BOFIT Weekly Review 37/2024

Russia continued on a more moderate growth path in July; fixed investment supported first-half growth

Russian economic growth slowed significantly in June, but sustained its lower pace in July. According to Russian economic development ministry’s preliminary estimate, on-year GDP growth in June and July was around 3 %, down from 4.5 % in the April-May period. The general indicator comprising Russia’s five core production sectors suggested that the volume of seasonally-adjusted economic output contracted on-month in June, but the contraction stopped in July.

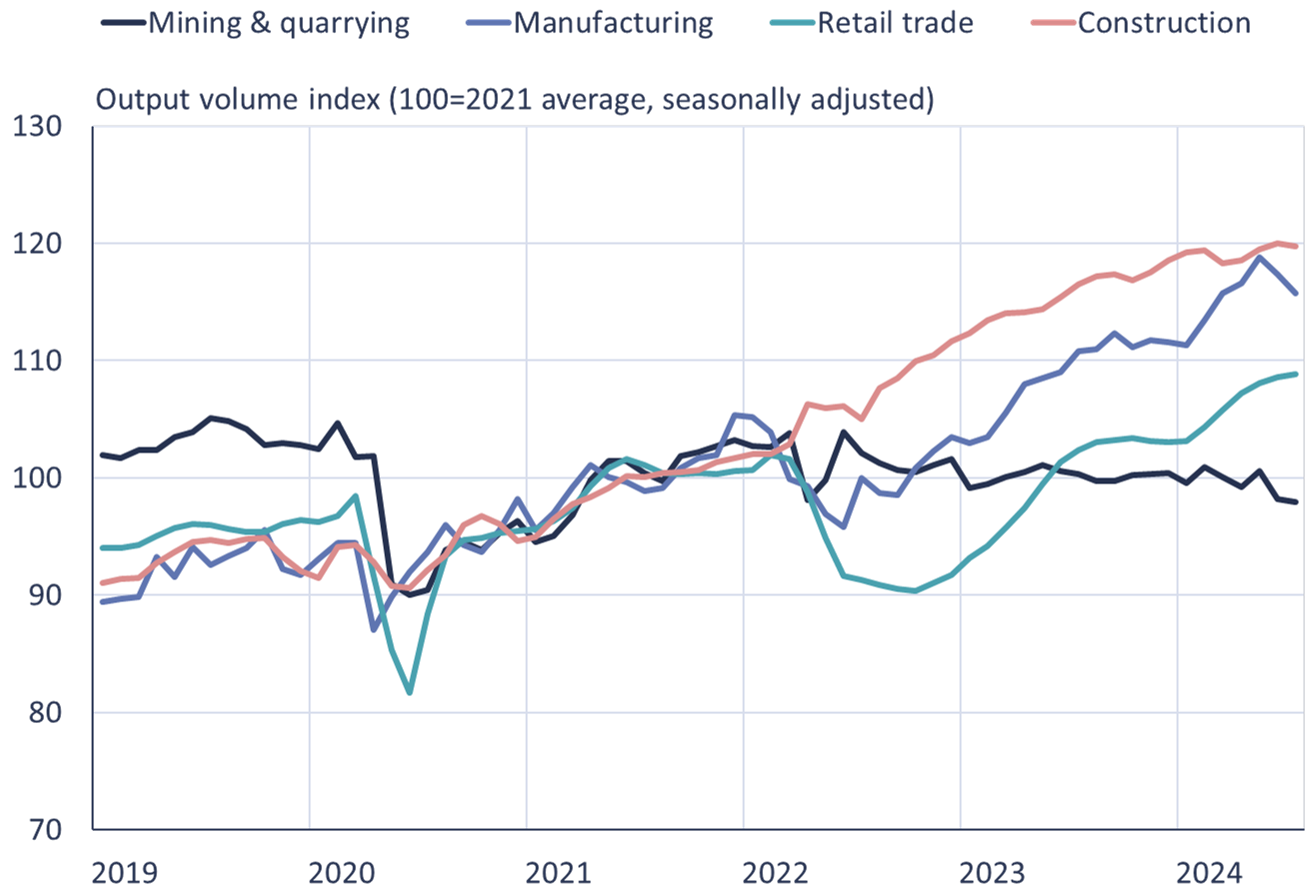

The volume of seasonally-adjusted industrial output fell further in July, however. Industrial output has declined in the latest months, both in the extractive industries and manufacturing. Growth also seems to have stalled in construction and retail sales, with no hints of recovery in July. The rapid increase in agricultural output (5 % y-o-y) supported economic output overall in July.

Although domestic production growth faded, preliminary figures suggest a slight return to growth in imports this summer. Preliminary figures released by the Central Bank of Russia show that the value of goods imports rose by 3 % in July. For the first seven months of this year, however, the value of goods imports was down by 6 % y-o-y.

Inflation remains high in Russia, with consumer prices up 9 % y-o-y in August. Prices for services last month rose nearly 12 % , foodstuffs 10 % and non-food goods 6 %.

The latest outlooks of most major institutional forecasters published in July or August see Russian GDP growing in the range of 3–3.5 % this year and around 1.5 % next year. The latest CBR forecast sees Russian GDP increasing by 3.5–4 % this year and 0.5–1.5 % next year.

Russian industrial output has declined in recent months

Sources: Rosstat, CEIC, BOFIT.

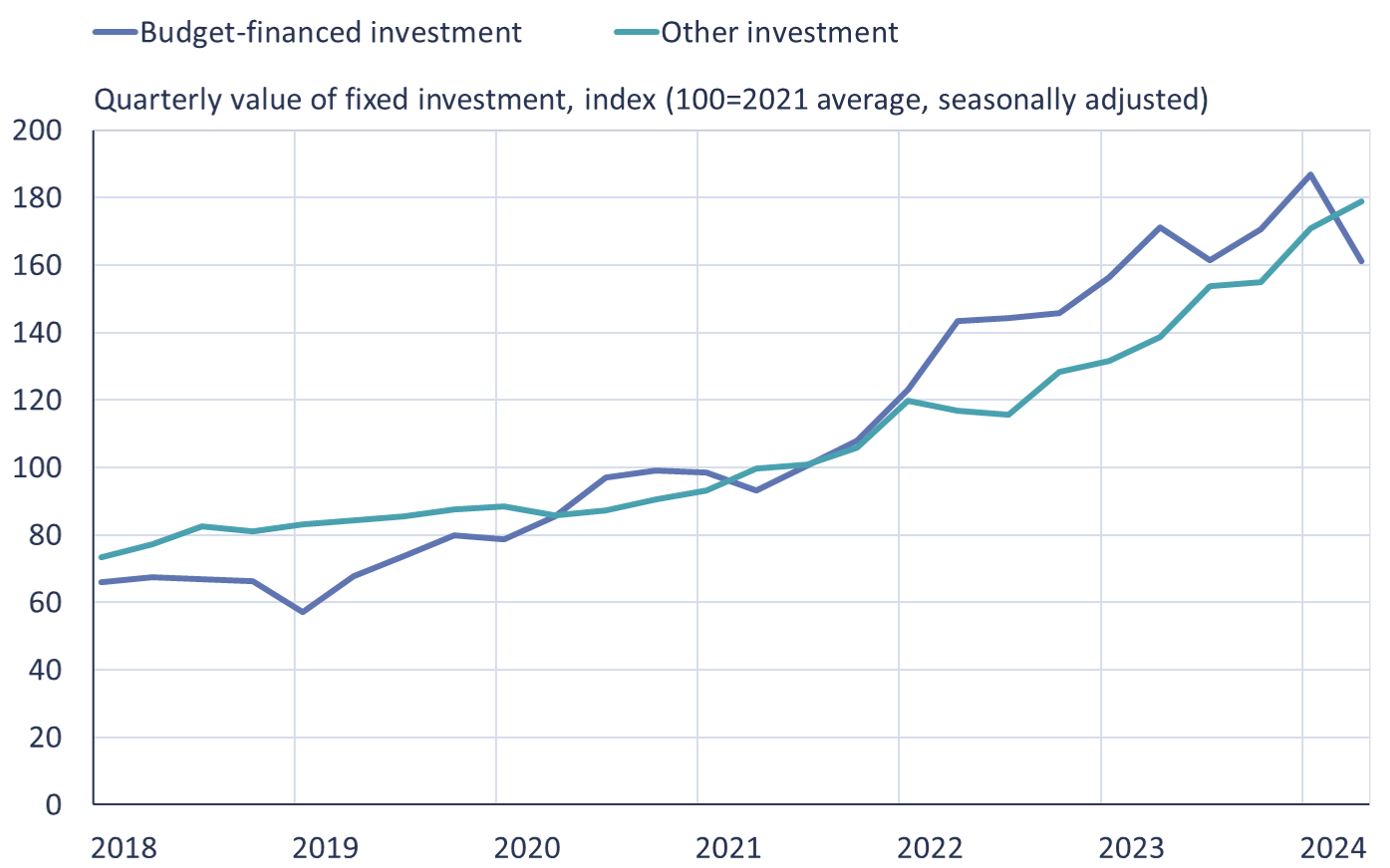

Despite a slowdown in recent months, first-half fixed investment growth was strong

The latest figures indicate that the volume of fixed capital investment grew at 11 % y-o-y in the first six months of this year. In recent months, however, fixed investment growth has slowed along with the rest of the economy. The growth emphasis has also shifted from construction and infrastructure in 2022-2o23 to machinery & equipment this year.

Much of the slowdown in fixed investment growth in recent months reflects reduced direct budget financing for investment projects. Investments financed directly with budget funds were up just 4 % y-o-y in nominal terms in the first half (i.e. a spending cut in real terms). Investment funded from the federal budget overall contracted slightly even in nominal terms, but varied significantly from region to region. High growth was posted in e.g. the Bashkortostan and Udmurtia republics, while sharp spending declines were registered in the Leningrad and Rostov regions.

Companies financed most fixed investment (60 %) out of pocket. Growth in such corporate investment is expected to slow in coming months as firms are facing higher costs. Wages and prices of many production inputs have risen rapidly, corporate taxation has become more stringent and interest rates are up. Even with higher interest rates, however, the share of bank lending in financing of fixed investment has grown this year and was 11 % in the first half of this year. Such debt-driven investment has been supported by government interest-subsidy programmes.

Due to Russia’s war of aggression on Ukraine and resulting economic sanctions, foreign financing of fixed investment has practically ceased. In January-June, foreign investors provided just 0.03 % of funding for fixed capital investment in Russia, while foreign bank lending accounted for a mere 0.01 %.

Budget-financed investment has declined in recent months in Russia

Sources: Rosstat, CEIC, BOFIT.

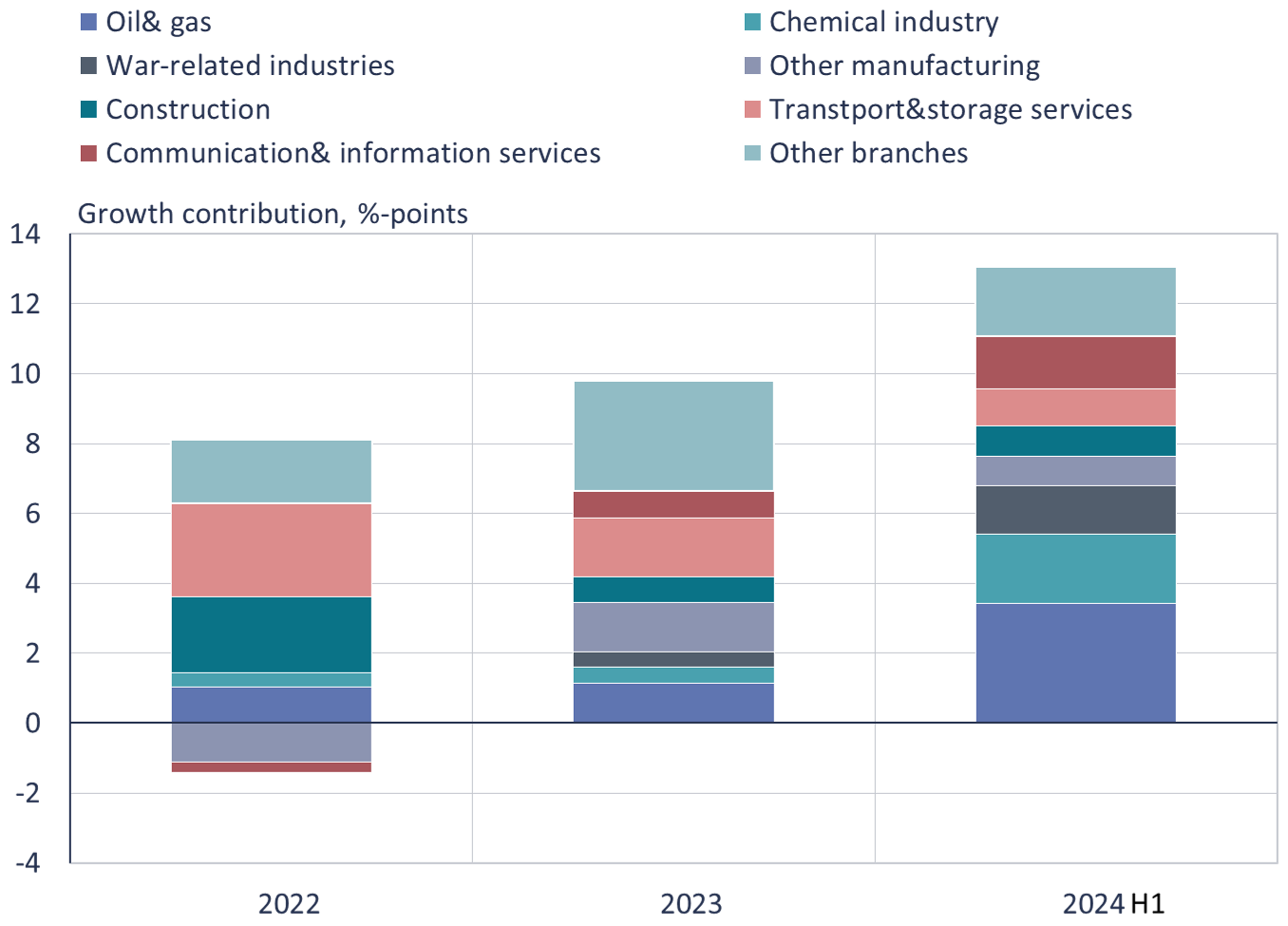

Oil & gas production lead fixed-investment growth this year

Broken down by branches, most of the fixed-investment growth in the first six months of this year came from oil & gas production. Fixed investment in manufacturing also rose briskly. Most manufacturing investment growth originated from the chemical industry or branches associated with the military industry. The largest service-sector growth contributors were information technology and telecommunications, as well as transport, logistics and warehousing services. Investment declined in such industries as agriculture, forest industry and pharmaceuticals. The breakdown of investment by branch, however, does not include investment by small and medium-sized enterprises (SMEs).

Regionally, the most significant shares of investment growth came from the city of Moscow and Tyumen region, particularly the Yamal-Nenets autonomous okrug, the largest producer of Russian natural gas. Other significant investment regions included the City of St. Petersburg and the surrounding Leningrad region, as well as Tatarstan and the Sverdlovsk region, which are home to many defence-related production facilities. Investment declined in the first half of this year in the Karelian Republic and the Arkangel region, among others.

Fixed investment growth in Russia was led by the oil & gas industry in the first half of this year

Note: War-related industries refer to manufacturing branches connected with the war effort.

Sources: Rosstat, CEIC, BOFIT.