BOFIT Weekly Review 31/2024

Russia’s central bank raises its key rate to 18 % on inflation concerns; key rate now expected to remain high for a longer time

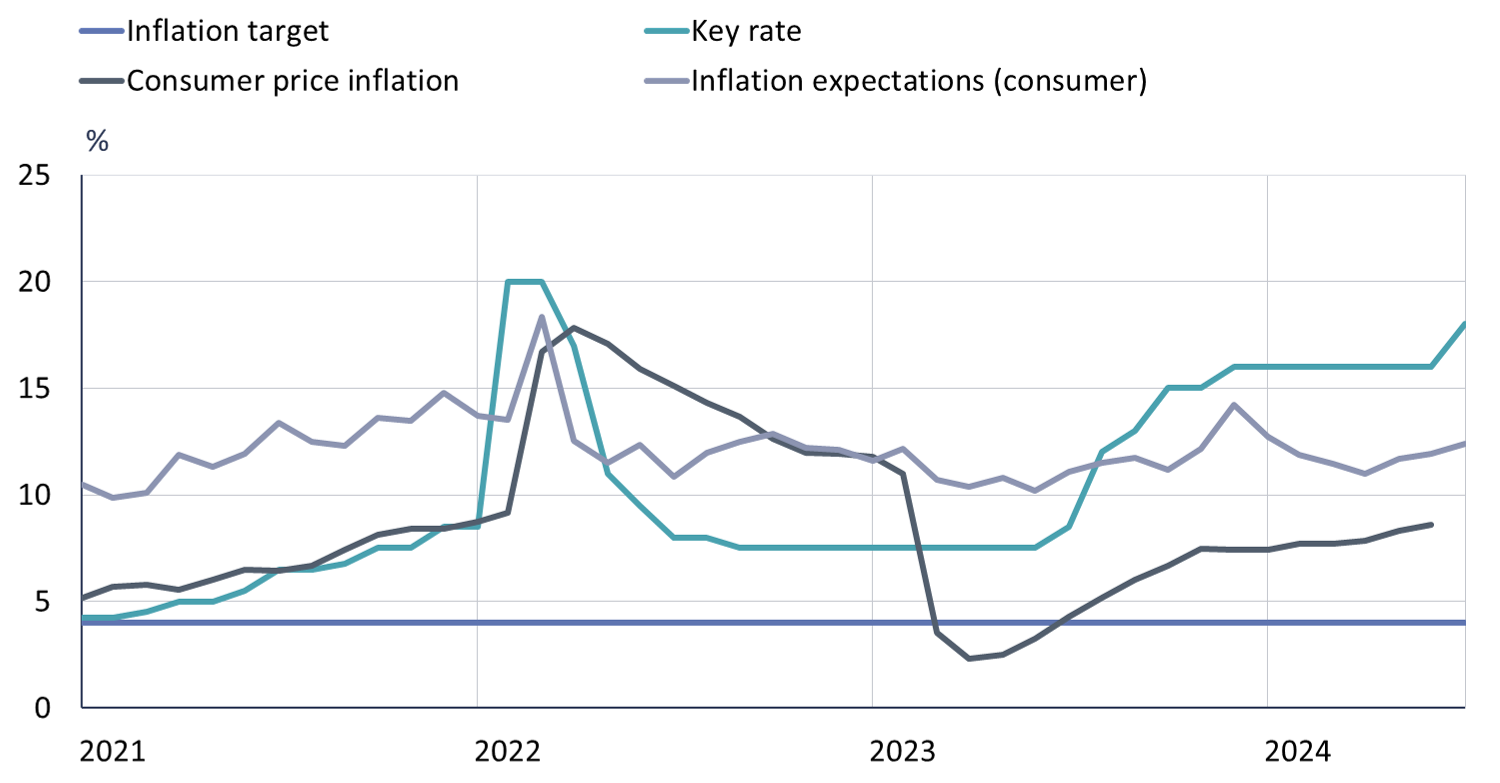

The Central Bank of Russia’s board of directors decided at its key rate-setting meeting on July 26 to raise the key rate by 200 basis points to 18 %. Worries about accelerating consumer price inflation and higher household and firm inflation expectation spurred the decision to go with a substantial rate hike. Although 12-month inflation was running at 8.6 % in June, weekly measures of July inflation suggested that inflation had surged to around 9 %. Administratively-set rates for municipal services also jumped at the start of July.

In addition to the rate hike, the CBR raised its key rate forecast for coming years by 400 basis points (14–16 % in 2025 and 10–11 % in 2026), signalling much more restrictive monetary policy over the medium term than previously anticipated. The CBR now expects slightly higher inflation at the end of this year (in the range of 6.5–7 % rather than 4.3–4.8 % in its April forecast), but even that would require a sharp decline in the pace of inflation in the second half of this year. The CBR sees inflation subsiding to near its target level of 4 % p.a. in 2025.

In late July, the key rate was raised to its highest level since March 2022

Sources: Macrobond, CBR and BOFIT.

The press release for the CBR rate meeting suggest the board expects inflationary pressures to persist and indicates that another hike is possible at the next meeting in September. Large wage increases (nominal 12-month wage growth hit 17.8 % in May) and generous government spending are expected to sustain inflationary pressure in coming months. The CBR’s revised inflation forecast dispels any notions that government spending will remain within previously-agreed budget frameworks. Thus, government spending constitutes one of the biggest threats to the CBR’s inflation forecast and could dilute the impacts of recent rate hikes. A good harvest season could, however, slow the rise in food prices, particularly prices of fruits and vegetables in July and August. The ban on fuel exports to reduce price pressures was reintroduced yesterday (Aug. 1), and should remain in force at least until September 1. The previous ban on fuel exports ran from March 1 to May 20.

After strong growth at the start of the year, efforts at monetary tightening could be complicated by a slowing Russian economy. New figures show that a key business-cycle indicator, industrial output growth, slowed in June to just 1.9 % y-o-y (and decreased 1.5 % from May in real price-adjusted terms). Industrial output was hit by a contraction in mining & quarrying activity in June (down 3.1 % y-o-y) and lower manufacturing growth (down from 9.1 % in May at 4.6 % in June). Growth in manufacturing branches involved in the war effort, however, continued to display robust growth.

CBR RAISES ITS ECONOMIC FORECAST FOR THIS YEAR, BUT LOWERS FOR NEXT YEAR

Along with the adjustment of the key rate, the CBR released its revised outlook for the rest of year. It now expects GDP to grow at around 3.5–4 %, well above the 3.5 % ceiling set out in its April forecast. While the revival in consumer demand bodes well for growth, the acceleration in inflation suggests the economy is overheating. This is evidenced both by labour shortages and production capacity stretched to the limits that prevent satisfying higher public- and private sector demand. Beyond the lack of workers, the economy’s biggest bottleneck, the CBR notes that Russia is dealing with lack of access to critical production technologies due to Western sanctions and rising inflation.

The CBR’s outlook for 2025 was also lowered from the April expectation of 1–2 % to 0.5–1.5 %. Part of the lower growth estimate reflects anticipation of restrictive monetary policies and planned budget cuts, which, if they occur, would dampen demand. The trend in government spending has an impact on economic growth and curbing inflation. If plans to balance the federal budget are abandoned, for example, due to increased military spending, it becomes harder to quell inflation and demands an even higher interest-rate level than at present. In that case, the risk of stagflation (high inflation combined with weak economic growth) will significantly increase, prompting central bank governor Elvira Nabiullina to warn of potential consequences at the press conference after the CBR’s rate meeting.