BOFIT Weekly Review 32/2024

Chinese direct investments overseas declined overall in the first half of this year, but investments in Europe increased

According to the American Enterprise Institute’s China Global Investment Tracker of Chinese foreign direct investments greater than $100 million, Chinese FDI in the first six months of this year amounted to $27 billion, a 13 % decrease from the first half of 2023. Chinese FDI outflows last year showed signs of recovery after many tepid years, but the pickup appears short-lived. Much of the drop in FDI in the first half of this year reflects reduced investments into Africa, South America, and the Middle East. Europe, on the other hand, has become a bigger destination for Chinese investors with investments up by 26 % y-o-y in the first half. Investments in Asia also grew rapidly (up 30 %). However, it is worth noting that large investments are not evenly distributed over the year, so the number for a few months likely gives a very rough indication of the investment trend for the entire year.

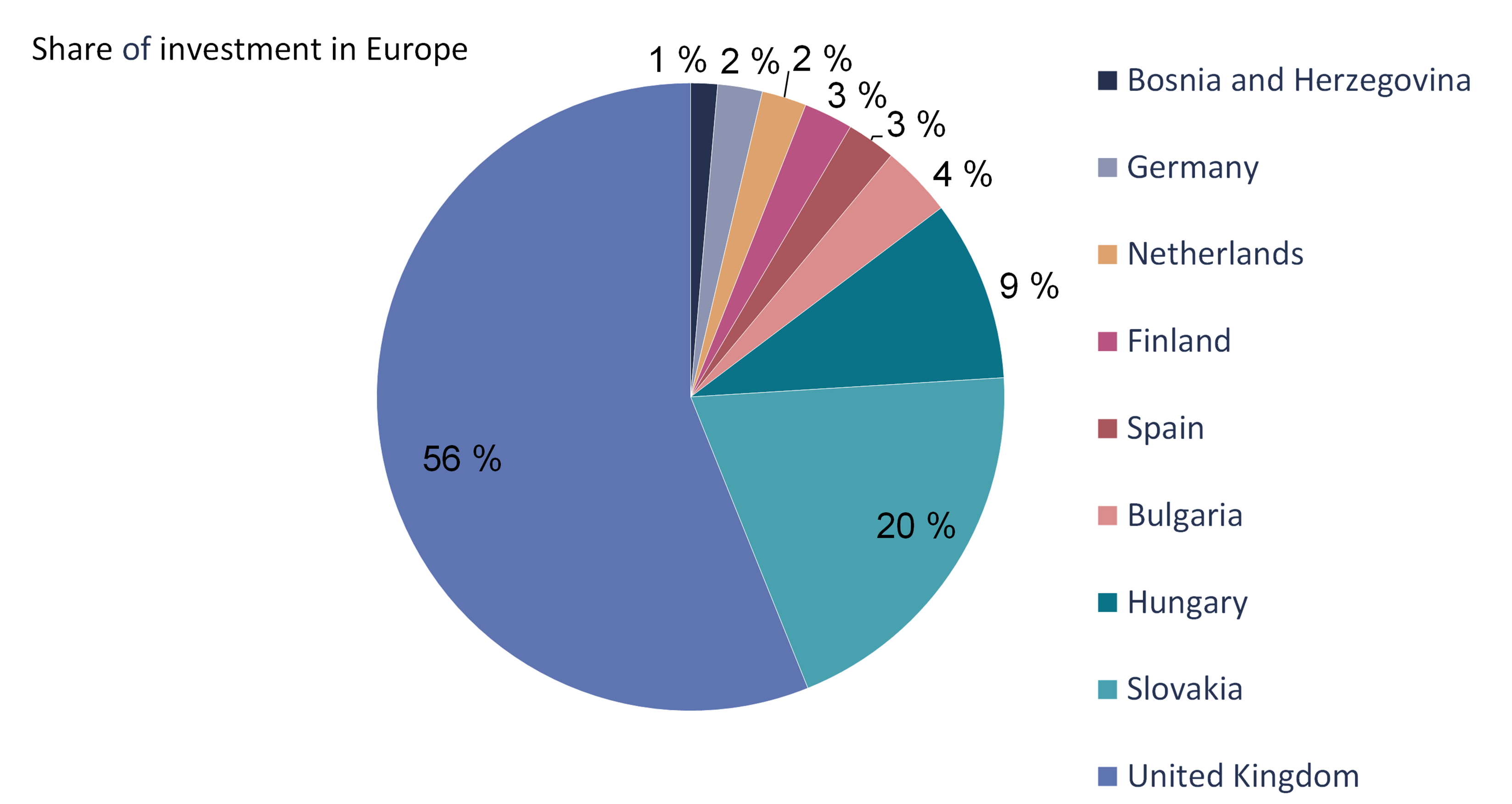

A substantial share of Chinese investment this year has gone to Asia (41 %) or Europe (32 %), while only 4 % of Chinese FDI went to North America. Chinese investors in Europe are particularly keen on the automobile industry (60 % of investments) and the energy sector (24 %). This emphasis reflects the growing markets for electric vehicles (EVs) and renewable energy systems. Chinese money has clearly favoured the UK, which has received over half (56 %) of total Chinese FDI in Europe. Slovakia (20 %) has also been punching well above its weight in FDI terms. In the first half of this year, Finland received $220 million of Chinese investment, which was related to the initial public offering of Amer Sports. Overall, a bit over half of Chinese investments in Europe are greenfield investments and the rest corporate acquisitions.

A June report from the Mercator Institute for China Studies (MERICS) finds that Chinese investment, especially in EV production chains, remains on the rise in Europe (BOFIT Weekly 2024/26). At the same time, healthcare, consumer products, and information & communication technologies remain popular fields with Chinese investors. In addition to EVs and related components, MERICS highlights medical devices as a key area of interest, having attracted the lion’s share of Chinese healthcare investment in recent years. MERICS notes that the EU will likely tighten its standards for screening of foreign investments.

Chinese foreign direct investments in Europe larger than $100 million, January-June 2024

Sources: American Enterprise Institute and BOFIT.