BOFIT Weekly Review 34/2024

IMF recommends that China implement a major support package for struggling real estate sector

The International Monetary Fund (IMF) released its latest overview of China’s economy (Article IV Consultation report) on August 2. The IMF expects the Chinese economy to keep slowing, with GDP growth settling at around 3 % at the end of the decade. Restraints on growth include China’s rapidly ageing population, modest productivity gains and structural issues. Structural adjustments proposed by the IMF include strengthening domestic consumer demand by redirecting public spending away from firms to households and strengthening social safety nets to reduce the need of households to save for a rainy day. Higher retirement ages for men and women should also be considered.

With the real estate sector facing its fourth year of contraction, the IMF called for a massive central government-funded support package to fund the completion already purchased but unfinished or yet-to-be-built apartments or otherwise compensate homebuyers for their sunk costs. The government should seek resolution of insolvent developers, while providing healthy developers with liquidity support. The IMF noted that such a programme would require the government provide about 5.5 % GDP (7–8 trillion yuan) in support over a period of four years. The economic argument for the package is that it would expedite resolution of real estate sector problems, resulting in an earlier return of consumer confidence that would then stimulate consumption growth.

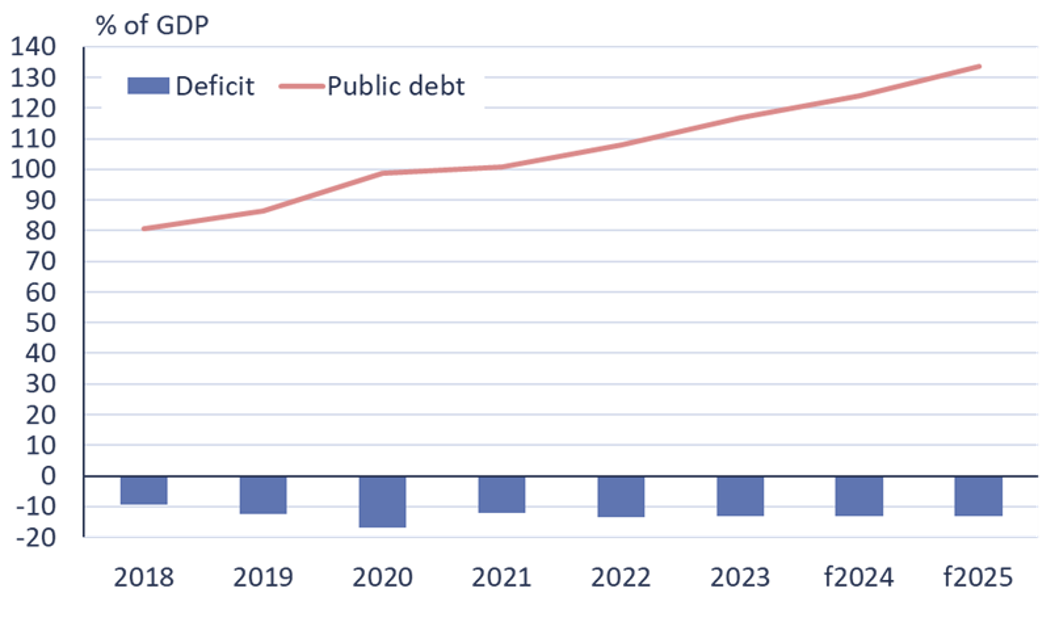

Over the medium term, China’s public sector deficit needs to be reduced to bring the pace of indebtedness growth down to a sustainable level. Such a change would require increased strengthening the tax base through such measures as introducing a property tax and raising taxes on wage and capital income, as well as higher taxes on alcohol, tobacco and sweetened beverages. On the spending side, the government is advised to cut back on investment and make improvements in the unemployment and medical insurance system, as well as introduce nationwide monthly payments to families with small children. The IMF’s broad measure (augmented) of China’s public sector deficit this year hit a whopping 13 % of GDP, while public sector debt is expected to reach 124 % of GDP by the end of this year. The figures include off-budget items such as the activities of local government financial vehicles (LGFVs).

The IMF noted that China currently has monetary policy room to manoeuvre that would allow for greater support of the economy. Monetary easing would stimulate domestic demand and help reduce the risk of a deflationary spiral. At the same time, the monetary policy framework should be simplified (the PBoC already seems to be moving in this direction). The IMF said that the risks to financial stability continue to rise and hopes that China develops crisis management mechanisms for the financial sector and improves its monitoring of systemic risks.

IMF estimates of China’s public sector debt (broadly defined), debt levels for 2018–2023 and projected debt levels in 2024–2025

Sources: IMF Article IV Consultation reports and BOFIT.