BOFIT Weekly Review 34/2024

Chinese economy yet to show clear signs of improvement

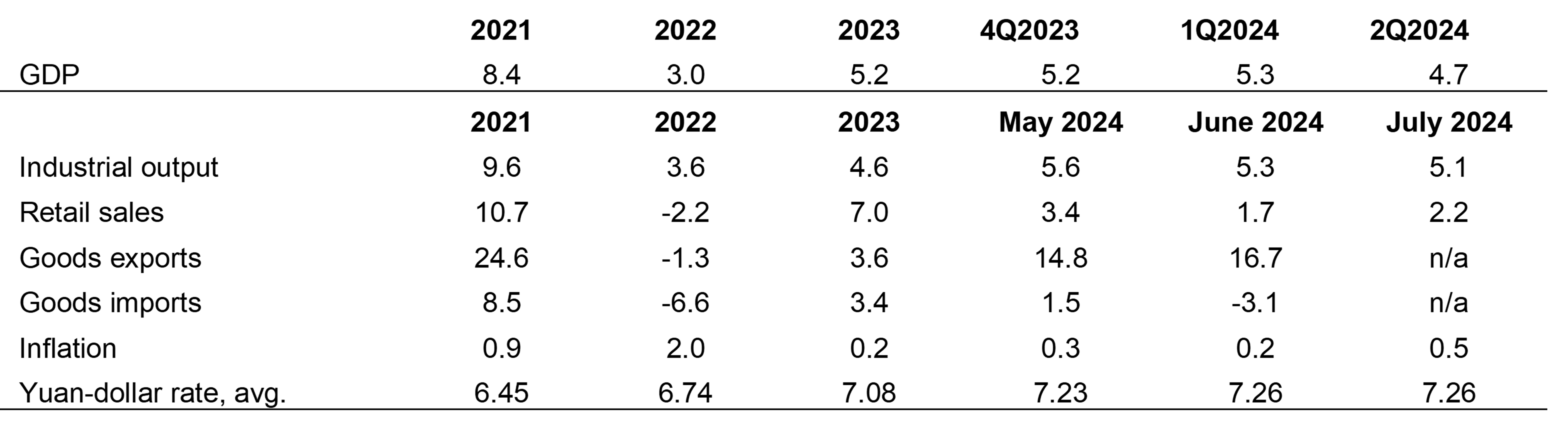

China’s real industrial production growth in July was 5.1 % y-o-y, a marked slowing from the beginning of the year when output gains reached 7 %. Foreign trade, benefitting from the competitive advantage of a weak yuan, gave the most support to industrial output growth. The dollar value of Chinese goods exports in July was up by 6.7 % y-o-y (up 6.1 % in yuan). The value of exports rose by 2.2 % y-o-y in the first seven months of the year. The dollar value of goods imports rose in July by 7.3 % (up 6.7 % in yuan), and for all of the first seven months by 2.3 % y-o-y. The increase in imports, however, did not signal a significant pick-up in domestic consumer demand, but rather greater component imports of automobile manufacturers and tech firms. Nominal fixed investment increased by 3.6 % in January-July (growth in fixed investment for all of 2023 averaged 3 %). Industry played a key role in supporting investment, while service sector investment lagged last year’s pace.

China’s retail sales growth, just 2.2 % y-o-y in July, nevertheless revived a bit in real terms. The unemployment rate in urban areas rose to 5.2 % in July after remaining at 5 % for the previous three months. Youth unemployment, however, jumped from 13 % in June to 17.1 % in July, reflecting in part the latest wave of new graduates entering the workforce. Chinese consumer confidence, which has been in the doldrums for a long time, indicates the grinding effect of struggling real estate markets on consumers as the lion’s share of household wealth in China is tied up in real estate. Despite many support measures, real estate sector conditions, even with a slight slowing in the rate of contraction, remained weak in July. Figures from China’s National Bureau of Statistics show that the apartment sales volume (measured by floorspace) decreased in July by about 15 % from a year earlier (down 19 % in January-July), while the value of apartment sales in July fell by 16 % y-o-y (down 24 % in January-July). Although apartment prices still appear to be dropping in many areas, reliable national-level figures on apartment price trends are unavailable.

China’s statistical reporting gives no indications of inflationary pressure. July consumer prices were up by just 0.5 % y-o-y, while producer prices fell by 0.8 %. The People’s Bank of China eased monetary conditions slightly in July to boost the economy. The impacts could remain modest, however, as demand for financing is meeker that in earlier years. The PBoC’s broad financing measure, aggregate financing to the real economy (AFRE), includes financing to households, central and local governments and non-financial firms. The July AFRE figure was 396 trillion yuan, an increase of 8.2 % y-o-y (up 9.2 % in July 2023). Most of the growth was driven by higher public borrowing (up roughly 15 % y-o-y). Growth in the stock of bank loans has been slowing for a while. In July, it grew by 8.7 % y-o-y, down from 11.5 % in July 2023. The stock of loans granted to households contracted in July from previous months, while on-year growth fell below 1 %.

Real on-year change and consumer prices, %

Sources: China National Bureau of Statistics, China Customs, WTO, CEIC and BOFIT.