BOFIT Weekly Review 33/2024

Slowing growth in Russia

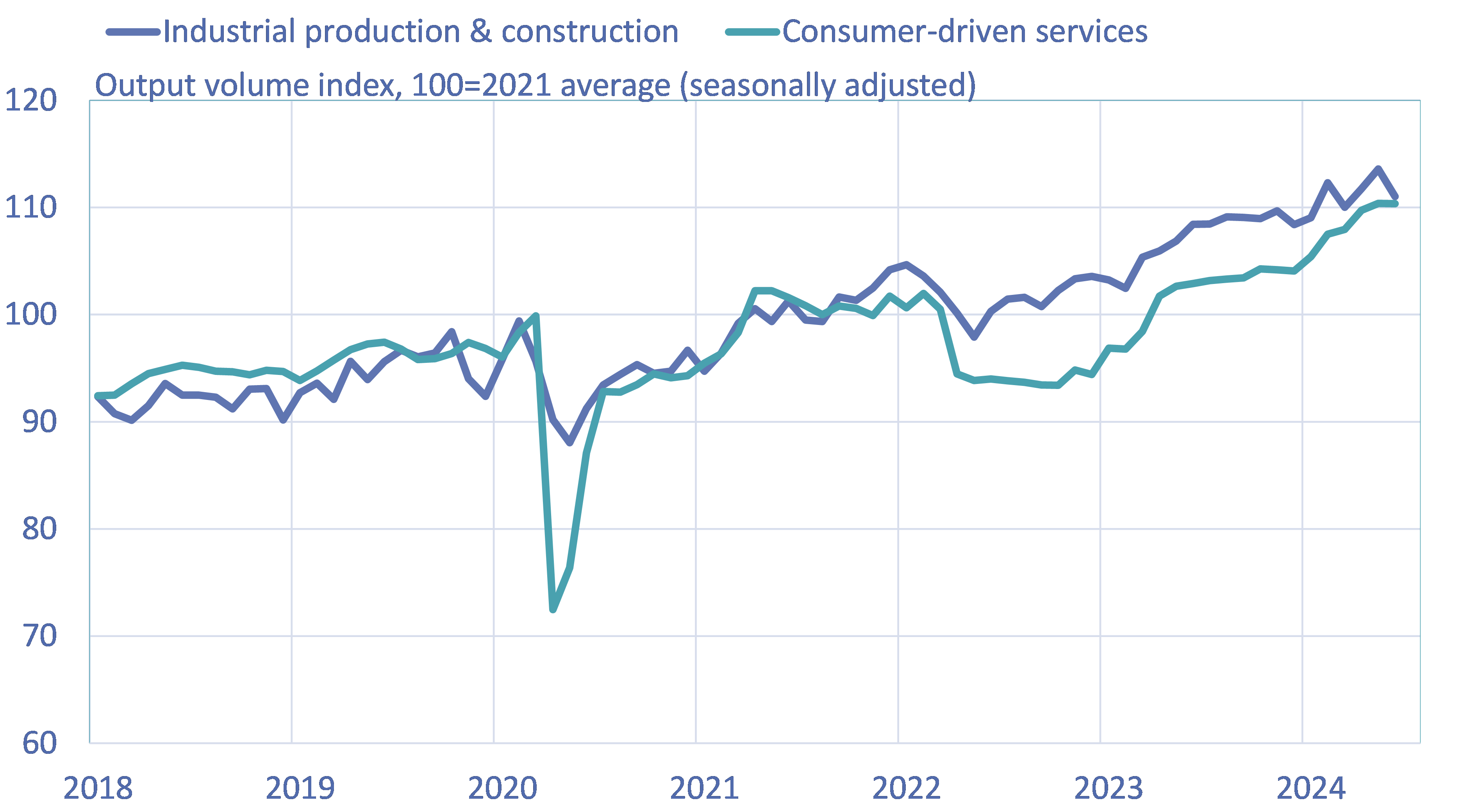

The preliminary figures released by Rosstat, Russia’s federal statistics service, show that Russian GDP grew by 4 % y-o-y in the second quarter. Growth has slowed in recent months. Seasonally-adjusted June output figures suggest declines in manufacturing and construction. Russia’s long growth streak in consumer-driven service branches ended in June. The spike in average real monthly wages has also stopped, with average wage levels remaining largely unchanged in recent months. In annual terms, the average real wage was still up 9 % in May.

Although consumer demand growth cooled down, domestic output and imports developed even more weakly. As demand continues to exceed supply, inflation has accelerated further with the on-month rise in consumer prices in July hitting its highest pace since spring 2022. According to the Central Bank of Russia, the seasonally adjusted annual rate (SAAR) of inflation rose to 16 % in July. Compared to July 2023, prices were up 9 %. Inflation was, however, partly boosted by scheduled rate hikes for municipal services at the beginning of July.

Although the slowdown in Russian output was expected, it is not clear how the rest of the year plays out. Higher government spending could reinvigorate growth in the coming months. Whatever happens, the official figures are likely to register rapid GDP growth for 2024 as a whole – preliminary figures for the first half already suggest growth of 4.7 % y-o-y. While there are no indications of widespread manipulation of Russian statistical data, uncertainty over the quality of reporting has increased.

Russian production growth slowed in June

Sources: Rosstat, CEIC, BOFIT.

Federal budget spending surged again in summer

Russian output gains this year have been supported by increased government spending. Federal budget spending growth again accelerated in the summer months, with spending up 43 % y-o-y in the June-July period. For the first seven months of this year, spending climbed by 23 % y-o-y.

Led by higher oil earnings, federal budget revenues have also increased substantially. Oil earnings have been boosted by the increase in global crude oil prices and the weak ruble. As a result, oil-related revenues to the federal budget have risen significantly even if the volume of Russian crude oil production has slightly declined according to various estimates. Revenues from oil & gas represented about a third of federal budget revenues in January-July.

Rising revenues have partly offset federal budget deficit growth from increased spending. Preliminary estimates of the federal budget deficit in January-July were roughly 1.4 trillion rubles (0.7 % of GDP according the Russian finance ministry’s estimate). The federal budget forecast for all of 2024 anticipates a deficit of 2.1 trillion rubles. The budgeted deficit this year can be easily covered from the National Wealth Fund (NWF), which, according to Russia’s finance ministry, held roughly 4.7 trillion rubles ($54 billion or 2.4 % of GDP according to the finance ministry) in liquid assets as of end-July. The value of liquid assets in the NWF at the start of this year was around 5 trillion rubles.

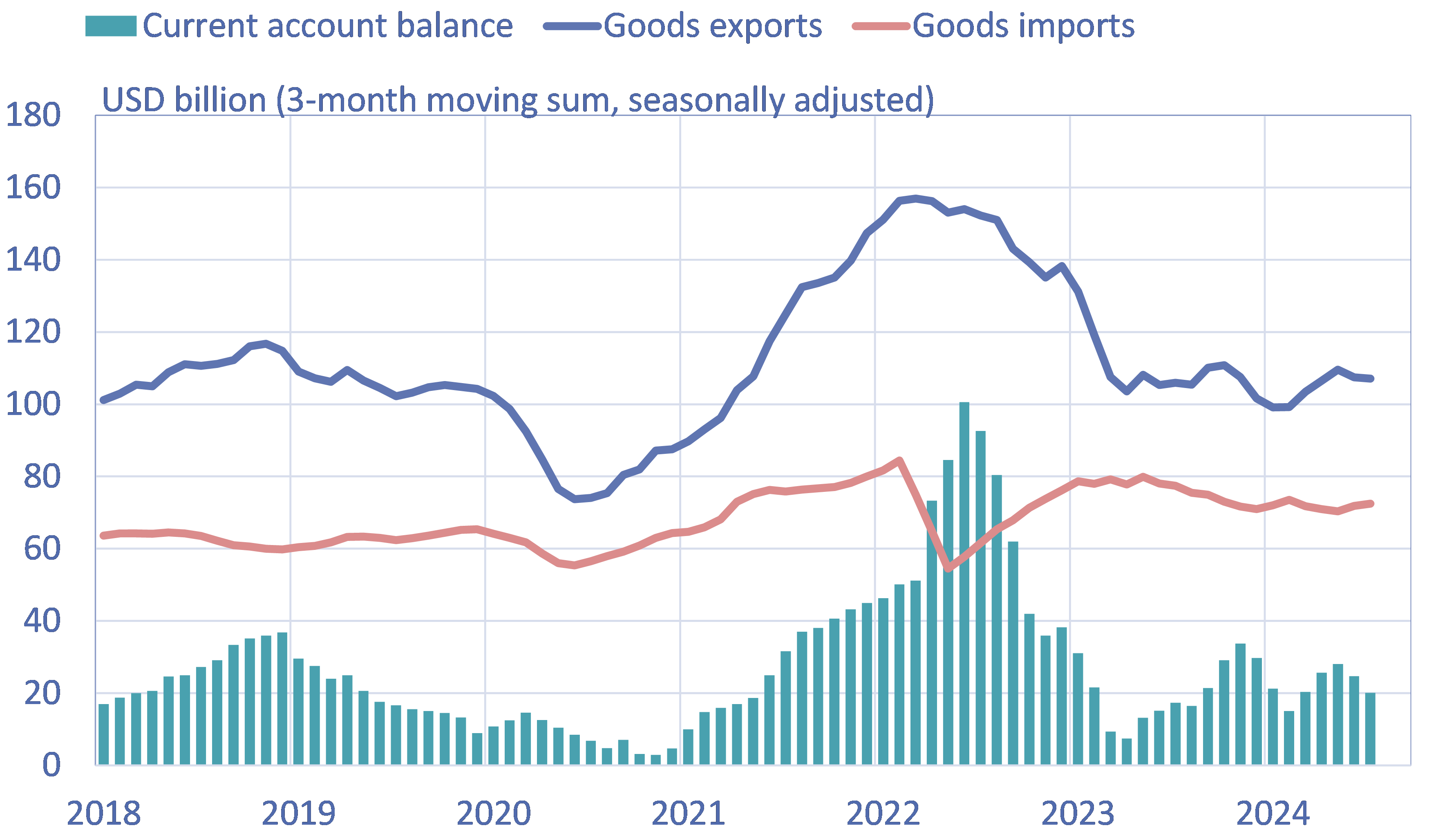

Russian current account surplus rises with the drop in imports

The value of Russian goods exports in January-July amounted to $240 billion, or about the same amount as a year earlier. The value of Russia’s monthly goods exports this year has averaged levels similar to the average of 2018-2019. The CBR reports that the value of exports has been boosted mainly by higher commodity prices. According to the International Energy Agency (IEA), the average price of Urals-blend crude oil in the first seven months of this year was $68 a barrel, up from $50 a barrel in the same period last year. Urals crude still sells at a substantial discount compared to other grades. The IEA estimates that the discount on Urals crude in July was about $13 a barrel.

The CBR reports that the volume of crude oil exports has shrunk slightly as Russia upheld its commitments under the OPEC+ agreement to limit global oil supplies. In addition, the CBR noted that the export volumes of many other types of goods have declined due to various restrictions. Among the most significant measures are the US and UK bans last spring on Russian aluminium, nickel and copper. Wheat exports have been hurt by Turkey’s decision to temporarily suspend imports from Russia, while Russian coal exports have been hit by China’s imposition of import duties on coal. The CBR said that exports of transport and IT-services have also continued to fall due to various restrictions. Russian Customs reports that Asian countries have accounted for about 76 % of Russian goods exports this year.

The value of Russian goods imports in January-July was $160 billion, an 8 % decline from a year earlier. Russian Customs says the contraction in imports was led by declines in imports of chemical products and machinery & equipment. Imports have declined with the depreciation of the ruble, as well as the logistical and payment traffic problems caused by sanctions. Asian countries have provided about 67 % of Russian goods imports this year.

Russia’s current account surplus has increased this year compared to 2023, largely due to the decline in imports. For January-July, the current account surplus amounted to $43 billion, up from $23 billion in the same period last year. The current account surplus has been this year on average at the same level as the average in 2018-2019.

Russia’s current account surplus has increased as imports have declined.

Sources: Central Bank of Russia, CEIC, BOFIT.

Net outflow of capital from Russia continues

The financial account figures in the latest preliminary balance-of-payments release show a net capital outflow of $47 billion in the January-July period ($21 billion in the same period last year). Russian assets abroad rose sharply from last year. The CBR notes that most of the increase in assets is due to export receivables. As with Russia foreign payment traffic generally, repatriation of export earnings to Russia has become difficult under tightened sanctions. Russia is seeking new solutions to international payment traffic to ease the problem. For example, the use of cryptocurrencies in international payments is set to become legal after September 1.

Following last year’s pattern, there was an overall net outflow of foreign capital from Russia in the first seven months of the year. In recent months, however, the net capital flow turned slightly positive. The CBR says that this shift largely reflects dividend payments owed to foreign investors. Foreign investors based in “unfriendly” countries are not able to withdraw their dividends from Russia, but they are held in Russia as compulsory “investments.”