BOFIT Weekly Review 30/2024

China’s GDP growth slowed in the second quarter; central bank eases monetary stance a bit

China’s National Bureau of Statistics (NBS) reports real GDP growth of 4.7 % y-o-y in the second quarter, down from 5.3 % in the first quarter. On-quarter growth in 2Q24 was a modest 0.7 % q-o-q. The growth in the second quarter was restrained by weak domestic consumption demand. On the other hand, higher fixed investment (includes changes in inventories) supported growth more than on previous quarters, despite the continued steep decline in real estate construction. Measured in terms of floorspace, the volume of apartment sales declined in June by 15 % y-o-y, new building starts were down by 20 % and the number of completed apartments fell by 30 %. The latest round of support measures for the real estate sector announced in May (BOFIT Weekly 22/2024) seems to have only a modest impact so far. GDP growth in the second quarter was supported by robust exports and modest imports, which was similar in the first quarter of the year.

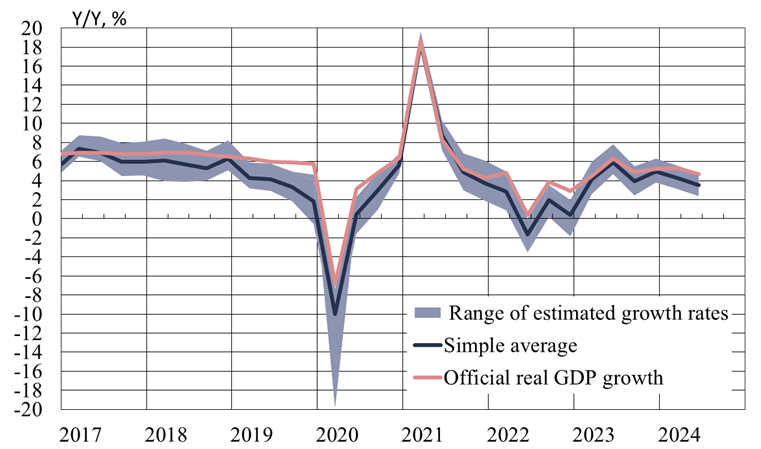

BOFIT’s alternative GDP indicators suggest that GDP growth slowed more in the second quarter than the official NBS assessment. The average of our alternative estimates fell below 4 %, or roughly one percentage point below the official number. When Chinese GDP growth is high, BOFIT alternative estimates and official figures tend to be in fairly close agreement. When the economy slows, our alternative estimates and official numbers typically diverge.

BOFIT’s alternative estimates also indicate slightly lower GDP growth in the second quarter

Sources: NBS, Macrobond and BOFIT.

To support the economy and spur near-zero inflation, the People’s Bank of China (PBoC) lowered its main policy rates by 10 basis points (the 7-day reverse repo rate and the 1-year and 5-year LPR rates) or 20 basis points (1-year MLF rate). The growth effects of these petite adjustments is expected to be modest, especially given that overall financing demand in the private sector remains tepid. On-year growth in the stock of outstanding bank loans slowed to around 8 % y-o-y, its lowest growth pace in over 20 years. The funding allocated by the shadow banking sector has also continued to dry up, while growth in the stock of corporate bond issues rose by a very modest 2 % y-o-y. Government debt was the single financial item in the balance-of-payments data showing robust growth. Driven by a wave of public sector bond issues, the stock of government bonds grew by 15 % y-o-y.

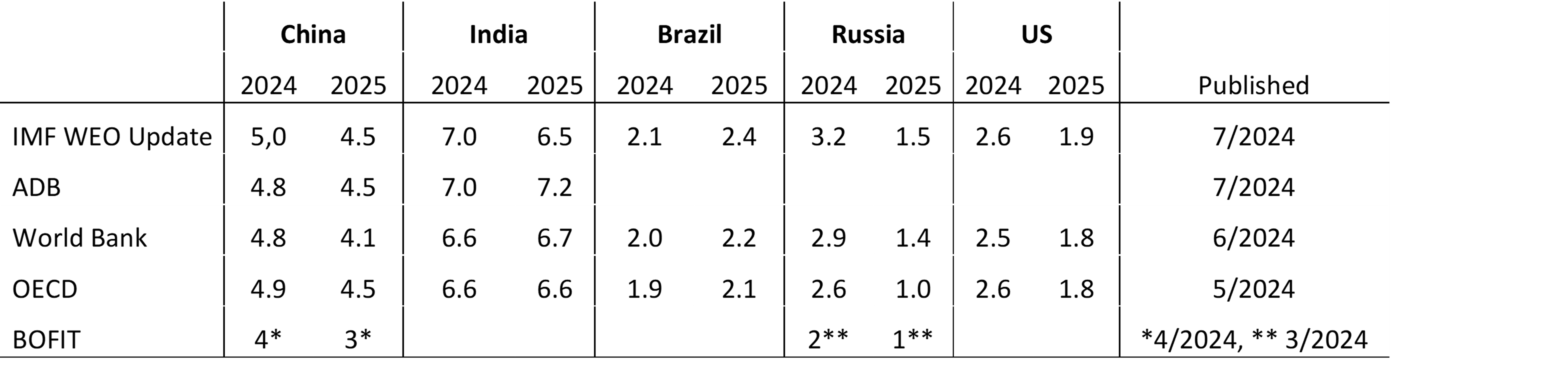

In the wake of publication of the PBoC’s announcement, a number of investment banks immediately reduced their growth outlooks for China this year, dropping the average of estimates to slightly below 5 %. International forecasting institutions are also expecting China’s growth to be at or just under 5 %. In our April release of BOFIT’s Forecast for China 2024–2026, we expected China’s growth for all of this year to come in at around 4 %. Forecasts for 2025 generally see GDP growth slowing further. Notably, the major institutional forecasters also see growth in India, the world’s most populous emerging economy, growing at a robust 7 % p.a. rate both this year and next, while Brazilian growth is expected to chug along at around 2 %. A huge government spending burst this year will boost Russian GDP growth this year, but growth is expected to slow to around 1 % next year.

GDP growth estimates for major developing nations and the United States