BOFIT Weekly Review 36/2024

Finland’s goods exports to China remained weak in the first half

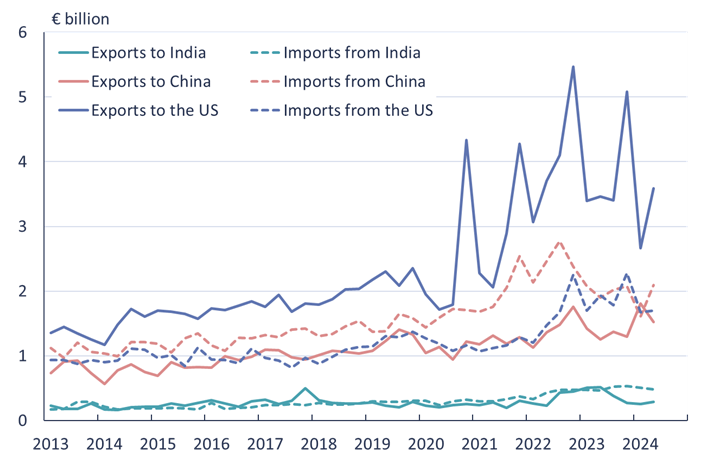

Finnish Customs reports that the value of Finland’s goods exports to China was €1.7 billion for January-June, an 11 % decrease from the same period a year earlier. Finland’s entire goods exports in the first half contracted (down 8 %) less than its exports to China, causing China’s share of Finland’s export market to shrink (4.8 % share in the first half). Finnish strikes likely drove a major decrease in goods exports in the first quarter of this year. In the second quarter, however, goods exports to China flowed at the higher pace than year earlier. Finland’s exports to the United States increased sharply in the first half, with the value of Finland’s goods exports to the US was nearly double that of Finnish exports to China.

Under the Combined Nomenclature, or CN codes (the EU’s specific system of trade categories based on the global Harmonized System coding), 30 % of Finland’s first-half exports to China fell in the leading category of cellulose pulp (CN4703), which was down in value terms by 20 % y-o-y. The volume of pulp exports also fell by over 10 %. The value of exports of machinery and mechanical devices (CN84, 20 % share of exports) fell by more than 15 %. The value of goods in the electrical equipment and machinery category (CN85, 11 % of exports) remained unchanged from the same period a year earlier, while the value of goods in the optical, metrological and pharmaceutical equipment (CN90, 9 % of exports) rose by 18 %. Nickel ore (CN2604) was the fastest growing major export category in terms of both volume and value in the first half of this year, exceeding the performance of all last year and representing 6 % of Finland’s total exports to China.

China, in comparison, continues to strengthen its position in Finnish goods imports. In the first half of this year, Finland imported €3.5 billion in goods from China, roughly the same as in 1H2023. Finland’s goods imports overall contracted by 8 % in the first half, and thus China’s share of Finland’s imports rose to nearly 10 %. Goods in the electrical machinery and equipment category (CN85) accounted for 40 % of imports, and imports in that category were up by 6 % y-o-y in the first half. The value of imports doubled in the electrical passenger vehicle category.

The value of Finland’s services exports to China doubled in the first half of this year to around €1 billion. While detailed data on the structure of services has yet to be published by Statistics Finland, the surging increase likely reflects a cooperation agreement between the Finnish telecom company Nokia and the Chinese cellphone makers OPPO and Vivo on the use of patents held by Nokia. Under the agreement, the Chinese firms agreed to pay licencing fees retroactively and in the future. Services imports in the first half fell by 14 % y-o-y to just under €4.6 billion.

India this year accounted for about 1 % of both Finland’s goods imports to India and exports from India. Imports from India rose by over 20 % y-o-y, while exports declined by 35 % from last year’s exceptional highs. Services exports to India represented about 1 % of Finnish services exports, while services imports from India, similar to China, represented around 3 % of Finland’s total services imports.

Quarterly volume of Finland’s goods and services trade with China, India and the United States, 2013–2024

Sources: Statistics Finland and BOFIT.