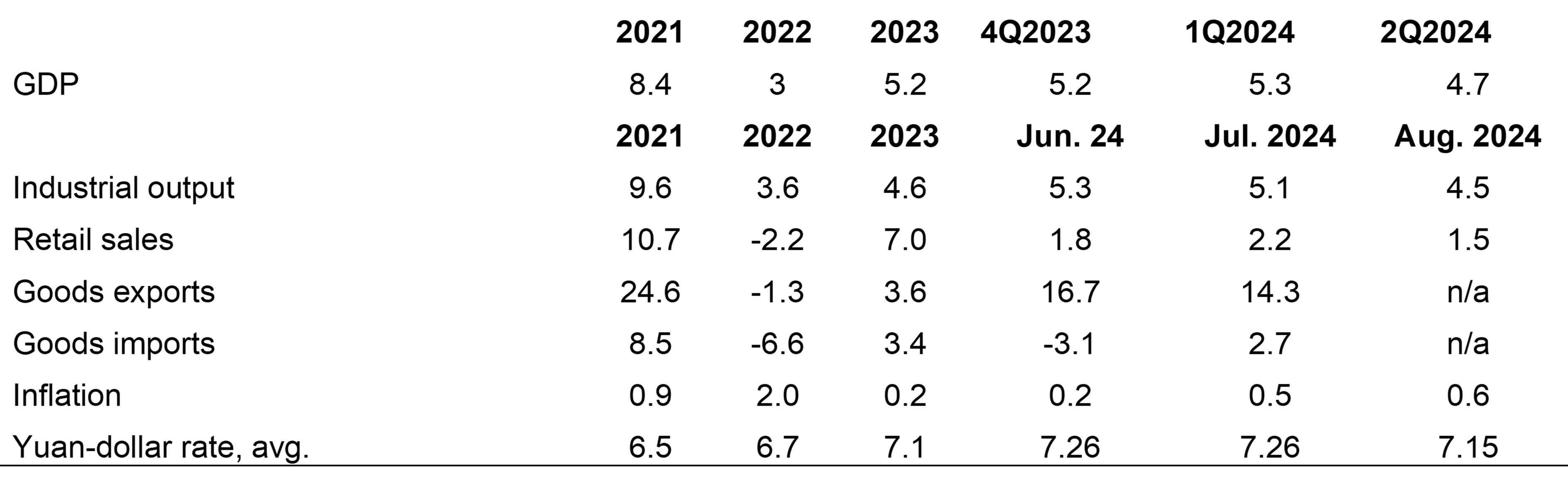

All major economic indicators suggest that China’s weak economic conditions persisted in August. Domestic consumers demand was particularly anaemic. The National Bureau of Statistics (NBS) reports that real growth in retail sales in August fell below 2 % y-o-y. Strikingly, the July reading of the household economic confidence index fell to its second-lowest level since 1990 when the index was introduced. The August reading of the consumer confidence index should be available within a couple weeks. Labour market surveys suggest the unemployment rate rose slightly in August, a month in which the unemployment rate typically declines.

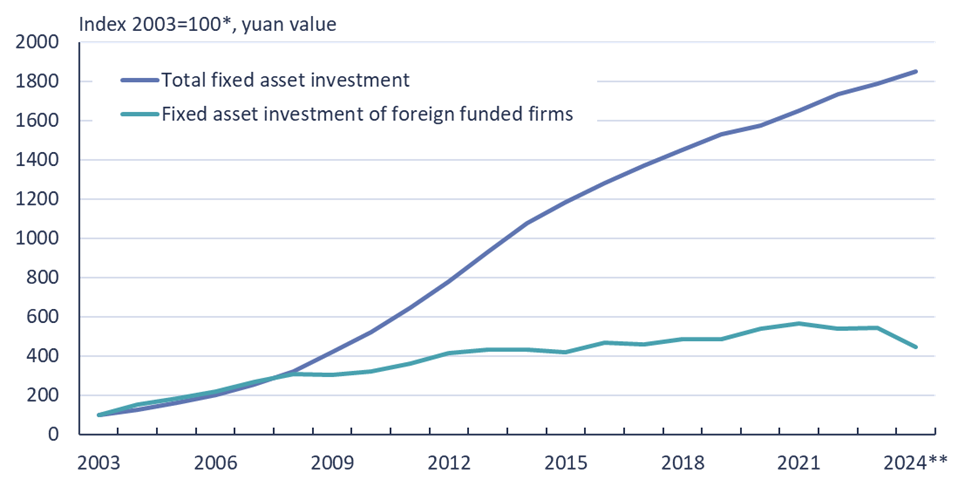

Industrial output was still growing above 6 % y-o-y in real terms this spring, but in recent months it has slowed, falling to 4.5 % in August. China’s economic fragility was also evident in the fixed investment numbers, which declined from an average pace of 3.6 % in the first seven months of this year to 2 % in August. Fixed investment of foreign funded firms operating in China has plunged this year, showing a nominal drop of nearly 20 % y-o-y in the January-August period. If the current pace of contraction continues to the end of December, the nominal value of fixed investment by foreign firms will contract to levels last seen ten years ago. The data on foreign firms excludes companies from Hong Kong, Macao and Taiwan. Evaluating the real value of fixed investment is challenging, however, as China ceased to publish the fixed investment price index in 2019. Even with signs that the contraction in the real estate sector has begun to bottom out, the misery persists. For example, the volume of apartment sales measured in terms of floorspace was down 14 % y-o-y in August, only a slight improvement from the over 20 % pace of decline last spring. Growth in the loan stock continues to decelerate despite central bank interest rate cuts. August core inflation of 0.3 % and weak imports further point to a flagging economy. China’s goods exports figures provided a bit of sunshine, however, with August growth figures above 8 % in both yuan and dollar terms.

The value of fixed investment in China by foreign firms dropped considerably this year

*) Index is compiled from annual growth rates. **) January-August 2024.

Sources: China National Bureau of Statistics, CEIC and BOFIT.

Major investment banks revised their China forecasts downwards immediately following the release of the latest round of economic data. Updated forecasts generally put China’s projected real GDP growth this year in the 4–5 % range. China’s official GDP growth target remains at “about 5 %.” Last week’s statement by president Xi Jinping that China would “strive to complete” this year’s economy growth targets has been interpreted by some observers to mean that actually reaching the target is no longer as critical as earlier. It could also imply, however, that the disparity between China’s official GDP growth estimate and alternative GDP estimates will widen at the end of this year should officials succumb to pressure to report target-hitting performances. In BOFIT’s April forecast, we expected GDP growth of around 4 % this year. Our updated forecast for China will be released on November 4 in conjunction with our China press briefing (in Finnish).

Real on-year change and consumer prices, %

Sources: China National Bureau of Statistics, PBoC, China Customs, WTO, CEIC and BOFIT.

Sources: China National Bureau of Statistics, PBoC, China Customs, WTO, CEIC and BOFIT.